The following events apply to Montgomery Company for Year 1, its first year of operation: 1. Received cash of $38,000 from the issue of common stock. 2. Performed $57,000 of services on account. 3. Incurred $8,300 of other operating expenses on account. 4. Paid $30,000 cash for salaries expense. 5. Collected $39,000 of accounts receivable. 6. Paid a $3,900 dividend to the stockholders. 7. Performed $10,400 of services for cash. 8. Paid $6,400 of the accounts payable. Required a. Record the preceding transactions in general journal form. b. Post the entries to T-accounts and determine the ending balance in each account. c. & d. Determine the amount of total assets at the end of Year 1, and the amount of net income for Year 1.

The following events apply to Montgomery Company for Year 1, its first year of operation: 1. Received cash of $38,000 from the issue of common stock. 2. Performed $57,000 of services on account. 3. Incurred $8,300 of other operating expenses on account. 4. Paid $30,000 cash for salaries expense. 5. Collected $39,000 of accounts receivable. 6. Paid a $3,900 dividend to the stockholders. 7. Performed $10,400 of services for cash. 8. Paid $6,400 of the accounts payable. Required a. Record the preceding transactions in general journal form. b. Post the entries to T-accounts and determine the ending balance in each account. c. & d. Determine the amount of total assets at the end of Year 1, and the amount of net income for Year 1.

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 11PB: Prepare journal entries to record the following transactions. Create a T-account for Unearned...

Related questions

Question

Please answer the full question

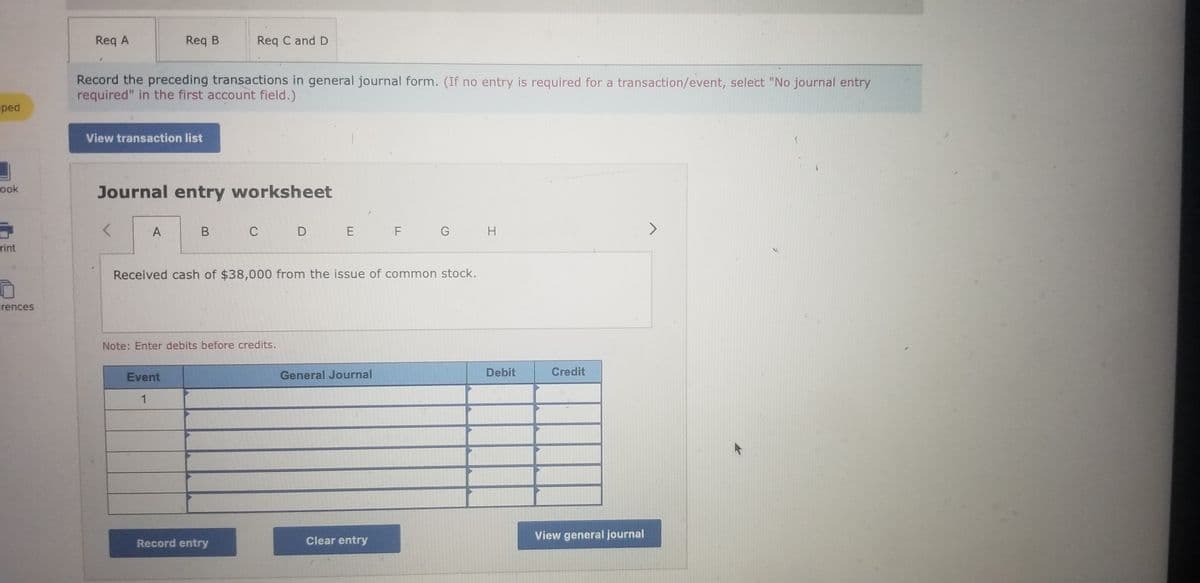

Transcribed Image Text:Req A

Req B

Reg C and D

Record the preceding transactions in general journal form. (If no entry is required for a transaction/event, select "No journal entry

required" in the first account field.)

ped

View transaction list

ook

Journal entry worksheet

B

C

D

E

G

H

rint

<>

Received cash of $38,000 from the issue of common stock.

rences

Note: Enter debits before credits.

Event

General Journal

Debit

Credit

Clear entry

View general journal

Record entry

Transcribed Image Text:Check

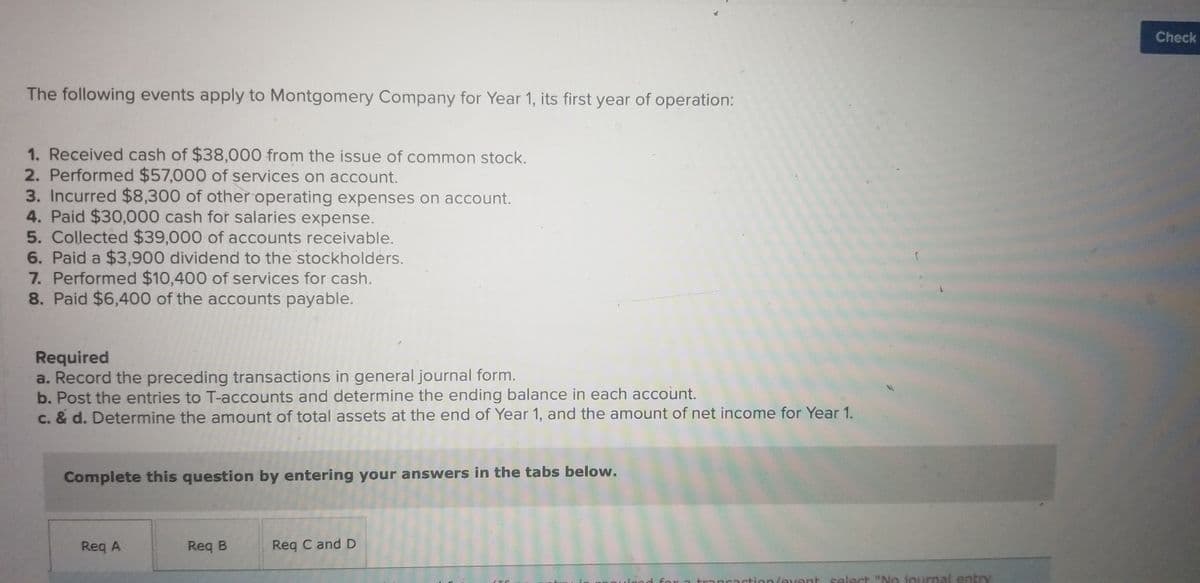

The following events apply to Montgomery Company for Year 1, its first year of operation:

1. Received cash of $38,000 from the issue of common stock.

2. Performed $57,000 of services on account.

3. Incurred $8,300 of other operating expenses on account.

4. Paid $30,000 cash for salaries expense.

5. Collected $39,000 of accounts receivable.

6. Paid a $3,900 dividend to the stockholders.

7. Performed $10,400 of services for cash.

8. Paid $6,400 of the accounts payable.

Required

a. Record the preceding transactions in general journal form.

b. Post the entries to T-accounts and determine the ending balance in each accoùnt.

c. & d. Determine the amount of total assets at the end of Year 1, and the amount of net income for Year 1.

Complete this question by entering your answers in the tabs below.

Reg A

Req B

Req C and D

tion(event select "No journal entry

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,