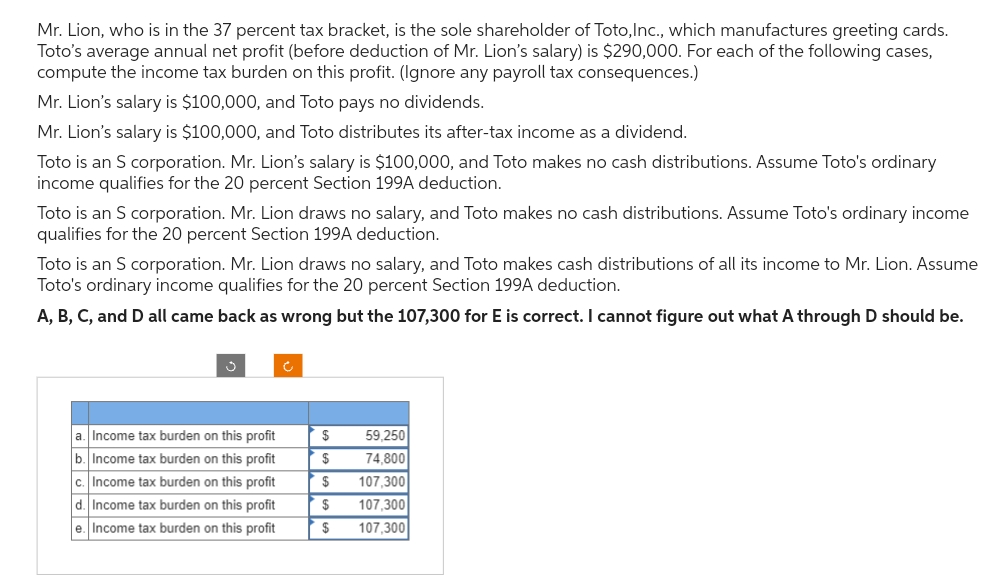

Mr. Lion, who is in the 37 percent tax bracket, is the sole shareholder of Toto, Inc., which manufactures greeting cards. Toto's average annual net profit (before deduction of Mr. Lion's salary) is $290,000. For each of the following cases, compute the income tax burden on this profit. (Ignore any payroll tax consequences.) Mr. Lion's salary is $100,000, and Toto pays no dividends. Mr. Lion's salary is $100,000, and Toto distributes its after-tax income as a dividend. Toto is an S corporation. Mr. Lion's salary is $100,000, and Toto makes no cash distributions. Assume Toto's ordinary income qualifies for the 20 percent Section 199A deduction. Toto is an S corporation. Mr. Lion draws no salary, and Toto makes no cash distributions. Assume Toto's ordinary income qualifies for the 20 percent Section 199A deduction. Toto is an S corporation. Mr. Lion draws no salary, and Toto makes cash distributions of all its income to Mr. Lion. Assume Toto's ordinary income qualifies for the 20 percent Section 199A deduction. A, B, C, and D all came back as wrong but the 107,300 for E is correct. I cannot figure out what A through D should be. a. Income tax burden on this profit b. Income tax burden on this profit c. Income tax burden on this profit d. Income tax burden on this profit e. Income tax burden on this profit $ $ 59,250 74,800 $ 107,300 $ 107,300 $ 107,300

Mr. Lion, who is in the 37 percent tax bracket, is the sole shareholder of Toto, Inc., which manufactures greeting cards. Toto's average annual net profit (before deduction of Mr. Lion's salary) is $290,000. For each of the following cases, compute the income tax burden on this profit. (Ignore any payroll tax consequences.) Mr. Lion's salary is $100,000, and Toto pays no dividends. Mr. Lion's salary is $100,000, and Toto distributes its after-tax income as a dividend. Toto is an S corporation. Mr. Lion's salary is $100,000, and Toto makes no cash distributions. Assume Toto's ordinary income qualifies for the 20 percent Section 199A deduction. Toto is an S corporation. Mr. Lion draws no salary, and Toto makes no cash distributions. Assume Toto's ordinary income qualifies for the 20 percent Section 199A deduction. Toto is an S corporation. Mr. Lion draws no salary, and Toto makes cash distributions of all its income to Mr. Lion. Assume Toto's ordinary income qualifies for the 20 percent Section 199A deduction. A, B, C, and D all came back as wrong but the 107,300 for E is correct. I cannot figure out what A through D should be. a. Income tax burden on this profit b. Income tax burden on this profit c. Income tax burden on this profit d. Income tax burden on this profit e. Income tax burden on this profit $ $ 59,250 74,800 $ 107,300 $ 107,300 $ 107,300

Chapter19: Corporations: Distributions Not In Complete Liquidation

Section: Chapter Questions

Problem 49P

Related questions

Question

N1.

Account

Transcribed Image Text:Mr. Lion, who is in the 37 percent tax bracket, is the sole shareholder of Toto, Inc., which manufactures greeting cards.

Toto's average annual net profit (before deduction of Mr. Lion's salary) is $290,000. For each of the following cases,

compute the income tax burden on this profit. (Ignore any payroll tax consequences.)

Mr. Lion's salary is $100,000, and Toto pays no dividends.

Mr. Lion's salary is $100,000, and Toto distributes its after-tax income as a dividend.

Toto is an S corporation. Mr. Lion's salary is $100,000, and Toto makes no cash distributions. Assume Toto's ordinary

income qualifies for the 20 percent Section 199A deduction.

Toto is an S corporation. Mr. Lion draws no salary, and Toto makes no cash distributions. Assume Toto's ordinary income

qualifies for the 20 percent Section 199A deduction.

Toto is an S corporation. Mr. Lion draws no salary, and Toto makes cash distributions of all its income to Mr. Lion. Assume

Toto's ordinary income qualifies for the 20 percent Section 199A deduction.

A, B, C, and D all came back as wrong but the 107,300 for E is correct. I cannot figure out what A through D should be.

a. Income tax burden on this profit

b. Income tax burden on this profit

c. Income tax burden on this profit

d. Income tax burden on this profit

e. Income tax burden on this profit

$

59,250

$ 74,800

$ 107,300

$ 107,300

$

107,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT