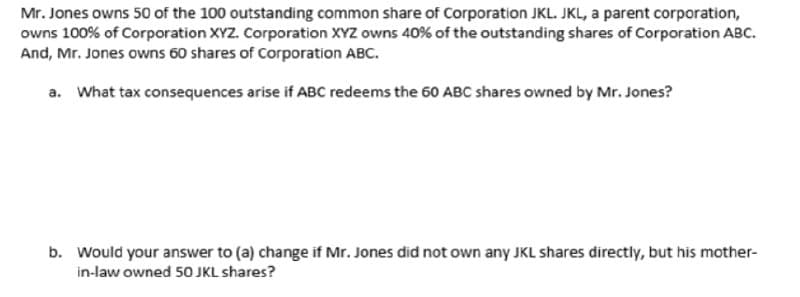

Mr. Jones owns 50 of the 100 outstanding common share of Corporation JKL. JKL, a parent corporation, owns 100% of Corporation XYZ. Corporation XYZ owns 40% of the outstanding shares of Corporation ABC. And, Mr. Jones owns 60 shares of Corporation ABC. a. What tax consequences arise if ABC redeems the 60 ABC shares owned by Mr. Jones? b. Would your answer to (a) change if Mr. Jones did not own any JKL shares directly, but his mother- in-law owned 50 JKL shares?

Mr. Jones owns 50 of the 100 outstanding common share of Corporation JKL. JKL, a parent corporation, owns 100% of Corporation XYZ. Corporation XYZ owns 40% of the outstanding shares of Corporation ABC. And, Mr. Jones owns 60 shares of Corporation ABC. a. What tax consequences arise if ABC redeems the 60 ABC shares owned by Mr. Jones? b. Would your answer to (a) change if Mr. Jones did not own any JKL shares directly, but his mother- in-law owned 50 JKL shares?

Chapter6: Corporations: Redemptions And Liquidations

Section: Chapter Questions

Problem 9DQ

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:Mr. Jones owns 50 of the 100 outstanding common share of Corporation JKL. JKL, a parent corporation,

owns 100% of Corporation XYZ. Corporation XYZ owns 40% of the outstanding shares of Corporation ABC.

And, Mr. Jones owns 60 shares of Corporation ABC.

a. What tax consequences arise if ABC redeems the 60 ABC shares owned by Mr. Jones?

b. Would your answer to (a) change if Mr. Jones did not own any JKL shares directly, but his mother-

in-law owned 50 JKL shares?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you