Monthly Income Monthly Expenses ITEM AMOUNT ITEM |Column1 AMOUNT Income Source 1 $2,000.00 Rent $800.00 Cell phone $100.00 Groceries $200.00 Car payment $273.00 Auto expenses $120.00 Student loans $250.00 Credit cards $100.00 Auto Insurance $78.00 Personal care $50.00 Entertainment $100.00 MiscellaneoUS $50.00

Q: Current Attempt in Progress Ritter Advertising Company's trial balance at December 31 shows Supplies...

A: Adjusting entries are those journal entries which are passed at the end of the period in order to ac...

Q: Objectivity refers to the obligation that all members of the professional bodies: a. be straightforw...

A: A professional body is an organization whereby the individual members practice their profession.

Q: During March, the following costs were charged to the manufacturing department: $13,520 for material...

A: Process costing is a method of costing which generally used in manufacturing where units are continu...

Q: The bond indenture for the 10-year, 9% debenture bonds issued January 2, 20Y5, required working capi...

A: Particulars Amount Cash $99,000 Temporary investments 48,000 Accounts and notes receivable (ne...

Q: For each transaction, decide whether it should be included in the cash budget for the business; prep...

A: Cash budget of the business shows all estimated cash receipts and all estimated cash payments from t...

Q: Berne Company (lessor) enters into a lease with Fox Company to lease equipment to Fox beginning Janu...

A: SOLUTION- LEASE IS A CONTRACT BY WHICH ONE PARTY CONVEYS LAND, PROPERTY , SERVICES ETC TO ANOTHER ...

Q: Calculate the interest on a 270−day, 11% note for $50,000. (Use a 365−day

A: Solution: Interest = principal amount * interest rate * days / 365

Q: %24 Requlred Informatlon [The following information applies to the questions displayed below] Wester...

A: Average operating assets = 1,437,500 + 287,500 = 1,725,000 Net operating income = 460,000 + [(460,00...

Q: Mohammed Corporation's comparative balance sheet for current assets and liabilities was as follows: ...

A: Cash flows from operating activities is an important section of cash flow statement of the business ...

Q: Identify whether the statement are True or False. 1. Insurance companies use replacement value as ...

A: S. No. Particulars True/False Reason 1. Insurance companies use replacement value as a basis to de...

Q: First-in, First-out: Ending Inventory Answer Cost of goods sold Answer B. Last-in, first-o...

A: Periodic inventory system: A periodic inventory system is a system of measuring inventory which is c...

Q: Summarized data for Ralph Corporation: Selling price Variable expenses $ 200 per unit $ 150 per unit...

A: Margin of safety in percentage is calculated by dividing the margin of safety by the total sales.

Q: i RequIred Informatlon The following information applies to the questions displayed below.] Cane Com...

A: Raw material cost is one of the direct cost of manufacturing the product by the business. This is a ...

Q: Roy dies and is survived by his wife, Marge. Under Roy’s will, all of his otherwise uncommitted asse...

A: 38 R dies and his assets are transferred to his wife M. it is required to compute R marital deductio...

Q: short answer Some companies go out of business due to lack of cash flow. Even if they may have a lo...

A: Cash flow statement means the statement which shows the cash flow in or out of business enterprises ...

Q: The total contribution margin is equivalent to the combined net profit and fixed costs. It can be co...

A: Solution: The total contribution margin is equivalent to the combined net profit and fixed costs = T...

Q: 34.For 2020, the maximum percentage of Social Security benefits that could be included in a taxpayer...

A: 35. The maximum percentage of Social Security benefits that could be included in a taxpayer’s gross ...

Q: Jack Wood is the engagement partner for the financial report audit of Clayton Ltd for the year ended...

A: The procedure of auditing a corporate institution's financial statements as well as other accounting...

Q: Statement of profit or loss and other comprehensive income, and Statement of financial position.

A: Statement of profit or loss and other comprehensive income For the year ended 28 February 2021 P...

Q: e Harriott manufacturing company uses job order costing system. The company uses machine hours to ap...

A: The question is based on the concept of Cost Accounting.

Q: Which of the following is most likely to be classified and reported as current liability? a. Bond Pa...

A: The liabilities that are payable within one year are classified as current liabilities. It includes ...

Q: When Kayla discovered she had a client with high inherent risk and high control risk how did she set...

A: There are three types of risks involved in the audit process. Inherent risk, control risk and detect...

Q: Prepare the December 31 adjusting entry to record $450 of earned but unpaid salaries.

A: Adjusting journal entry: At year-end when the company finalizes its accounts then any unrecognized i...

Q: Companies are required to highlight certain items in the financial statements so that users can bett...

A: Unusual gains and losses is not mentioned in the financial statement. They are generally mentioned i...

Q: for $36 each. The following was taken from the inventory records during May. The company had no begi...

A: Using FIFO method, the older units are sold first and newer units are left in inventory.

Q: 10x ≤ 30 is a mathematical model for a production constraint. Constraint is also referred to as limi...

A: Solution: True, 10x ≤ 30 is a mathematical model for a production constraint as constraint is repres...

Q: A company pays a basic rate of N$5 per hour. An employee is expected to work seven hours a day Monda...

A: Wage refers to the amount that is paid by the company to their employees for the services provided b...

Q: You are given the following figures as of December 31, 2021: Installment contracts receivable - 202...

A: Installment method is used when item is sold on installment basis. Buyer will pay a down payment and...

Q: Requlred Information The following information applies to the questions displayed below] Cane Compan...

A: financial advantage (disadvantage) of discontinuing the Beta product line Beta = 130000 * $37 = $4,8...

Q: Sims Company, a manufacturer of tablet computers, began operations on January 1, 2019. Its cost and ...

A: Req-1 Sims Company Variable costing Income Statement Sales (75000 units * $360) ...

Q: This year, Paula and Simon (married filing jointly) estimate that their tax liability will be $204,5...

A: Tax payments are the liability of the individual, that, needs to be paid to the government on accoun...

Q: Using the trial balance below, prepare Martini Inc.'s September 30, 2021 Statement of Financial Posi...

A: Statement of financial position is also referred to as the balance sheet that states all the company...

Q: Trey has two dependents, his daughters, ages 14 and 18, at year-end. Trey files a joint return with ...

A: Taxes are the amount of dues or liabilities that needs to be paid by individual to government. These...

Q: Due to differences between depreciation reported in the income statement and depreciation deducted f...

A: Deferred tax liability forms a part of balance sheet and represent the taxes that will be due in the...

Q: Determine the tax liability, marginal tax rate, and average tax rate (rounded to two decimal places)...

A: Case 1: Married taxpayers, taxable income of $36,162: Taxable income bracket Taxable Amount Tax r...

Q: Taking a physical count of inventory a.is not necessary when a periodic inventory system is used b....

A: In the periodic method, the inventory is counted at the end of the accounting period. but in the per...

Q: eld me preparing Schedule 1 Cash flow from operating activities and Schedule 2 cash flows from opera...

A: The question is based on the concept of Cashflow Statements.

Q: 对 a Required Information [The following information applies to the questions displayed below.] Cane ...

A: The contribution margin per unit is calculated by deducting variable expenses per unit from sales pe...

Q: If Debtors turned over ration is 20 times in 2018 as compared to only 11 times in 2018, there is a p...

A: Debtor turnover ratio is calculated by dividing the net credit sales by the average accounts receiva...

Q: Xavier and his wife Maria have total W-2 income of $95,102. They will file their tax return as marri...

A: Tax Liability: the tax liability is the amount of money owed to the IRS in the form of tax debt. It'...

Q: The intangible asset of copyright OA Gives its owner an exclusive right to manufacture and sell a de...

A: Solution: The intangible asset of copyright "gives its owner the exclusive right to publish and sell...

Q: Choose the correct letter of answer materials used, P500,000; labor cost, 60% of raw materials used...

A: Period cost is the amount of cost that is not related to the production of goods. Material cost, di...

Q: Which of the following statements concerning the entries made on the spreadsheet used to prepare the...

A:

Q: At the beginning of current year, Nilli company purchased a coal mine for P30,000,000. Removable coa...

A: All natural resources that are being acquired by the business loses their value over the period of t...

Q: Apr. 27 Discovered an error in computing a commission; received cash from the salesperson for the ov...

A: A journal entry is the act of keeping or making records of any transactions either economic or non-e...

Q: What is the acid−test ratio for a merchant with the following account balances? (Round your answer ...

A: Ratio analysis means where different ratio of various years of years companies has been compared and...

Q: Impairment and Revaluation Surplus Problem 2. On January 1, 2001, MM Inc. constructed a building cl...

A: Hi student Since there are multiple questions, we will answer only first question. Since first quest...

Q: a) On June 15th, a company sells $1mm of clothing that cost them $600k to Macy’s with 30 day terms. ...

A: AFFECT UNDER BALANCE SHEET ON JUNE 30TH : THE COMPANY'S ACCOUNT RECEIVABLE WILL INCREASE WITH $1MM A...

Q: Parson Company Syber Company Consolidated Totals Sales $ (744,000 ) $ (654,000 ) $ (1,223,00...

A: Working Notes: 1. Income tax expenses = Consolidated net income x tax rate ...

Q: The following information is from the 2025 records of Fast Lane Racing Gear: Accounts receivable...

A: Allowance for Bad debt: A bad debt allowance is a valuation account intended to estimate the amount ...

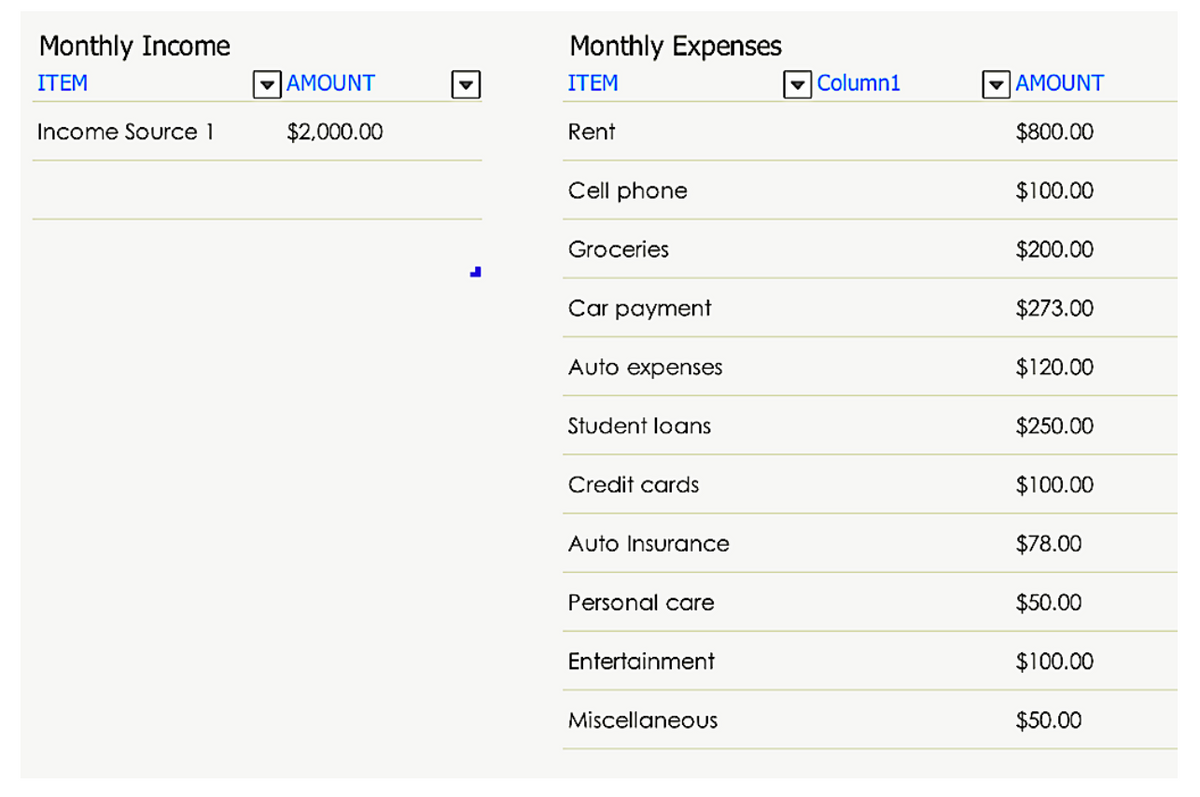

This is Ben’s budget. Use his budget to determine the answer to the following question:

Calculate the amount of income tax Ben owes monthly using the tax rate of 25%.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Marked out of 20.00P Flag questionusing the income summary account for the month ofSiren MarketingAdjusted Trial BalanceMay 31, 2022Account TitleCashDebitCredit$8, 600Accounts Receivable$2, 500Prepaid Insurance$2,700 Accounts PayableUnearned RevenueKirk, Capital$1, 200$1, 800$5, 880Kirk, Withdrawals$1,600Service Revenue$8, 620Advertising Expenselnsurance ExpenseRent Expense Total$790$450$860$17,500 $17,500No comma or dollar sign should be included in the imput icklPrepare the closing entries in the proper order. For transactions that have more than 1 debit or more than 1 deditDebitAccount Title and Explanation Date May 31eBook Question Content Area Ratio Analysis The following information was taken from Nash Inc.’s December 31st trial balances for this year and the previous year. This Year Previous Year Accounts receivable $32,000 $39,000 Accounts payable 47,000 36,000 Sales 219,000 128,000 Sales returns 4,000 2,300 Retained earnings 47,000 16,000 Dividends declared and paid 5,000 1,000 Net income 36,000 9,000 Required: 1. Calculate the net profit margin and accounts receivable turnover for the this year. Assume a 365-day year. Round your answers to two decimal places. This Year Net profit margin fill in the blank 1% Accounts receivable turnover fill in the blank 2 2. How much profit does Nash make on each sales dollar? Round your answer to two decimal places.3. How many days does the average receivable take, in a 365 year, to be paid (assuming all sales are on account)? Round your answer to nearest whole day.Income Statement Prepare an income statement for Jay Pembroke for the month of April 20xx using the account balances given below. Cash $12,950 Accounts Receivable 2,000 Office Supplies 4,600 Prepaid Insurance 1,200 Accounts Payable 300 Jay Pembroke, Capital 18,000 Jay Pembroke, Drawing 100 Service Fees 3,300 Rent Expense 750

- Maria's Beauty SpaAdjusted Trial BalanceJune 30, 20-- ACCOUNT TITLE DEBIT BALANCE CREDIT BALANCE Cash 11,185.00 Accounts Receivable 750.00 Supplies 220.00 Prepaid Insurance 500.00 Accounts Payable 150.00 Maria Costa, Capital 10,520.00 Maria Costa, Drawing 1,200.00 Income from Spa Services 7,500.00 Wages Expense 2,620.00 Rent Expense 700.00 Telephone Expense 65.00 Supplies Expense 585.00 Miscellaneous Expense 345.00 18,170.00 18,170.00 Prepare a post-closing trial balance for Maria’s Beauty Spa. List all the accounts in the proper order as described in the textbook. If an amount box does not require an entry, leave it blank.Maria's Beauty SpaAdjusted Trial BalanceJune 30, 20-- ACCOUNT TITLE DEBIT BALANCE CREDIT BALANCE Cash 11,185.00 Accounts Receivable 750.00 Supplies 220.00 Prepaid Insurance 500.00 Accounts Payable 150.00 Maria Costa, Capital 10,520.00 Maria Costa, Drawing 1,200.00 Income from Spa Services 7,500.00 Wages Expense 2,620.00 Rent Expense 700.00 Telephone Expense 65.00 Supplies Expense 585.00 Miscellaneous Expense 345.00 18,170.00 18,170.00 Using this information, journalize the four closing entries. For compound entries, if an amount box does not require an entry, leave it blank.We prepared the statements for Quarter 1 (Q1) in class. Prepare the statements for Q2(April 1 –June30). Show your work on the next page. XYZ Company PRO FORMA Quarterly Income Statements Q1 Q2 Sales $165,000 Cost of goods sold 115,500 Gross profit 49,500 Operating expenses 138,000 Depreciation expense 131,250 Income before interest &taxes (219,750) Interest expense 25,000 Income before taxes (244,750) Income tax (expense)/recovery 122,375 Net Income $(122,375) PRO FORMA Quarterly Balance…

- balane Q5: The following comparable balance sheet for Ibrahim Stores for the year ended Dec.31, 2012. Dec. 31, 2012 84,500 21,000 Jan.1, 2012 33,000 Accounts Cash Notes receivable Accounts receivable 20,000 000' 160,000 95,000 Enventory Prepaid expenses Short term investment 000'OSI 000'01 000'01 000'7I 000'0F Building & Equipment (net) Total Assets 000'071 000'001 490,500 439,000 Accounts payable Interest payable Expenses payable Bonds payable Capital Retained earning Total liabilities & owners' equity 000'SEI 006 000 000'os 000'E 200,000 52,000 439,000 280,000 73,600 490,500 An analysis of cash receipts and disbursements discloses the following: keceipts New capital investment Disbursement Trade creditor - 210,000 $ $ 0000$ Accounts Pay. Trade debtors - Notes and səsuədx accounts Cash sales N/R discounted - Face value 19,500 Dividends Equipment 28,000 000'0 00007 Note issued to bank Bonds 50,000 Sales of investment 25,000 Required: 1) Prepare an income statement supported by…5points eBookHintReferences Check my workCheck My Work button is now enabled Item1 Oroblanco Company has prepared consolidated financial statements for the current year and is now gathering information in connection with the following five operating segments it has identified. (Figures are in thousands.) Accounts Company Total Books Computers Maps Travel Finance Sales to outside parties $ 1,735 $ 191 $ 752 $ 447 $ 345 $ 0 Intersegment sales 559 43 290 58 168 0 Interest income—external 130 74 0 0 0 56 Interest income—intersegment loans 166 0 0 0 0 166 Assets 3,715 256 1,473 298 353 1,335 Operating expenses 1,560 134 868 297 209 52 Expenses—intersegment sales 264 89 70 40 65 0 Interest expense—external 126 0 0 0 0 126 Interest expense—intersegment loans 223 40 90 57 36 0 Income tax expense (savings) 140 62 (22) 77 81 (58) General corporate expenses 105 - - - - - Unallocated operating costs 130 - - - - - Required: Determine the reportable…3. The following was the trial balance extract from ABC Trading as at 31 March 2019.Particulars DEBIT (RM) CREDIT (RM)Purchases and Sales 22,800 41,000Inventory on 1 April 2018 5,100Capital 8,170Bank overdraft 4,300Cash 140Discount allowed and received 1,440Returns inwards and outwards 790Carriage outwards 2,180Office expenses 450Fixtures and fittings 1,210Delivery van 2,000Accounts receivables and account payables 11,900 6,720Rent and insurance 1,790Drawings 2,850Wages and salaries 8,980TOTAL 61,690 61,690Additional information as at 31 March 2019:a. Inventory on 31 March 2019 was RM4,250b. Wages and salaries accrued as at 31 march 2019 was RM210; outstanding office expenses was RM30c. Rent and insurance prepaid was RM150Required:i. Prepare the Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 March 2019ii. Prepare Statement of Financial Position as at 31 March 2019

- F company Trial balance Debit $ Credit$ Cash =6300-5000 Accounts receivable =6000+(400-40) Supplies =400+900 Equipment 16490 Computers 49000 Accounts payable =2800+900 Notes payable 185000 Capital 50000 Drawing 4000 Service revenue =4100+6800 Salary expense 1400 Rent expense =800+340+340 Advertising expense 900 Utilities expense =800+70 Total 83100 83100 Prepare the company's financial statements for the month of February 2020.Q1: Lewiston Company reports the following trial balance on December 31, 2014: Account title Debit Credit Cash $35,500 Account Receivable $12,000 Allowance for uncollectable $3,000 Prepaid rent $8,000 Inventories $10,000 Land $40,000 Patent $29,500 Account Payable $2,000 Unearned Revenue $6,000 Bond Payable $15,000 Common Stock $72,000 Retained Earning $37,000 Total $135,000 $135,000 Additional Information: The land account consists of $30,000 for the cost of the land where the office buildings are located. The remaining balance represent the cost of the land held for sale. $9,500 of cash balance will be used as an investment in marketable securities that is going to take place next year. The remaining represent commercial papers due in January 2015. Out of $15,000 balance of Bond payable, $7,000 will be payable in 2015. Required: Prepare classified balance…QUESTION I Apple , Inc. Adjusted Trial Balance June 30, 2020 Account Debit Credit Cash $ 21.200 Accounts receivable 38.900 Supplies 14.300 Prepaid insurance 1.800 Equipment 32.600 Acc.dep:equipment 26.800 Building 42.800 Acc.dep:building 10.800 Land 28.300 Accounts payable 22.700 Notes payable 22.400 Interest payable 100 Wages payable 200 Uneraned service revenue 5.600 Capital stock 79.100 Retained earnings - Dividends 4.200 Service revenue…