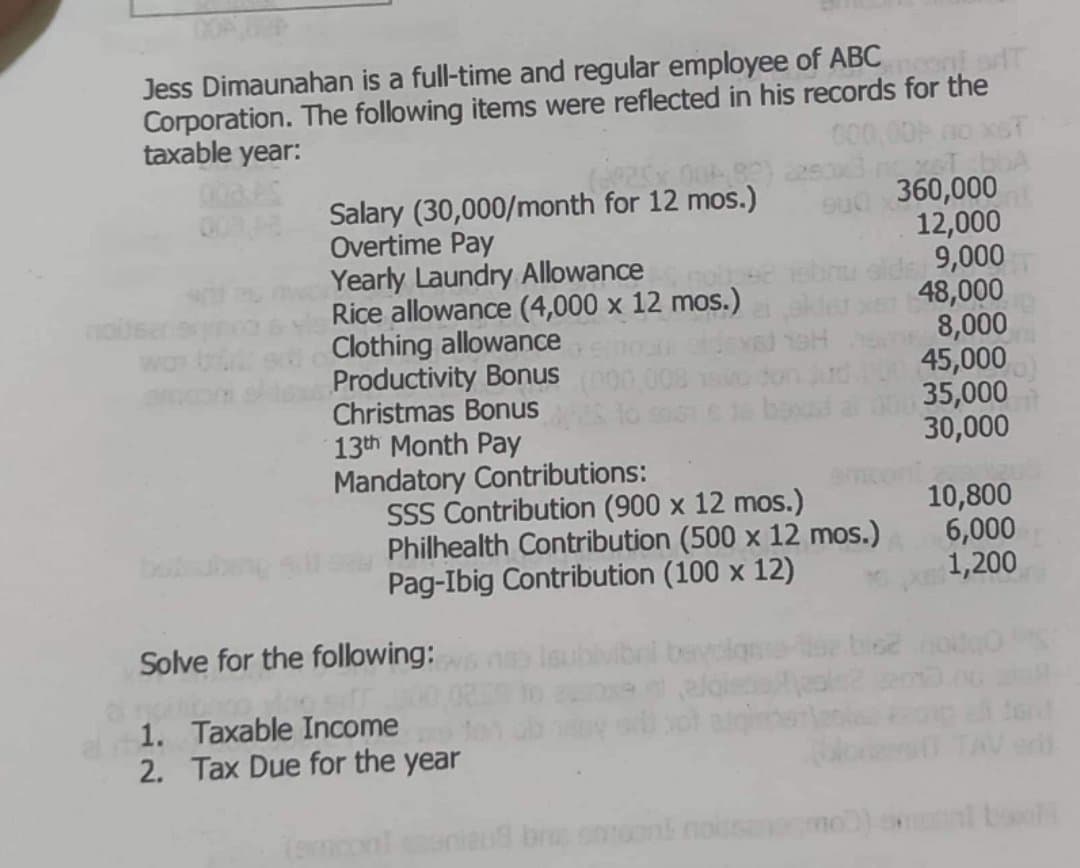

Jess Dimaunahan is a full-time and regular employee of ABC Corporation. The following items were reflected in his records for the taxable year: 000 00 Salary (30,000/month for 12 mos.) Overtime Pay Yearly Laundry Allowance Rice allowance (4,000 x 12 mos.) Clothing allowance Productivity Bonus Christmas Bonus 13th Month Pay Mandatory Contributions: SSS Contribution (900 x 12 mos.) Philhealth Contribution (500 x 12 mos.) Pag-Ibig Contribution (100 x 12) 360,000 12,000 ds9,000 48,000 8,000 45,000 35,000 30,000 10,800 6,000 1,200 Solve for the following: 1. Taxable Income 2. Tax Due for the year nl

Jess Dimaunahan is a full-time and regular employee of ABC Corporation. The following items were reflected in his records for the taxable year: 000 00 Salary (30,000/month for 12 mos.) Overtime Pay Yearly Laundry Allowance Rice allowance (4,000 x 12 mos.) Clothing allowance Productivity Bonus Christmas Bonus 13th Month Pay Mandatory Contributions: SSS Contribution (900 x 12 mos.) Philhealth Contribution (500 x 12 mos.) Pag-Ibig Contribution (100 x 12) 360,000 12,000 ds9,000 48,000 8,000 45,000 35,000 30,000 10,800 6,000 1,200 Solve for the following: 1. Taxable Income 2. Tax Due for the year nl

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 14EB: In EB13, you prepared the journal entries for Janet Evanovich, an employee of Marc Associates. You...

Related questions

Question

Transcribed Image Text:Jess Dimaunahan is a full-time and regular employee of ABC ni sdT

Corporation. The following items were reflected in his records for the

taxable year:

Salary (30,000/month for 12 mos.)

Overtime Pay

Yearly Laundry Allowance

Rice allowance (4,000 x 12 mos.)

Clothing allowance

Productivity Bonus

Christmas Bonus

13th Month Pay

Mandatory Contributions:

SSS Contribution (900 x 12 mos.)

Philhealth Contribution (500 x 12 mos.)

Pag-Ibig Contribution (100 x 12)

360,000

12,000

9,000

48,000

8,000

45,000

35,000

30,000

10,800

6,000

1,200

bbn

Solve for the following:

1. Taxable Income

2. Tax Due for the year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning