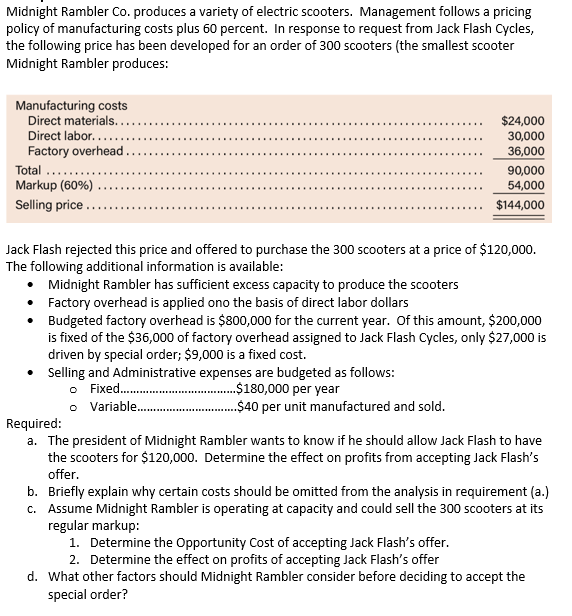

Midnight Rambler Co. produces a variety of electric scooters. Management follows a pricing policy of manufacturing costs plus 60 percent. In response to request from Jack Flash Cycles, the following price has been developed for an order of 300 scooters (the smallest scooter Midnight Rambler produces: Manufacturing costs Direct materials...... Direct labor..... Factory overhead $24,000 30,000 36,000 Total 90,000 Markup (60%) 54,000 $144,000 Selling price. Jack Flash rejected this price and offered to purchase the 300 scooters at a price of $120,000. The following additional information is available: Midnight Rambler has sufficient excess capacity to produce the scooters Factory overhead is applied ono the basis of direct labor dollars Budgeted factory overhead is $800,000 for the current year. Of this amount, $200,000 is fixed of the $36,000 of factory overhead assigned to Jack Flash Cycles, only $27,000 is driven by special order; $9,000 is a fixed cost. Selling and Administrative expenses are budgeted as follows: o Fixed.. o Variable. .$180,000 per year .$40 per unit manufactured and sold. Required: a. The president of Midnight Rambler wants to know if he should allow Jack Flash to have the scooters for $120,000. Determine the effect on profits from accepting Jack Flash's offer b. Briefly explain why certain costs should be omitted from the analysis in requirement (a.) c. Assume Midnight Rambler is operating at capacity and could sell the 300 scooters at its regular markup: 1. Determine the Opportunity Cost of accepting Jack Flash's offer 2. Determine the effect on profits of accepting Jack Flash's offer d. What other factors should Midnight Rambler consider before deciding to accept the special order?

Midnight Rambler Co. produces a variety of electric scooters. Management follows a pricing policy of manufacturing costs plus 60 percent. In response to request from Jack Flash Cycles, the following price has been developed for an order of 300 scooters (the smallest scooter Midnight Rambler produces: Manufacturing costs Direct materials...... Direct labor..... Factory overhead $24,000 30,000 36,000 Total 90,000 Markup (60%) 54,000 $144,000 Selling price. Jack Flash rejected this price and offered to purchase the 300 scooters at a price of $120,000. The following additional information is available: Midnight Rambler has sufficient excess capacity to produce the scooters Factory overhead is applied ono the basis of direct labor dollars Budgeted factory overhead is $800,000 for the current year. Of this amount, $200,000 is fixed of the $36,000 of factory overhead assigned to Jack Flash Cycles, only $27,000 is driven by special order; $9,000 is a fixed cost. Selling and Administrative expenses are budgeted as follows: o Fixed.. o Variable. .$180,000 per year .$40 per unit manufactured and sold. Required: a. The president of Midnight Rambler wants to know if he should allow Jack Flash to have the scooters for $120,000. Determine the effect on profits from accepting Jack Flash's offer b. Briefly explain why certain costs should be omitted from the analysis in requirement (a.) c. Assume Midnight Rambler is operating at capacity and could sell the 300 scooters at its regular markup: 1. Determine the Opportunity Cost of accepting Jack Flash's offer 2. Determine the effect on profits of accepting Jack Flash's offer d. What other factors should Midnight Rambler consider before deciding to accept the special order?

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 7PB: Remarkable Enterprises requires four units of part A for every unit of Al that it produces....

Related questions

Question

- The president of Midnight Rambler wants to know if he should allow Jack Flash to have the scooters for $120,000. Determine the effect on profits from accepting Jack Flash’s offer.

- Briefly explain why certain costs should be omitted from the analysis in requirement (a.)

- Assume Midnight Rambler is operating at capacity and could sell the 300 scooters at its regular markup:

- Determine the Opportunity Cost of accepting Jack Flash’s offer.

- Determine the effect on profits of accepting Jack Flash’s offer

- What other factors should Midnight Rambler consider before deciding to accept the special order?

Transcribed Image Text:Midnight Rambler Co. produces a variety of electric scooters. Management follows a pricing

policy of manufacturing costs plus 60 percent. In response to request from Jack Flash Cycles,

the following price has been developed for an order of 300 scooters (the smallest scooter

Midnight Rambler produces:

Manufacturing costs

Direct materials......

Direct labor.....

Factory overhead

$24,000

30,000

36,000

Total

90,000

Markup (60%)

54,000

$144,000

Selling price.

Jack Flash rejected this price and offered to purchase the 300 scooters at a price of $120,000.

The following additional information is available:

Midnight Rambler has sufficient excess capacity to produce the scooters

Factory overhead is applied ono the basis of direct labor dollars

Budgeted factory overhead is $800,000 for the current year. Of this amount, $200,000

is fixed of the $36,000 of factory overhead assigned to Jack Flash Cycles, only $27,000 is

driven by special order; $9,000 is a fixed cost.

Selling and Administrative expenses are budgeted as follows:

o Fixed..

o Variable.

.$180,000 per year

.$40 per unit manufactured and sold.

Required:

a. The president of Midnight Rambler wants to know if he should allow Jack Flash to have

the scooters for $120,000. Determine the effect on profits from accepting Jack Flash's

offer

b. Briefly explain why certain costs should be omitted from the analysis in requirement (a.)

c. Assume Midnight Rambler is operating at capacity and could sell the 300 scooters at its

regular markup:

1. Determine the Opportunity Cost of accepting Jack Flash's offer

2. Determine the effect on profits of accepting Jack Flash's offer

d. What other factors should Midnight Rambler consider before deciding to accept the

special order?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,