▪mputing Annuity Amounts to a Debt Re nd n January 1, Chang Inc. establishes a bor nd (a bond retirement fund) amounting 00,000. A trustee has agreed to handle t d to increase it each year on a 10% anni

▪mputing Annuity Amounts to a Debt Re nd n January 1, Chang Inc. establishes a bor nd (a bond retirement fund) amounting 00,000. A trustee has agreed to handle t d to increase it each year on a 10% anni

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 12E

Related questions

Question

please solve all parts within 30 minutes...

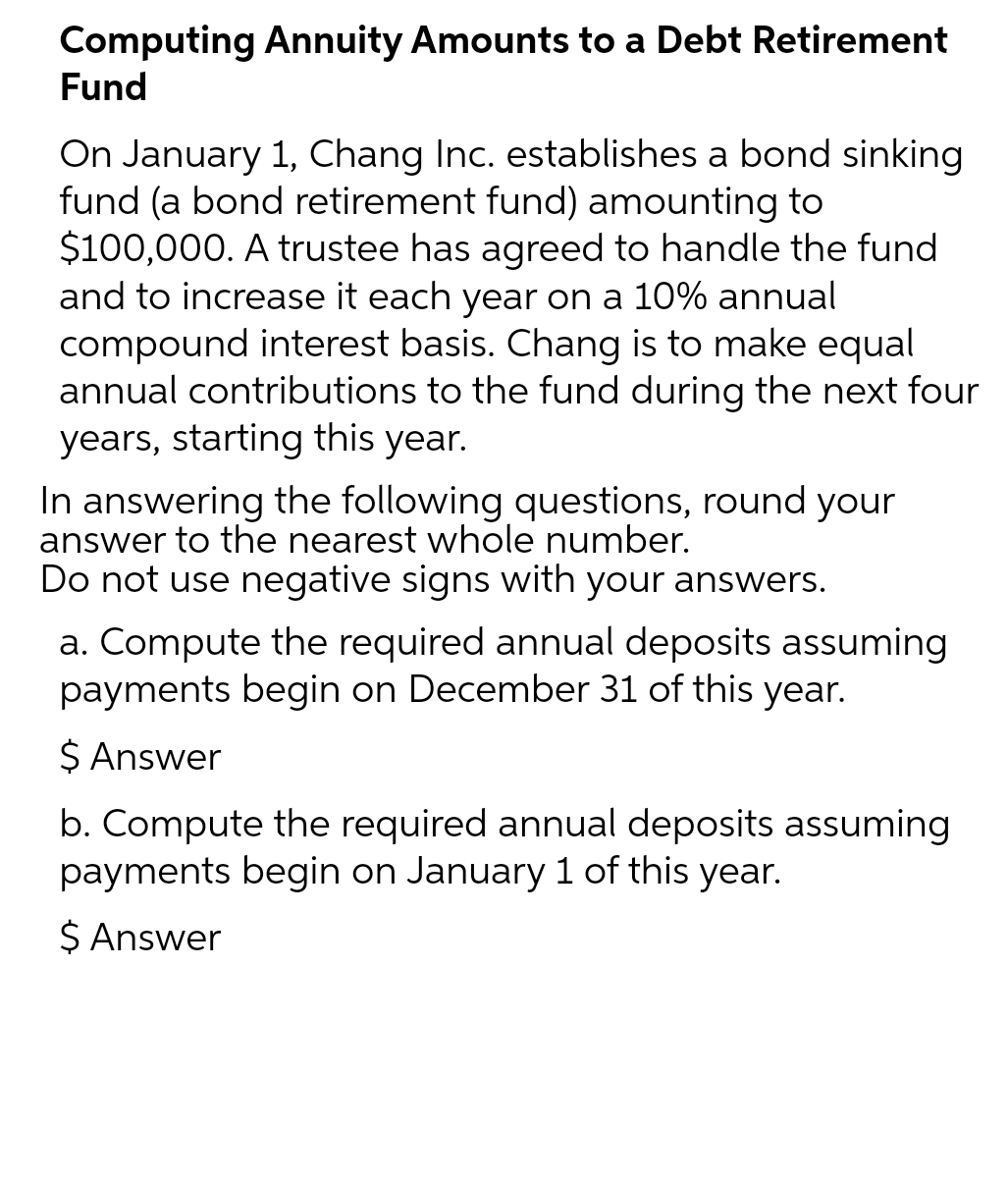

Transcribed Image Text:Computing Annuity Amounts to a Debt Retirement

Fund

On January 1, Chang Inc. establishes a bond sinking

fund (a bond retirement fund) amounting to

$100,000. A trustee has agreed to handle the fund

and to increase it each year on a 10% annual

compound interest basis. Chang is to make equal

annual contributions to the fund during the next four

years, starting this year.

In answering the following questions, round your

answer to the nearest whole number.

Do not use negative signs with your answers.

a. Compute the required annual deposits assuming

payments begin on December 31 of this year.

$ Answer

b. Compute the required annual deposits assuming

payments begin on January 1 of this year.

$ Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College