Mr. Juan Lopez launched Lopez Fiesta Mart on December 1, 2022 with a cash investment of P220,000. The following are additional transactions for the month: NM 4 1000 PEMFODO29 3 6882 3 18 22 2.5 26 30 31 Mr. Lopez invested equipment for the business worth P30,000. Bought supplies on account for P12,600. Acquired a service vehicle costing P75,000. A payment of P25,000 cash was made and promissory note was given for the remainder, payable for 6 equal monthly installment Purchased merchandise from JKL Enterprises P45,500, Term, 3/20, n/30. Paid P1,200 delivery charge for December 5 purchase. Sold merchandise on account P37,000, Term, 3/10, n/30. Cost of Merchandise, P25,000 Paid P700 freight for December 8 transaction. Returned defective merchandise to JKL Enterprises amounting to P8,500. Paid salaries, P12,300 Signed a promissory note for P25,000 loaned amount from Commonwealth Bank. Received returned merchandise from customers on December 10, P4.000. Paid P7,600 of the amount owed from the December 3 transaction. Purchase additional groceries from QR Supermarket amounting to P86,000. Collected full settlement of customer from December 10 sale. #21,450 cost of merchandise was sold for P38,750. Settled account to JKL Enterprises. Cash received, 10,000 and a promissory note for P25,000 for merchandise sold to a key customer. Cost of merchandise, P28,000. fr. Loper withdrew P20,000 cash from the business. Pald telephone expense, P2,300 Paid building rentals for the month, PS 200. Paid the first installment of the note payable on Service Vehicle. Pald Salaries #11,300, ret of the following deductions: SSS, P380; Pag-IBIG, P100; Pr health, #2.20 The Merchandise Inventory at the end of the of the month is P48,000. Additional Information for year-end adjustments. The useful life of the equipment is 5 years with no salvage value. The useful life of the service venice is 10 years with no salvage value. 2 Remaining unused suppies worth P9.100. Use asset method.

Mr. Juan Lopez launched Lopez Fiesta Mart on December 1, 2022 with a cash investment of P220,000. The following are additional transactions for the month: NM 4 1000 PEMFODO29 3 6882 3 18 22 2.5 26 30 31 Mr. Lopez invested equipment for the business worth P30,000. Bought supplies on account for P12,600. Acquired a service vehicle costing P75,000. A payment of P25,000 cash was made and promissory note was given for the remainder, payable for 6 equal monthly installment Purchased merchandise from JKL Enterprises P45,500, Term, 3/20, n/30. Paid P1,200 delivery charge for December 5 purchase. Sold merchandise on account P37,000, Term, 3/10, n/30. Cost of Merchandise, P25,000 Paid P700 freight for December 8 transaction. Returned defective merchandise to JKL Enterprises amounting to P8,500. Paid salaries, P12,300 Signed a promissory note for P25,000 loaned amount from Commonwealth Bank. Received returned merchandise from customers on December 10, P4.000. Paid P7,600 of the amount owed from the December 3 transaction. Purchase additional groceries from QR Supermarket amounting to P86,000. Collected full settlement of customer from December 10 sale. #21,450 cost of merchandise was sold for P38,750. Settled account to JKL Enterprises. Cash received, 10,000 and a promissory note for P25,000 for merchandise sold to a key customer. Cost of merchandise, P28,000. fr. Loper withdrew P20,000 cash from the business. Pald telephone expense, P2,300 Paid building rentals for the month, PS 200. Paid the first installment of the note payable on Service Vehicle. Pald Salaries #11,300, ret of the following deductions: SSS, P380; Pag-IBIG, P100; Pr health, #2.20 The Merchandise Inventory at the end of the of the month is P48,000. Additional Information for year-end adjustments. The useful life of the equipment is 5 years with no salvage value. The useful life of the service venice is 10 years with no salvage value. 2 Remaining unused suppies worth P9.100. Use asset method.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 9PA: Mohammed LLC is a growing consulting firm. The following transactions take place during the current...

Related questions

Question

Give the General ledger

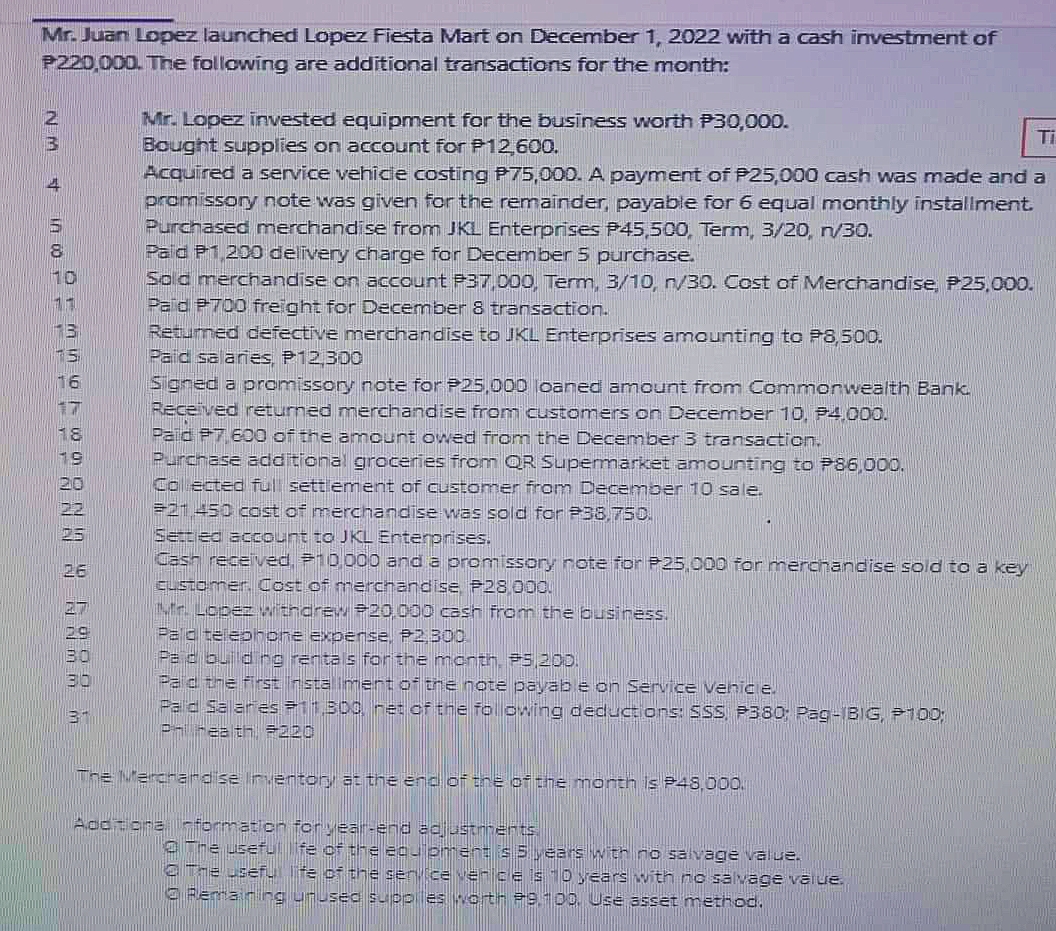

Transcribed Image Text:Mr. Juan Lopez launched Lopez Fiesta Mart on December 1, 2022 with a cash investment of

P220,000. The following are additional transactions for the month:

NM + 1000PFPPEPPAND 2 6888 M

Mr. Lopez invested equipment for the business worth P30,000.

Bought supplies on account for P12,600.

Ti

Acquired a service vehicle costing P75,000. A payment of P25,000 cash was made and a

promissory note was given for the remainder, payable for 6 equal monthly installment.

Purchased merchandise from JKL Enterprises P45,500, Term, 3/20, n/30.

Paid P1,200 delivery charge for December 5 purchase.

Sold merchandise on account P37,000, Term, 3/10, n/30. Cost of Merchandise, P25,000.

Paid P700 freight for December 8 transaction.

Returned defective merchandise to JKL Enterprises amounting to P8,500.

Paid salaries, P12,300

Signed a promissory note for P25,000 loaned amount from Commonwealth Bank.

Received returned merchandise from customers on December 10, P4,000.

Paid P7 600 of the amount owed from the December 3 transaction.

Purchase additional groceries from QR Supermarket amounting to P86,000.

Collected full settlement of customer from December 10 sale.

#21,450 cast of merchandise was sold for P38.750.

Settled account to JKL Enterprises.

Cash received, P10,000 and a promissory note for P25,000 for merchandise sold to a key

customer. Cost of merchandise P28,000.

Mfr. Loper withdrew #20,000 cash from the business.

Pald telephone expense, P2,300

Ped building rentals for the month, PS 200.

Paid the first installment of the note payable on Service Venice.

Paid Salaries #11,300, ret of the following deductions: SSS, P380: Pag-IBIG, P100;

P- health 2020

The Merchandise Inventory at the end of the of the month is P48,000.

Additional leformation for year-end adjustments.

The useful life of the eculement is 5 years with no salvage value.

The useful life of the service ve- ce is 10 years with no salvage value.

Remaining unused supples worth P9.100. Use asset method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning