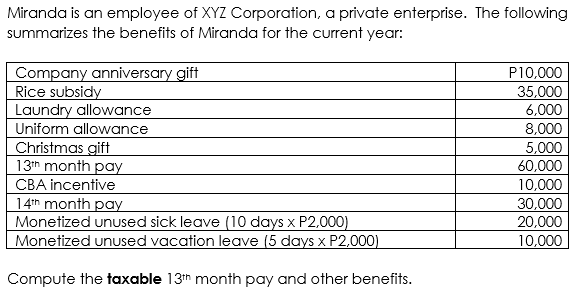

Miranda is an employee of XYZ Corporation, a private enterprise. The following summarizes the benefits of Miranda for the current year: |Company anniversary gift Rice subsidy Laundry allowance Uniform allowance Christmas gift 13th month pay CBA incentive 14th month pay Monetized unused sick leave (10 days x P2,000) Monetized unused vacation leave (5 days x P2,000) P10,000 35,000 6,000 8,000 5,000 60,000 10,000 30,000 20,000 10,000 Compute the taxable 13th month pay and other benefits.

Miranda is an employee of XYZ Corporation, a private enterprise. The following summarizes the benefits of Miranda for the current year: |Company anniversary gift Rice subsidy Laundry allowance Uniform allowance Christmas gift 13th month pay CBA incentive 14th month pay Monetized unused sick leave (10 days x P2,000) Monetized unused vacation leave (5 days x P2,000) P10,000 35,000 6,000 8,000 5,000 60,000 10,000 30,000 20,000 10,000 Compute the taxable 13th month pay and other benefits.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 1PB

Related questions

Question

Transcribed Image Text:Miranda is an employee of XYZ Corporation, a private enterprise. The following

summarizes the benefits of Miranda for the current year:

Company anniversary gift

Rice subsidy

Laundry allowance

Uniform allowance

Christmas gift

13h month pay

CBA incentive

14th month pay

Monetized unused sick leave (10 days x P2,000)

Monetized unused vacation leave (5 days x P2,000)

P10,000

35,000

6,000

8,000

5,000

60,000

10,000

30,000

20,000

10,000

Compute the taxable 13h month pay and other benefits.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning