Which of the following statements is true regarding minimum corporate income tax? Minimum corporate income tax may be imposed on a proprietary educational institution but not on non-stock non-profit educational institution. The excess of minimum corporate income tax over the regular corporate income tax may be carried over for a period of three years. O Upon determination of force majeure or prolonged labor dispute, the Commissioner of Internal Revenue may suspend the imposition of the minimum corporate income tax. One person corporations are exempt from the imposition of the minimum corporate income tax.

Which of the following statements is true regarding minimum corporate income tax? Minimum corporate income tax may be imposed on a proprietary educational institution but not on non-stock non-profit educational institution. The excess of minimum corporate income tax over the regular corporate income tax may be carried over for a period of three years. O Upon determination of force majeure or prolonged labor dispute, the Commissioner of Internal Revenue may suspend the imposition of the minimum corporate income tax. One person corporations are exempt from the imposition of the minimum corporate income tax.

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 10MCQ

Related questions

Question

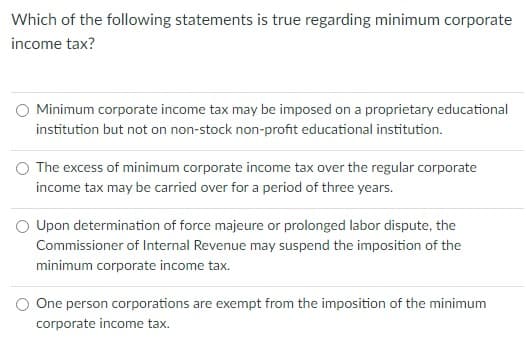

Which of the following statements is true regarding minimum corporate income tax?

Transcribed Image Text:Which of the following statements is true regarding minimum corporate

income tax?

O Minimum corporate income tax may be imposed on a proprietary educational

institution but not on non-stock non-profit educational institution.

The excess of minimum corporate income tax over the regular corporate

income tax may be carried over for a period of three years.

O Upon determination of force majeure or prolonged labor dispute, the

Commissioner of Internal Revenue may suspend the imposition of the

minimum corporate income tax.

O One person corporations are exempt from the imposition of the minimum

corporate income tax.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you