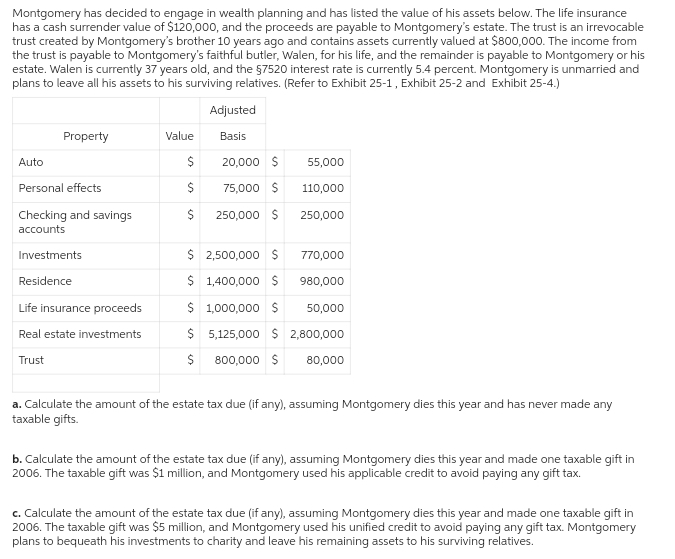

Montgomery has decided to engage in wealth planning and has listed the value of his assets below. The life insurance has a cash surrender value of $120,000, and the proceeds are payable to Montgomery's estate. The trust is an irrevocable trust created by Montgomery's brother 10 years ago and contains assets currently valued at $800,000. The income from the trust is payable to Montgomery's faithful butler, Walen, for his life, and the remainder is payable to Montgomery or his estate. Walen is currently 37 years old, and the $7520 interest rate is currently 5.4 percent. Montgomery is unmarried and plans to leave all his assets to his surviving relatives. (Refer to Exhibit 25-1, Exhibit 25-2 and Exhibit 25-4.) Property Auto Personal effects Checking and savings accounts Investments Residence Value $ $ in $ Adjusted Basis 20,000 $ 75,000 $ 250,000 $ $ 2,500,000 $ $ 1,400,000 $ 55,000 110,000 250,000 770,000 980,000

Montgomery has decided to engage in wealth planning and has listed the value of his assets below. The life insurance has a cash surrender value of $120,000, and the proceeds are payable to Montgomery's estate. The trust is an irrevocable trust created by Montgomery's brother 10 years ago and contains assets currently valued at $800,000. The income from the trust is payable to Montgomery's faithful butler, Walen, for his life, and the remainder is payable to Montgomery or his estate. Walen is currently 37 years old, and the $7520 interest rate is currently 5.4 percent. Montgomery is unmarried and plans to leave all his assets to his surviving relatives. (Refer to Exhibit 25-1, Exhibit 25-2 and Exhibit 25-4.) Property Auto Personal effects Checking and savings accounts Investments Residence Value $ $ in $ Adjusted Basis 20,000 $ 75,000 $ 250,000 $ $ 2,500,000 $ $ 1,400,000 $ 55,000 110,000 250,000 770,000 980,000

Chapter27: The Federal Gift And Estate Taxes

Section: Chapter Questions

Problem 37P

Related questions

Question

Dd.107.

Transcribed Image Text:Montgomery has decided to engage in wealth planning and has listed the value of his assets below. The life insurance

has a cash surrender value of $120,000, and the proceeds are payable to Montgomery's estate. The trust is an irrevocable

trust created by Montgomery's brother 10 years ago and contains assets currently valued at $800,000. The income from

the trust is payable to Montgomery's faithful butler, Walen, for his life, and the remainder is payable to Montgomery or his

estate. Walen is currently 37 years old, and the $7520 interest rate is currently 5.4 percent. Montgomery is unmarried and

plans to leave all his assets to his surviving relatives. (Refer to Exhibit 25-1, Exhibit 25-2 and Exhibit 25-4.)

Auto

Property

Personal effects

Checking and savings

accounts

Investments

Residence

Life insurance proceeds

Real estate investments

Trust

Value

$

$

$

Adjusted

Basis

20,000 $

75,000 $

250,000 $

55,000

110,000

250,000

$ 2,500,000 $

$ 1,400,000 $

$ 1,000,000 $

50,000

$ 5,125,000 $ 2,800,000

$ 800,000 $ 80,000

770,000

980,000

a. Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and has never made any

taxable gifts.

b. Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and made one taxable gift in

2006. The taxable gift was $1 million, and Montgomery used his applicable credit to avoid paying any gift tax.

c. Calculate the amount of the estate tax due (if any), assuming Montgomery dies this year and made one taxable gift in

2006. The taxable gift was $5 million, and Montgomery used his unified credit to avoid paying any gift tax. Montgomery

plans to bequeath his investments to charity and leave his remaining assets to his surviving relatives.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning