Midwest reports assets in each divisloh as $48,500 18, 950 15, 650 3, 250 Bus Charters Lodging Concerts Ticket services Required: a. Using the retail values for transfer pricing for segment reporting purposes, what are the operating profits for each Midwest division b. What are the operating profits for each Midwest division using the differential cost basis for pricing transfers? c-1. Rank each division by ROI using the transfer pricing methods in requirement (a). c-2. Rank each division by ROI using the transfer pricing methods in requirement (b). Complete this question by entering your answers in the tabs below.

Midwest reports assets in each divisloh as $48,500 18, 950 15, 650 3, 250 Bus Charters Lodging Concerts Ticket services Required: a. Using the retail values for transfer pricing for segment reporting purposes, what are the operating profits for each Midwest division b. What are the operating profits for each Midwest division using the differential cost basis for pricing transfers? c-1. Rank each division by ROI using the transfer pricing methods in requirement (a). c-2. Rank each division by ROI using the transfer pricing methods in requirement (b). Complete this question by entering your answers in the tabs below.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter14: Decentralized Operations

Section: Chapter Questions

Problem 14.9E: Profit center responsibility reporting On-Demand Sports Co. operates two divisions—the Action Sports...

Related questions

Question

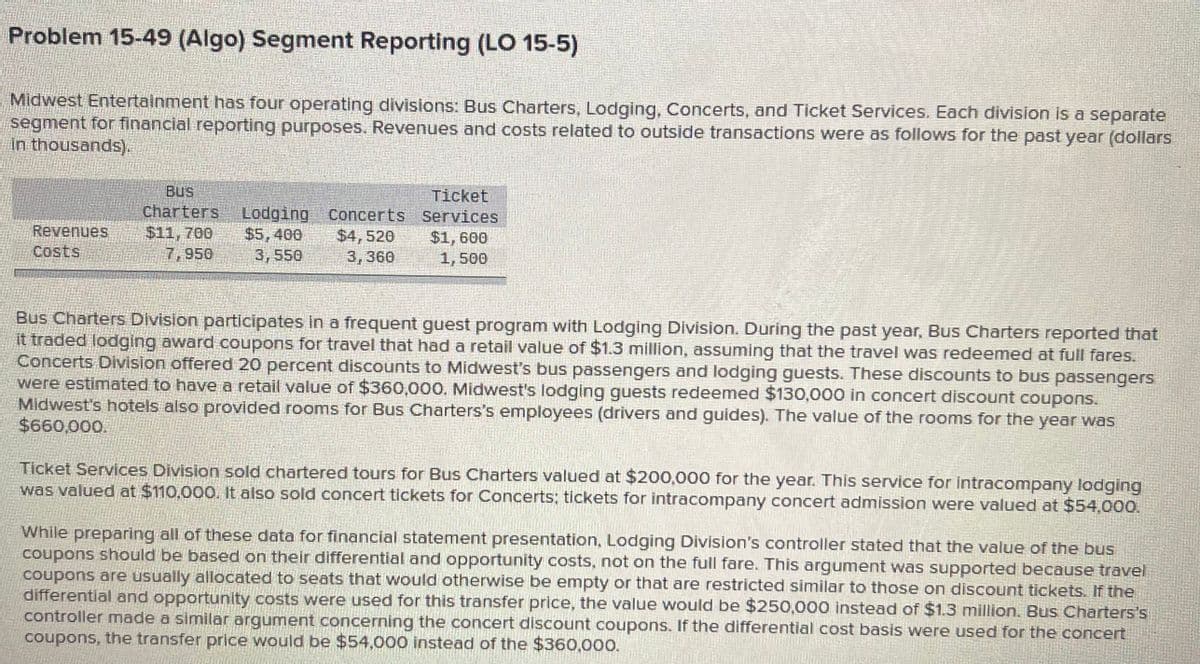

Transcribed Image Text:Problem 15-49 (Algo) Segment Reporting (LO 15-5)

Midwest Entertainment has four operating divisions: Bus Charters, Lodging, Concerts, and Ticket Services. Each division is a separate

segment for financial reporting purposes. Revenues and costs related to outside transactions were as follows for the past year (dollars

in thousands).

BUS

Charters

$11,700

7,950

Ticket

Revenues

Costs

Lodging Concerts Services

$4,520

3,360

$5,400

3,550

$1,600

1,500

Bus Charters Division participates in a frequent guest program with Lodging Division. During the past year, Bus Charters reported that

it traded lodging award coupons for travel that had a retail value of $1.3 million, assuming that the travel was redeemed at full fares.

Concerts Division offered 20 percent discounts to Midwest's bus passengers and lodging guests. These discounts to bus passengers

were estimated to have a retail value of $360,000. Midwest's lodging guests redeemed $130,000 in concert discount coupons.

Midwest's hotels also provided rooms for Bus Charters's employees (drivers and guides). The value of the rooms for the year was

$660,000.

Ticket Services Division sold chartered tours for Bus Charters valued at $200,000 for the year. This service for intracompany lodging

was valued at $110,000. It also sold concert tickets for Concerts; tickets for intracompany concert admission were valued at $54.000.

While preparing all of these data for financial statement presentation, Lodging Division's controller stated that the value of the bus

coupons should be based on their differential and opportunity costs, not on the full fare. This argument was supported because travel

coupons are usually allocated to seats that would otherwise be empty or that are restricted similar to those on discount tickets. If the

differential and opportunity costs were used for this transfer price, the value would be $250,000 instead of $1.3 million. Bus Charters's

controller mnade a similar argument concerning the concert discount coupons. If the differential cost basis were used for the concert

coupons, the transfer price would be $54,000 instead of the $360,000.

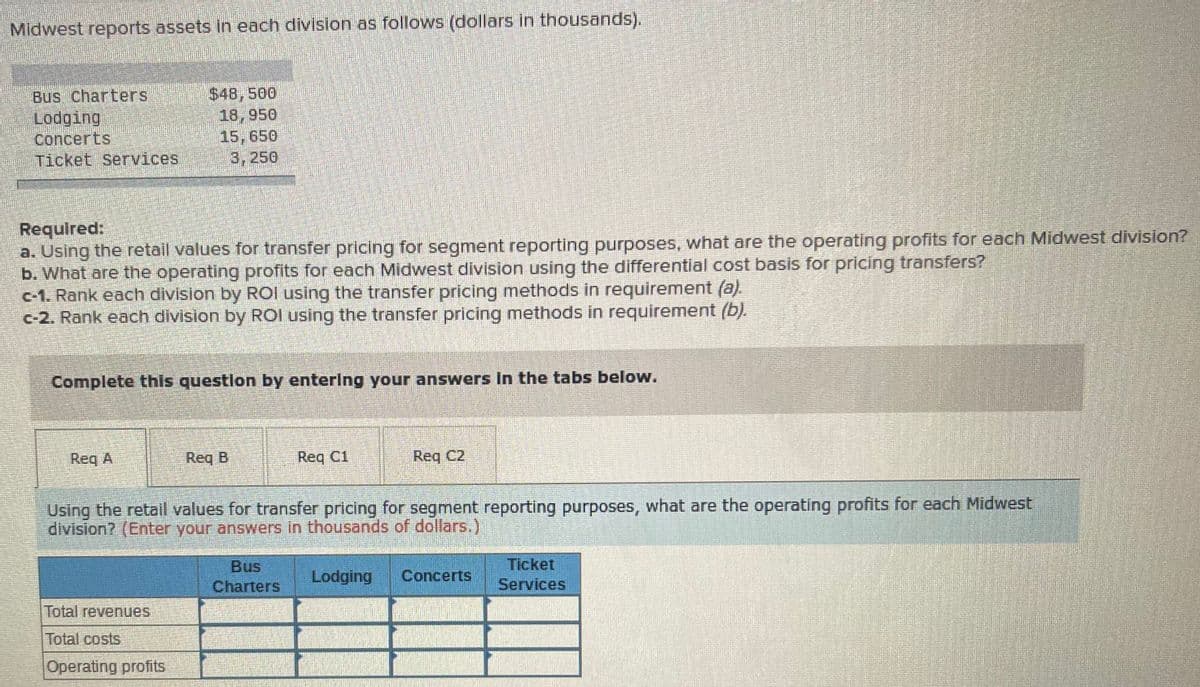

Transcribed Image Text:Midwest reports assets in each division as follows (dollars in thousands).

Bus Charters

Lodging

Concerts

Ticket Services

$48,500

18,950

15,650

3,250

Required:

a. Using the retaill values for transfer pricing for segment reporting purposes, what are the operating profits for each Midwest division?

b. What are the operating profits for each Midwest division using the differential cost basis for pricing transfers?

c-1. Rank each division by ROI using the transfer pricing methods in requirement (a).

c-2. Rank each division by ROI using the transfer pricing methods in requirement (b).

Complete this questlon by entering your answers in the tabs below.

Req A

Req B

Req C1

Req C2

Using the retail values for transfer pricing for segment reporting purposes, what are the operating profits for each Midwest

division? (Enter your answers in thousands of dollars.)

Bus

Charters

Ticket

Services

Lodging

Concerts

Total revenues

Total costs

Operating profits

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning