Brent received 1,000 shares of lowa Corporation stock from his uncle as a gift on July 20, 2020, when the stock had a $220,000 FMV. His uncle paid $125,000 for the stock on April 12, 2004. The taxable gift was $220,000, because his uncle made another gift to Brent for $22,000 in January and used the annual exclusion. The uncle paid a gift tax of $33,000. Without considering the transactions below, Brent's AGI is $55,000 in 2021. No other transactions involving capital assets occur during the year. Read the requirement. a. b. C. AGI prior to sale of stock + Gain (loss) on sale of stock = + + + = = AGI C...

Brent received 1,000 shares of lowa Corporation stock from his uncle as a gift on July 20, 2020, when the stock had a $220,000 FMV. His uncle paid $125,000 for the stock on April 12, 2004. The taxable gift was $220,000, because his uncle made another gift to Brent for $22,000 in January and used the annual exclusion. The uncle paid a gift tax of $33,000. Without considering the transactions below, Brent's AGI is $55,000 in 2021. No other transactions involving capital assets occur during the year. Read the requirement. a. b. C. AGI prior to sale of stock + Gain (loss) on sale of stock = + + + = = AGI C...

Chapter10: Deductions And Losses: Certain Itemized Deductions

Section: Chapter Questions

Problem 3RP: Marcia, a shareholder in a corporation with stores in five states, donated stock with a basis of...

Related questions

Question

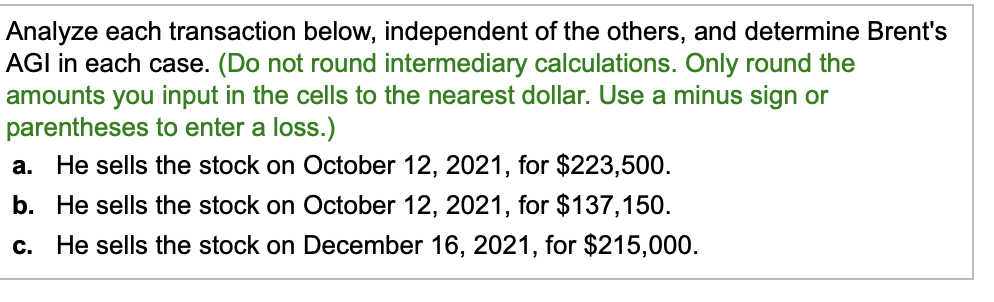

Transcribed Image Text:Analyze each transaction below, independent of the others, and determine Brent's

AGI in each case. (Do not round intermediary calculations. Only round the

amounts you input in the cells to the nearest dollar. Use a minus sign or

parentheses to enter a loss.)

a. He sells the stock on October 12, 2021, for $223,500.

b. He sells the stock on October 12, 2021, for $137,150.

c. He sells the stock on December 16, 2021, for $215,000.

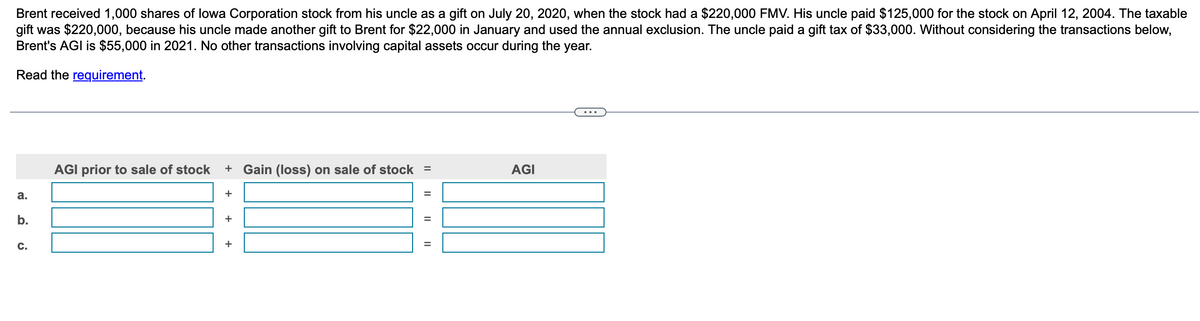

Transcribed Image Text:Brent received 1,000 shares of lowa Corporation stock from his uncle as a gift on July 20, 2020, when the stock had a $220,000 FMV. His uncle paid $125,000 for the stock on April 12, 2004. The taxable

gift was $220,000, because his uncle made another gift to Brent for $22,000 in January and used the annual exclusion. The uncle paid a gift tax of $33,000. Without considering the transactions below,

Brent's AGI is $55,000 in 2021. No other transactions involving capital assets occur during the year.

Read the requirement.

a.

b.

C.

AGI prior to sale of stock + Gain (loss) on sale of stock =

+

+

|| || ||

AGI

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT