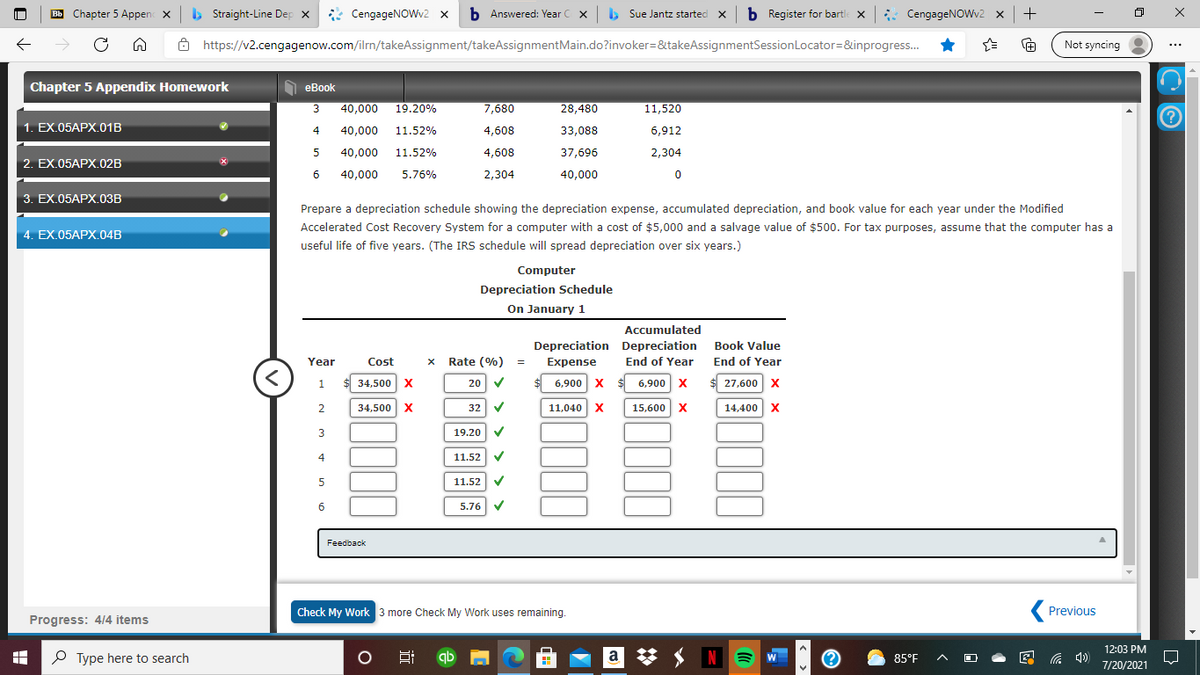

Modified Accelerated Cost Recovery System An example of a depreciation schedule under the Modified Accelerated Cost Recovery System of depreciation is shown. The Internal Revenue Service (IRS) classifies various assets according to useful life and sets depreciation rates for each year of the asset’s life. This asset has a five year life. The MACRS rates are shown in the schedule. This example is for an asset with a cost of $40,000 and a salvage value of $4,000. MODIFIED ACCELERATED COST RECOVERY SYSTEM Year Cost × Rate = Depreciation Expense Accumulated Depreciation (End of Year) Book Value (End of Year) 1 $40,000 20.00% $8,000 $8,000 $32,000 2 40,000 32.00% 12,800 20,800 19,200 3 40,000 19.20% 7,680 28,480 11,520 4 40,000 11.52% 4,608 33,088 6,912 5 40,000 11.52% 4,608 37,696 2,304 6 40,000 5.76% 2,304 40,000 0 Prepare a depreciation schedule showing the depreciation expense, accumulated depreciation, and book value for each year under the Modified Accelerated Cost Recovery System for a computer with a cost of $5,000 and a salvage value of $500. For tax purposes, assume that the computer has a useful life of five years. (The IRS schedule will spread depreciation over six years.) Computer Depreciation Schedule On January 1

Modified Accelerated Cost Recovery System

An example of a

| MODIFIED ACCELERATED COST RECOVERY SYSTEM | |||||||

Year |

Cost |

× |

Rate |

= |

Depreciation Expense |

Accumulated Depreciation (End of Year) |

Book Value (End of Year) |

| 1 | $40,000 | 20.00% | $8,000 | $8,000 | $32,000 | ||

| 2 | 40,000 | 32.00% | 12,800 | 20,800 | 19,200 | ||

| 3 | 40,000 | 19.20% | 7,680 | 28,480 | 11,520 | ||

| 4 | 40,000 | 11.52% | 4,608 | 33,088 | 6,912 | ||

| 5 | 40,000 | 11.52% | 4,608 | 37,696 | 2,304 | ||

| 6 | 40,000 | 5.76% | 2,304 | 40,000 | 0 |

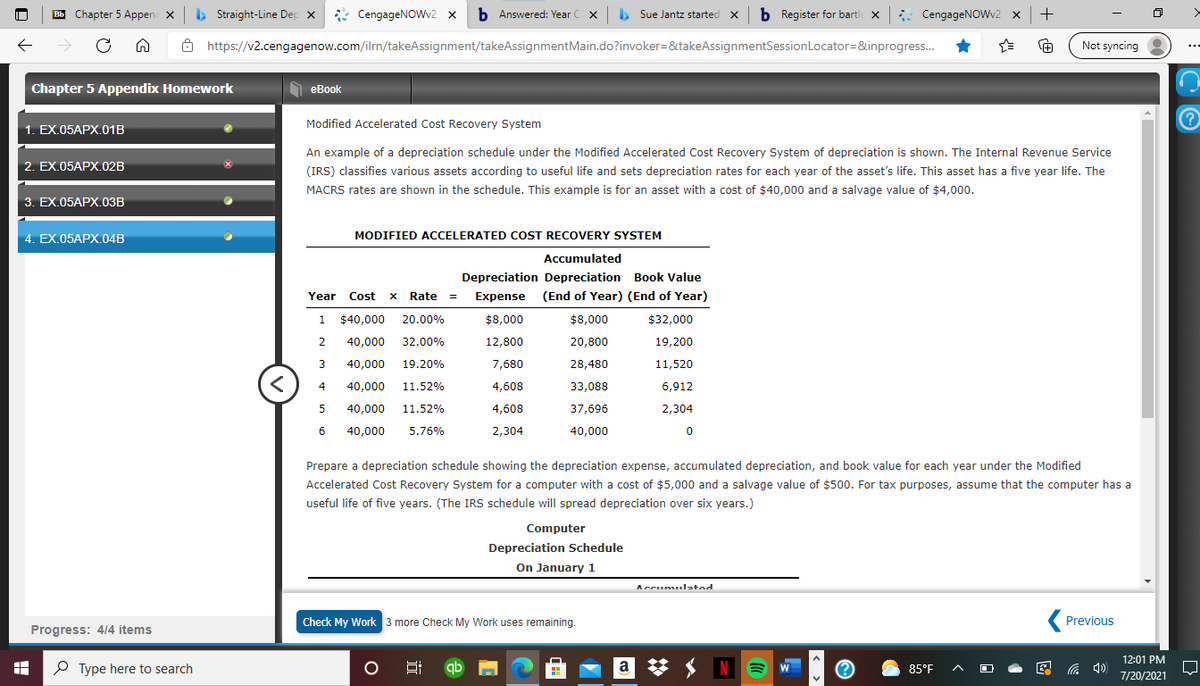

Prepare a depreciation schedule showing the depreciation expense, accumulated depreciation, and book value for each year under the Modified Accelerated Cost Recovery System for a computer with a cost of $5,000 and a salvage value of $500. For tax purposes, assume that the computer has a useful life of five years. (The IRS schedule will spread depreciation over six years.)

| Computer |

| Depreciation Schedule |

| On January 1 |

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images