Members of the board of directors of Security One have received the following operating income data for the year ended May 31, 2018: E (Click the icon to view the operating income data.) Members of the board are surprised that the industrial systems product line is not profitable. They commission a study to determine whether the company should drop the line. Company accountants estimate that dropping industrial systems will decrease fixed cost of goods sold by $82,000 and decrease fixed selling and administrative expenses by $10,000. Read the requirements Requirement 1. Prepare a differential analysis to show whether Security One should drop the industrial systems product line. (Use parentheses or a minus sign to enter decreases to profits.) in operating income Requirements 1. Prepare a differential analysis to show whether Security One should drop the industrial systems product line. 2. Prepare contribution margin income statements to show Security One's total operating income under the two alternatives: (a) with the industrial systems line and (b) without the line. Compare the difference between the two alternatives' income numbers to your answer to Requirement 1. 3. What have you learned from the comparison in Requirement 2?

Members of the board of directors of Security One have received the following operating income data for the year ended May 31, 2018: E (Click the icon to view the operating income data.) Members of the board are surprised that the industrial systems product line is not profitable. They commission a study to determine whether the company should drop the line. Company accountants estimate that dropping industrial systems will decrease fixed cost of goods sold by $82,000 and decrease fixed selling and administrative expenses by $10,000. Read the requirements Requirement 1. Prepare a differential analysis to show whether Security One should drop the industrial systems product line. (Use parentheses or a minus sign to enter decreases to profits.) in operating income Requirements 1. Prepare a differential analysis to show whether Security One should drop the industrial systems product line. 2. Prepare contribution margin income statements to show Security One's total operating income under the two alternatives: (a) with the industrial systems line and (b) without the line. Compare the difference between the two alternatives' income numbers to your answer to Requirement 1. 3. What have you learned from the comparison in Requirement 2?

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter13: Emerging Topics In Managerial Accounting

Section: Chapter Questions

Problem 55P

Related questions

Question

Transcribed Image Text:Members of the board of directors of Security One have received the following operating income data for the year ended May 31, 2018:

E (Click the icon to view the operating income data.)

Members of the board are surprised that the industrial systems product line is not profitable. They commission a study to determine whether the company

should drop the line. Company accountants estimate that dropping industrial systems will decrease fixed cost of goods sold by $82,000 and decrease fixed

selling and administrative expenses by $10,000.

Read the requirements.

Requirement 1. Prepare a differential analysis to show whether Security One should drop the industrial systems product line. (Use parentheses or a minus sign

to enter decreases to profits.)

in operating income

Requirements

1. Prepare a differential analysis to show whether Security One should drop the industrial

systems product line.

2. Prepare contribution margin income statements to show Security One's total operating income

under the two alternatives: (a) with the industrial systems line and (b) without the line. Compare

the difference between the two alternatives' income numbers to your answer to Requirement 1.

3. What have you learned from the comparison in Requirement 2?

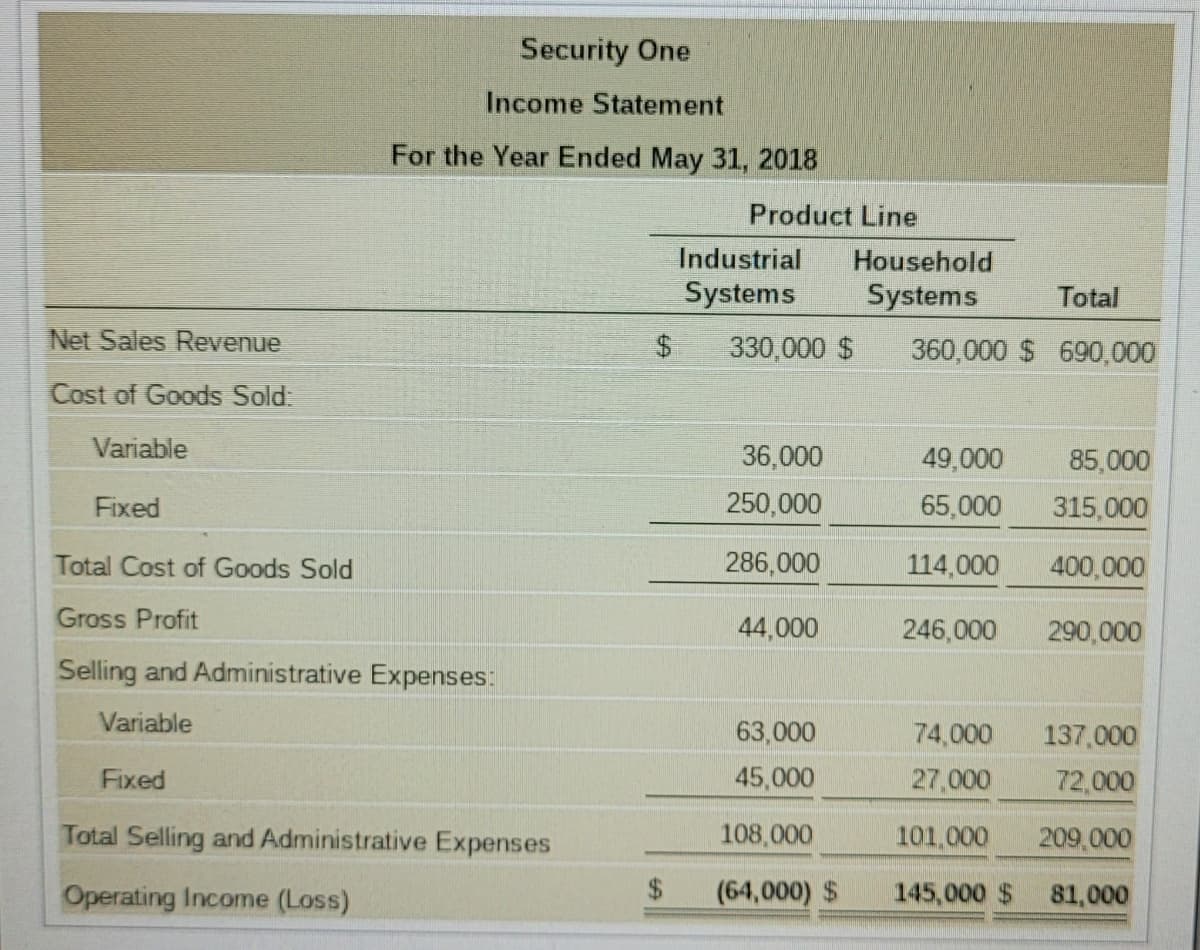

Transcribed Image Text:Security One

Income Statement

For the Year Ended May 31, 2018

Product Line

Industrial

Household

Systems

Systems

Total

Net Sales Revenue

24

330,000 $

360,000 $ 690,000

Cost of Goods Sold:

Variable

36,000

49,000

85,000

Fixed

250,000

65,000

315,000

Total Cost of Goods Sold

286,000

114,000

400,000

Gross Profit

44,000

246,000

290,000

Selling and Administrative Expenses:

Variable

63,000

74,000

137,000

Fixed

45,000

27,000

72,000

Total Selling and Administrative Expenses

108,000

101,000

209,000

Operating Income (Loss)

$4

(64,000) $

145,000 $

81,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub