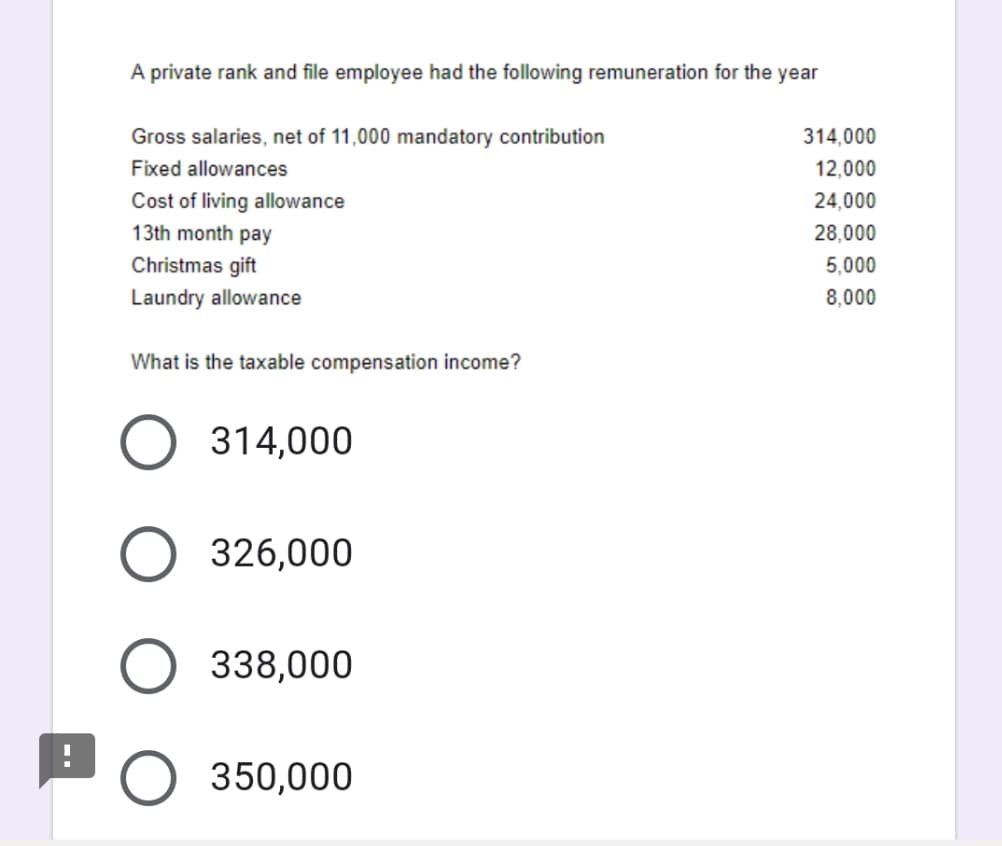

A private rank and file employee had the following remuneration for the year Gross salaries, net of 11,000 mandatory contribution 314,000 Fixed allowances 12,000 Cost of living allowance 13th month pay 24,000 28,000 Christmas gift 5,000 Laundry allowance 8,000 What is the taxable compensation income? 314,000 326,000 338,000 350,000

A private rank and file employee had the following remuneration for the year Gross salaries, net of 11,000 mandatory contribution 314,000 Fixed allowances 12,000 Cost of living allowance 13th month pay 24,000 28,000 Christmas gift 5,000 Laundry allowance 8,000 What is the taxable compensation income? 314,000 326,000 338,000 350,000

Chapter9: Deductions: Employee And Self-employed-related Expenses

Section: Chapter Questions

Problem 22CE

Related questions

Question

Transcribed Image Text:A private rank and file employee had the following remuneration for the year

Gross salaries, net of 11,000 mandatory contribution

314,000

Fixed allowances

12,000

Cost of living allowance

24,000

13th month pay

28,000

Christmas gift

5,000

Laundry allowance

8,000

What is the taxable compensation income?

314,000

326,000

338,000

350,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College