Use the double-declining-balance method to make a depreciation schedule for a piece of equipment thats costs $2,780 and has a salvage value of $300. The equipment is expected to be used for four years.

Use the double-declining-balance method to make a depreciation schedule for a piece of equipment thats costs $2,780 and has a salvage value of $300. The equipment is expected to be used for four years.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 3CE: A machine costing 350,000 has a salvage value of 15,000 and an estimated life of three years....

Related questions

Question

6

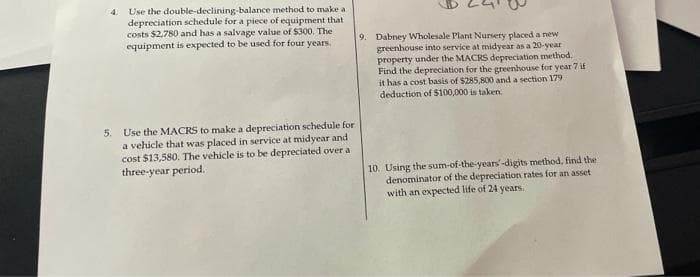

Transcribed Image Text:4. Use the double-declining-balance method to make a

depreciation schedule for a piece of equipment that

costs $2,780 and has a salvage value of $300. The

equipment is expected to be used for four years.

5.

Use the MACRS to make a depreciation schedule for

a vehicle that was placed in service at midyear and

cost $13,580. The vehicle is to be depreciated over a

three-year period.

9. Dabney Wholesale Plant Nursery placed a new

greenhouse into service at midyear as a 20-year

property under the MACRS depreciation method.

Find the depreciation for the greenhouse for year 7 if

it has a cost basis of $285,800 and a section 179-

deduction of $100,000 is taken.

10. Using the sum-of-the-years'-digits method, find the

denominator of the depreciation rates for an asset

with an expected life of 24 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning