MPI Incorporated has $7 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 11%, and its return on assets (ROA) is 4%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What is MPI's times-interest-earned (TIE) ratio? Round your answer to two decimal places

MPI Incorporated has $7 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 11%, and its return on assets (ROA) is 4%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What is MPI's times-interest-earned (TIE) ratio? Round your answer to two decimal places

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 35BEB: The income statement, statement of retained earnings, and balance sheet for Santiago Systems are as...

Related questions

Question

MPI Incorporated has $7 billion in assets, and its tax rate is 35%. Its basic earning power (BEP) ratio is 11%, and its

What is MPI's times-interest-earned (TIE) ratio? Round your answer to two decimal places.

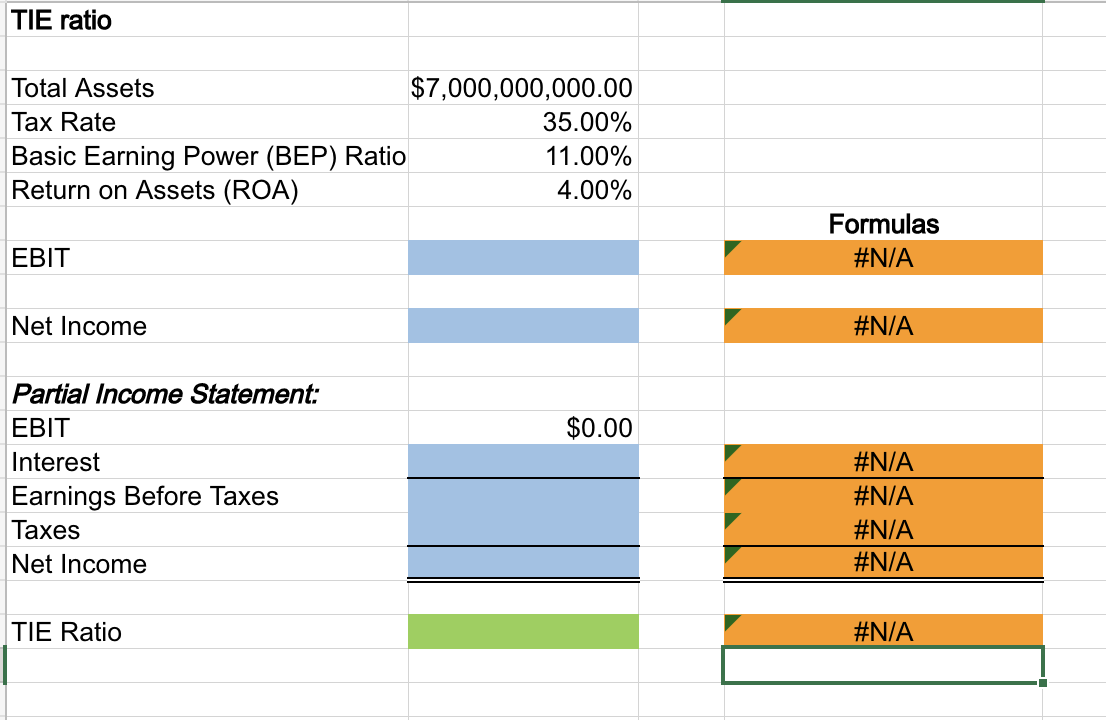

Transcribed Image Text:TIE ratio

Total Assets

Tax Rate

Basic Earning Power (BEP) Ratio

Return on Assets (ROA)

EBIT

Net Income

Partial Income Statement:

EBIT

Interest

Earnings Before Taxes

Taxes

Net Income

TIE Ratio

$7,000,000,000.00

35.00%

11.00%

4.00%

$0.00

Formulas

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

#N/A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning