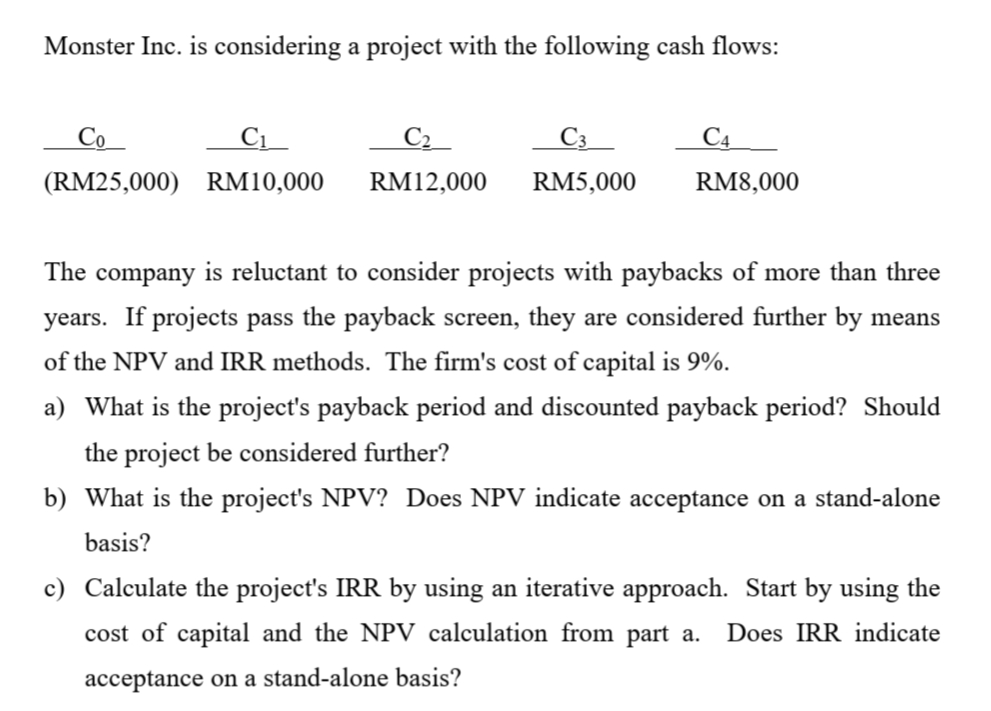

Monster Inc. is considering a project with the following cash flows: Co C1 C2 C3 C4 (RM25,000) RM10,000 RM12,000 RM5,000 RM8,000 The company is reluctant to consider projects with paybacks of more than three years. If projects pass the payback screen, they are considered further by means of the NPV and IRR methods. The firm's cost of capital is 9%. a) What is the project's payback period and discounted payback period? Should the project be considered further? b) What is the project's NPV? Does NPV indicate acceptance on a stand-alone basis? c) Calculate the project's IRR by using an iterative approach. Start by using the cost of capital and the NPV calculation from part a. Does IRR indicate acceptance on a stand-alone basis?

Monster Inc. is considering a project with the following cash flows: Co C1 C2 C3 C4 (RM25,000) RM10,000 RM12,000 RM5,000 RM8,000 The company is reluctant to consider projects with paybacks of more than three years. If projects pass the payback screen, they are considered further by means of the NPV and IRR methods. The firm's cost of capital is 9%. a) What is the project's payback period and discounted payback period? Should the project be considered further? b) What is the project's NPV? Does NPV indicate acceptance on a stand-alone basis? c) Calculate the project's IRR by using an iterative approach. Start by using the cost of capital and the NPV calculation from part a. Does IRR indicate acceptance on a stand-alone basis?

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 8P

Related questions

Question

Calculate this question by using formula [WITHOUT EXCEL]

Transcribed Image Text:Monster Inc. is considering a project with the following cash flows:

Со

C1_

C4

(RM25,000) RM10,000

RM12,000

RM5,000

RM8,000

The company is reluctant to consider projects with paybacks of more than three

years. If projects pass the payback screen, they are considered further by means

of the NPV and IRR methods. The firm's cost of capital is 9%.

a) What is the project's payback period and discounted payback period? Should

the project be considered further?

b) What is the project's NPV? Does NPV indicate acceptance on a stand-alone

basis?

c) Calculate the project's IRR by using an iterative approach. Start by using the

cost of capital and the NPV calculation from part a.

Does IRR indicate

acceptance on a stand-alone basis?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College