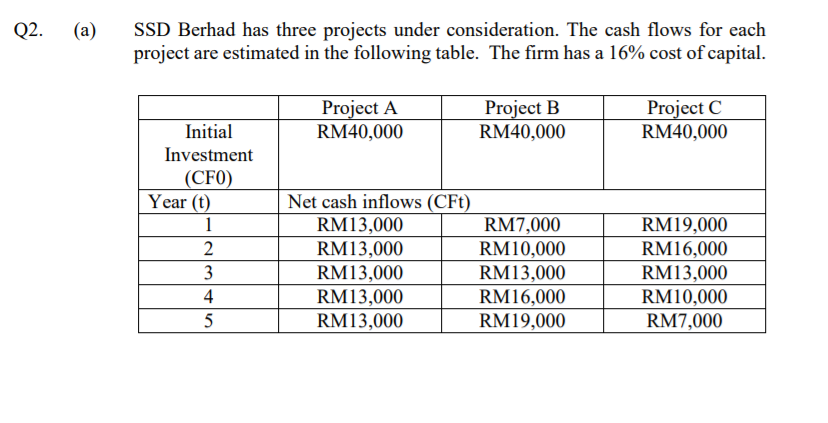

SSD Berhad has three projects under consideration. The cash flows for each project are estimated in the following table. The firm has a 16% cost of capital. Project A RM40,000 Project B RM40,000 Project C RM40,000 Initial Investment (CF0) Year (t) Net cash inflows (CFt) RM13,000 RM13,000 RM13,000 RM13,000 RM13,000 RM7,000 RM10,000 RM13,000 RM16,000 RM19,000 RM19,000 RM16,000 RM13,000 RM10,000 RM7,000 1 2 3 4

Q: Baltusrol Inc. has the following three investment opportunities. A P70,000 10,000 Initial investment…

A: Payback period is the amount of time required to recover initial investment.

Q: Rafael Corporation has two projects under consideration. The cash flows for each project are shown…

A: Solution:- Payback period means the period at which the summation of cash inflows from the project…

Q: Neil Corporation has two projects under consideration. The cash flows for each project are shown in…

A: The payback period refers to the amount of time it takes to recover the cost of an investment. In…

Q: A project cost $1.3 million and will generate cash flows in perpetuity of $230,000. The firm's cost…

A: Given information in question: - Project cost= $1300000 Perpetuity=$230000 Cost of capital=14%

Q: NPV Calculate the net present value (NPV) for the following 15-year projects. Comment on the…

A: NPV is the difference between present value of all cash inflows and initial investment. In this…

Q: In order to finance a new project costing $30 million, a company borrowed $21 million at 16% per…

A: Computation of weighted average cost of capital: Answer: The correct answer is 14.8%. Option (c)

Q: 260 750,000 2 15,000 475 280 750,000 3 10,000 500 295 750,000 4 10,000 570 320

A: The measurement is given as,

Q: Based upon the following cash flows, should Chipper Nipper Cookie Company introduce a new product,…

A: The NPV and IRR can be computed using excel as follows:

Q: Financial Manager of Agusta Company is considering two projects (project A and project H), which…

A: Capital budgeting techniques are used to determine the whether the project is acceptable or not.…

Q: Crane Bakeries recently purchased equipment at a cost of $587,500. Management expects the equipment…

A: Given information : Cost of equipment = $587,500 Cash flows = $305,250 Tenure = 4 years Cost of…

Q: Rajawali Sdn Bhd has two potential projects with an initial cost of RM1,500,000. The capital budget…

A: Under interpolation technique :- IRR = Lowest rate + [Lower rate NPV x (Higher rate - Lower…

Q: A project is expected to provide the cash flows indicated below. Would you invest GH¢100000 in this…

A: A method of capital budgeting that helps to evaluate the present worth of cash flow and a series of…

Q: A project cost $2.6 million up front and will generate cash flows in perpetuity of $210,000.…

A: a) Net present value (NPV) is the contrast between the present value of money inflows over some…

Q: Firm x has made an investment of $ 300.000 . It is thought that the project will provide $170.000…

A: Present value is the sum of future cashflows discounted at discount rate

Q: Hsung Company accumulates the following data concerning a proposed capital investment: cash cost…

A: Net present value = Present value of cash inflows - Initial investment. If the net present value is…

Q: Perez Company is considering an investment of $30,485 that provides net cash flows of $9,000…

A: Internal rate of return is the rate at which the present value of cash inflows is equal to the…

Q: A given project requires an initial investment of 29800 in order to collect the following cash…

A: The first question is answered for you. Please resubmit specifying the question number you want…

Q: ) A firm is evaluating a proposal which has an initial investment of RM35,000 and has cash flows of…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: The total investment required for two projects are estimated at OMR100, 000. The cash flows expected…

A: Using excel for calculations

Q: Gone Mad Company Limited is considering two mutually exclusive projects to expand its operations:…

A: Cash flow for R&D: Year Cash inflow Cumulatice cash inflow 1 $100,000 $100,000 2 115,000…

Q: Tropical Candy Inc are considering two mutually-exclusive projects, A and B. Their cash flows are…

A:

Q: Tesla Systems has estimated the cash flows over the 5-year lives for two projects, A and B. These…

A: Replacement Decision in financial management refers to change in an existing asset with one similar…

Q: Project X Project Y Initial investment (CF,) $980,000 $363,000 Year (f) Cash inflows (CF) $150,000…

A: An internal rate of return is defined as the financial metric, which used for making the financial…

Q: Cocoa Company is evaluating an investment shown below. The investment will acquire an initial…

A: SINCE THERE ARE MORE THAN 3 QUESTION, ONLY ANSWERS OF 1ST 3 SUB PARTS WILL BE PROVIDED. KINDLY POST…

Q: Sandhill Bakeries recently purchased equipment at a cost of $490,500. Management expects the…

A: Given information: Initial cost = $490,500 Annual cash flows = $243,250 Tenure = 4 years Cost of…

Q: Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment…

A: Present value is the concept wherein the future cash flows are discounted at a specified discount…

Q: Profitaility Index Please solve for the profitiability index and explain. The information is…

A: Profitability Index measures ratio between present value of future cash flows and initial…

Q: b) Gone Mad Company Limited is considering two mutually exclusive projects to expand its operations,…

A: Since you have asked a question with multiple parts, we will solve the first 3 parts for you. Please…

Q: The Carlo Company has been allocated RM600,000 on investment projects for the coming year. Four…

A: NET PRESENT VALUE NPV means the present value of cash inflows are compared with…

Q: Y-Bar uses IRR to evaluate projects. The company has a cost of capital of 15% They are currently…

A: NPV and IRR are two methods of investment appraisal. NPV is the net present value of all cash…

Q: The Alfred Company has been allocated RM600,000 on investment projects for the coming year. Four…

A: Capital rationing is the term used to consider various projects on the basis of higher profitability…

Q: firm is considering two projects and the cash flows associated with them are shown in the following…

A: Pay back period is the number of years required to recover the initial investment and it must be…

Q: The Carlo Company has been allocated RM600,000 on investment projects for the coming year. Four…

A: As per company policy it is only possible to solve one question.

Q: Invest in any or all of the four projects whose relevant cash flows are given in the following…

A: Hi, since you have posted a question with multiple sub-parts, we will answer the first three…

Q: Rajawali Sdn Bhd has two potential projects with an initial cost of RM1,500,000. The capital budget…

A: Payback period = Years before full recovery + (Unrecovered cost/Cash flow during the year)

Q: Blossom Company accumulates the following data concerning a proposed capital investment: cash cost…

A: Solution: Net present value = present value of cash inflows - Initial cash cost = (44000*5.22) -…

Q: When ∈=15% andMARR = 20% per year, determine whether the project (whose net cash-flow diagram…

A: Net Present Value (NPV) is one of the method used for making capital budgeting decisions. It is…

Q: Gone Mad Company Limited is considering two mutually exclusive projects to expand its operations:…

A: Net Present Value (NPV) is a capital budgeting technique which uses a discount rate to bring all the…

Q: Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment…

A: As per the given information: Initial investment - $330,000 Rate of return - 8%Net cash flowsProject…

Q: 1) "Millie's Ice Cream" Company Limited has two (2) projects under consideration. The cash flows for…

A: (b) (ii) Project B - Payback Period: Payback period is the period within which initial investment is…

Q: Seagated Corp Sdn Bhd is considering two projects of machinery that perform the same task. The…

A: Net present value is the difference between Present Value of cash Inflows and Initial Investment.…

Q: Anderson International Limited is evaluating a project in Erewhon. The project will create the…

A: NPV can be calculated by following function in excel =NPV(rate,value1,[value2],…) + Initial…

Q: Distinguish between hard and soft capital rationing

A: Capital Rationing is the strategy of picking up the most profitable projects to invest the available…

Q: X company provides spetialty manufacturing services to defence contractors located in the Seattle,…

A: To open the "NPV function" window - MS-Excel --> Formulas --> Financials --> NPV.

Q: SAP!! Sufain Limited planning to invest in a project with an initial investment of Rs. 2,000,000.…

A: Honor code: As per guidelines, we are allowed to answer a maximum of 3 subparts. Introduction: Net…

Q: Sunshine Corporation is reviewing an investment proposal. The initial cost of the investment is R52…

A: 1. Year Cash inflows Cumulative Cash inflows 1 20000 20000 2 17500 37500 3 15000 52500 4…

Q: A firm has the following investment alternatives and has the following cash inflows. Each costs…

A: Honor code: Since you have posted a question with multiple sub-parts, we will solve the first three…

Calculate each project’s payback period. Decide which project is preferred according to this capital budgeting method.

Step by step

Solved in 5 steps with 3 images

- White Company can invest in one of two projects, TD1 or TD2. Each project requires an initial investment of $101,250 and produces the year-end cash inflows shown in the following table.Thomas Company is considering two mutually exclusive projects. The firm, which has a cost of capital of 14%, has estimated its cash flows as shown in the following table: Project A Project B Initial investment (CF0) $150,000 $83,000 Year (t) Cash inflows (CFt) 1 $20,000 $45,000 2 $35,000 $25,000 3 $40,000 $35,000 4 $50,000 $10,000 5 $70,000 $15,000 a. Calculate the NPV of each project, and assess its acceptability. b. Calculate the IRR for each project, and assess its acceptability.Bates & Reid, LLC, has identified two mutually exclusive projects, A and B. Project A has a NPV of $14,050.47. Project B has cash flows as described below. Year Cash Flow B 0 -$77,000 1 35,000 2 25,000 3 25,000 4 25,000 If the WACC is 8%, then B’s NPV is _______ and therefore the firm should accept _________ $11,337.55; project B because NPVA > NPVB. $15,062.43; project B because NPVA < NPVB. $15,062.43; project A because NPVA < NPVB. The projects are equally profitable. $11,337.55; project A because NPVA > NPVB.

- which of the two projects, Project O and Project Y, should the company pursue? Why? The firm's cost of capital has been determined at 9% Project O Project Y Initilal Investment P50,000 P48 000 Cash Flows 1 P20,000 30,000 2 25,000 35,000 3 15,000 40,000 4 20,000 10,00023. Simms Corp. is considering a project that has the following cash flow data. The project's IRR is_______ %. Show 2 decimals in your answer. Year 0 1 2 3 Cash Flows -$1,000 $380 $475 $450Queens Soliderate is considering two mutually exclusive projects. The firm, which has a 12% cost of capital, has estimated its cash flows as shown in the following table. Project A Project B Initial investment (CF0) $130,000 $85,000 Year (t) Cash inflows (CFt) 1 $25,000 $40,000 2 35,000 35,000 3 45,000 30,000 4 50,000 10,000 5 55,000 5,000 a. Calculate the NPV of each project, and assess its acceptability. b. Calculate the IRR for each project, and assess its acceptability. Required to answer. Single line text.

- Q3) 3. The company will invest $150,000 in a project and average annual income $50,000. The investment will provide the following inflows: Year Cash inflow 1 $ 25,000 2 45,000 3 30,000 4 50,000 5 70,000 Calculate: Accounting rate of return Internal Rate of Return at 10% and 15% discount factor.22.Harry's Inc. is considering a project that has the following cash flow and WACC data. The project's NPV is $ _________. (Show 2 decimals.) WACC = 10.25% Year 0 1 2 3 4 Cash Flows -$1,000 $100 $450 $450 $350Assume that Anonas Company is planning to invest P4M in a new project which will provide net cash inflows of P1.5M in 2022, P1.4M in 2023, P1.3M in 2024, P1.2M in 2025 and P1.1M in 2026. The company uses 12% as cost of capital. If the IRR will be computed using Excel Formula, which computation will give the lowest rate? • IRR• XIRR• MIRR• Answer not given

- Neil Corporation has two projects under consideration. The cash flows for each project are shown in the following table. The firm has a 16% cost of capital Project A Project B Initial Cash Outflow Php400,000 Php400,000 Year Cash Inflows 1 70,000 190,000 2 100,000 160,000 3 130,000 130,000 4 160,000 100,000 5 190,000 70,000 1.Compute for the Payback Period of the two projects. 2.Compute for the Net Present Value of the two projects. 3.Considering the Payback Period and Net Present Value, Which of the two project would you recommend and why?A firm evaluates all of its projects by applying the IRR rule. Year Cash Flow 0 –$ 150,000 1 66,000 2 73,000 3 57,000 What is the project's IRR? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)a company is deciding between two mutually exclusive projects. the cash flows are shown below. year 0 project a -$1,000 project b -$1,000 ywar 1 project a 550 project b 400 year 2 project a 550 projecy b 600 year 3 project a 550 project b 900 if the cosy of capital is 10% which project should the compsny select