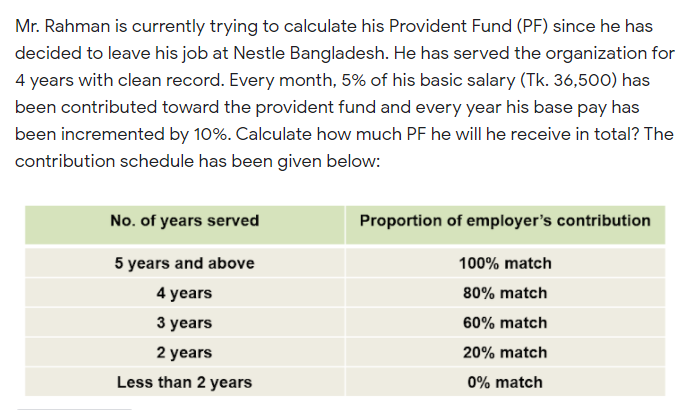

Mr. Rahman is currently trying to calculate his Provident Fund (PF) since he has decided to leave his job at Nestle Bangladesh. He has served the organization for 4 years with clean record. Every month, 5% of his basic salary (Tk. 36,500) has been contributed toward the provident fund and every year his base pay has been incremented by 10%. Calculate how much PF he will he receive in total? The contribution schedule has been given below: No. of years served Proportion of employer's contribution 5 years and above 100% match 4 years 80% match 3 years 60% match 2 years 20% match Less than 2 years 0% match

Mr. Rahman is currently trying to calculate his Provident Fund (PF) since he has decided to leave his job at Nestle Bangladesh. He has served the organization for 4 years with clean record. Every month, 5% of his basic salary (Tk. 36,500) has been contributed toward the provident fund and every year his base pay has been incremented by 10%. Calculate how much PF he will he receive in total? The contribution schedule has been given below: No. of years served Proportion of employer's contribution 5 years and above 100% match 4 years 80% match 3 years 60% match 2 years 20% match Less than 2 years 0% match

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 49P

Related questions

Question

Transcribed Image Text:Mr. Rahman is currently trying to calculate his Provident Fund (PF) since he has

decided to leave his job at Nestle Bangladesh. He has served the organization for

4 years with clean record. Every month, 5% of his basic salary (Tk. 36,500) has

been contributed toward the provident fund and every year his base pay has

been incremented by 10%. Calculate how much PF he will he receive in total? The

contribution schedule has been given below:

No. of years served

Proportion of employer's contribution

5 years and above

100% match

4 years

80% match

3 years

60% match

2 years

20% match

Less than 2 years

0% match

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT