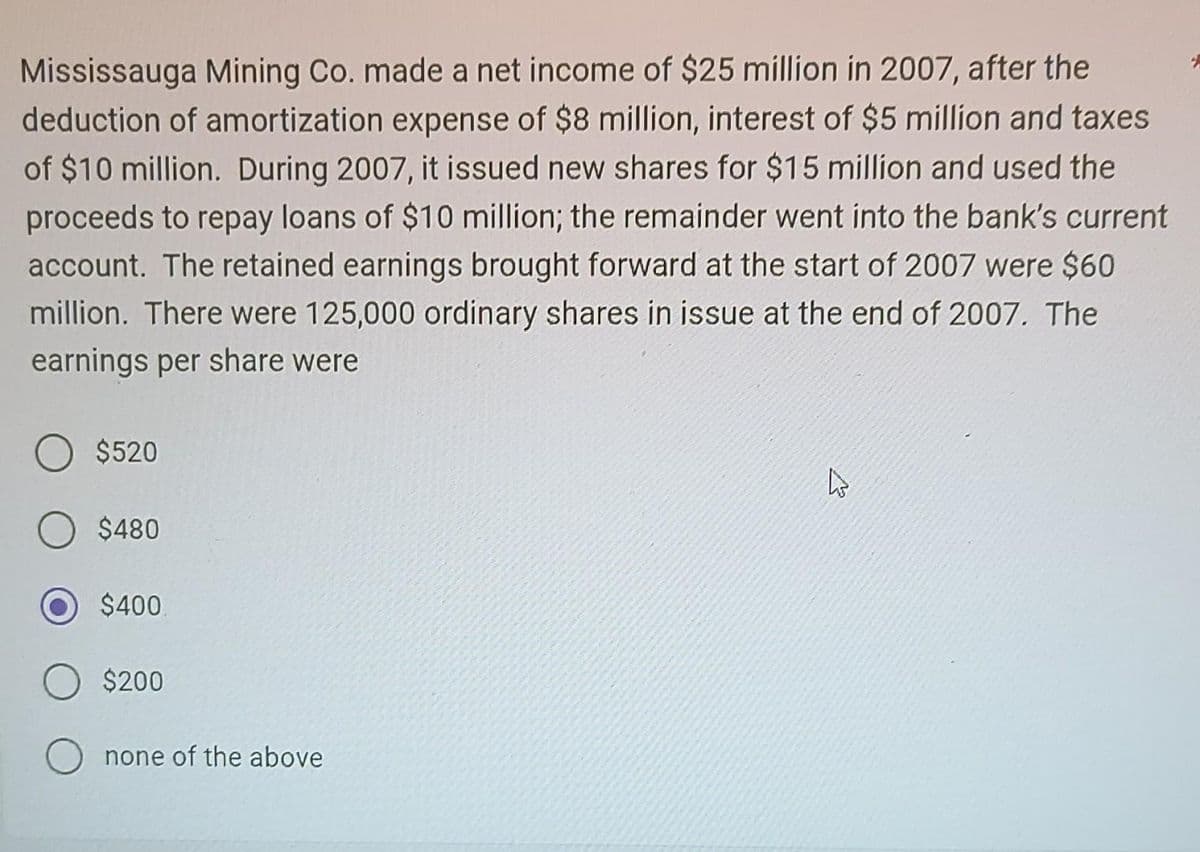

Mississauga Mining Co. made a net income of $25 million in 2007, after the deduction of amortization expense of $8 million, interest of $5 million and taxes of $10 million. During 2007, it issued new shares for $15 million and used the proceeds to repay loans of $10 million; the remainder went into the bank's current account. The retained earnings brought forward at the start of 2007 were $60 million. There were 125,000 ordinary shares in issue at the end of 2007. The earnings per share were O $520 O $480 $400 $200 none of the above

Mississauga Mining Co. made a net income of $25 million in 2007, after the deduction of amortization expense of $8 million, interest of $5 million and taxes of $10 million. During 2007, it issued new shares for $15 million and used the proceeds to repay loans of $10 million; the remainder went into the bank's current account. The retained earnings brought forward at the start of 2007 were $60 million. There were 125,000 ordinary shares in issue at the end of 2007. The earnings per share were O $520 O $480 $400 $200 none of the above

Chapter2: The Domestic And International Financial Marketplace

Section2.A: Taxes

Problem 8P

Related questions

Question

146.

Subject : - Accounting

Transcribed Image Text:Mississauga Mining Co. made a net income of $25 million in 2007, after the

deduction of amortization expense of $8 million, interest of $5 million and taxes

of $10 million. During 2007, it issued new shares for $15 million and used the

proceeds to repay loans of $10 million; the remainder went into the bank's current

account. The retained earnings brought forward at the start of 2007 were $60

million. There were 125,000 ordinary shares in issue at the end of 2007. The

earnings per share were

$520

$480

$400

$200

none of the above

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning