Mrs. Aquino retires at the age of 63 and uses her life savings of 120,000 to purchase an annuity. The life insurance company gives an interest rate of 6% and they estimate that her life expectancy is 15 years. How much annuity due (that is how big an annual pension) will she receive?

Mrs. Aquino retires at the age of 63 and uses her life savings of 120,000 to purchase an annuity. The life insurance company gives an interest rate of 6% and they estimate that her life expectancy is 15 years. How much annuity due (that is how big an annual pension) will she receive?

Advanced Engineering Mathematics

10th Edition

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Erwin Kreyszig

Chapter2: Second-order Linear Odes

Section: Chapter Questions

Problem 1RQ

Related questions

Topic Video

Question

Please help me understand amd anwer answer it, I already provided the references, thank you

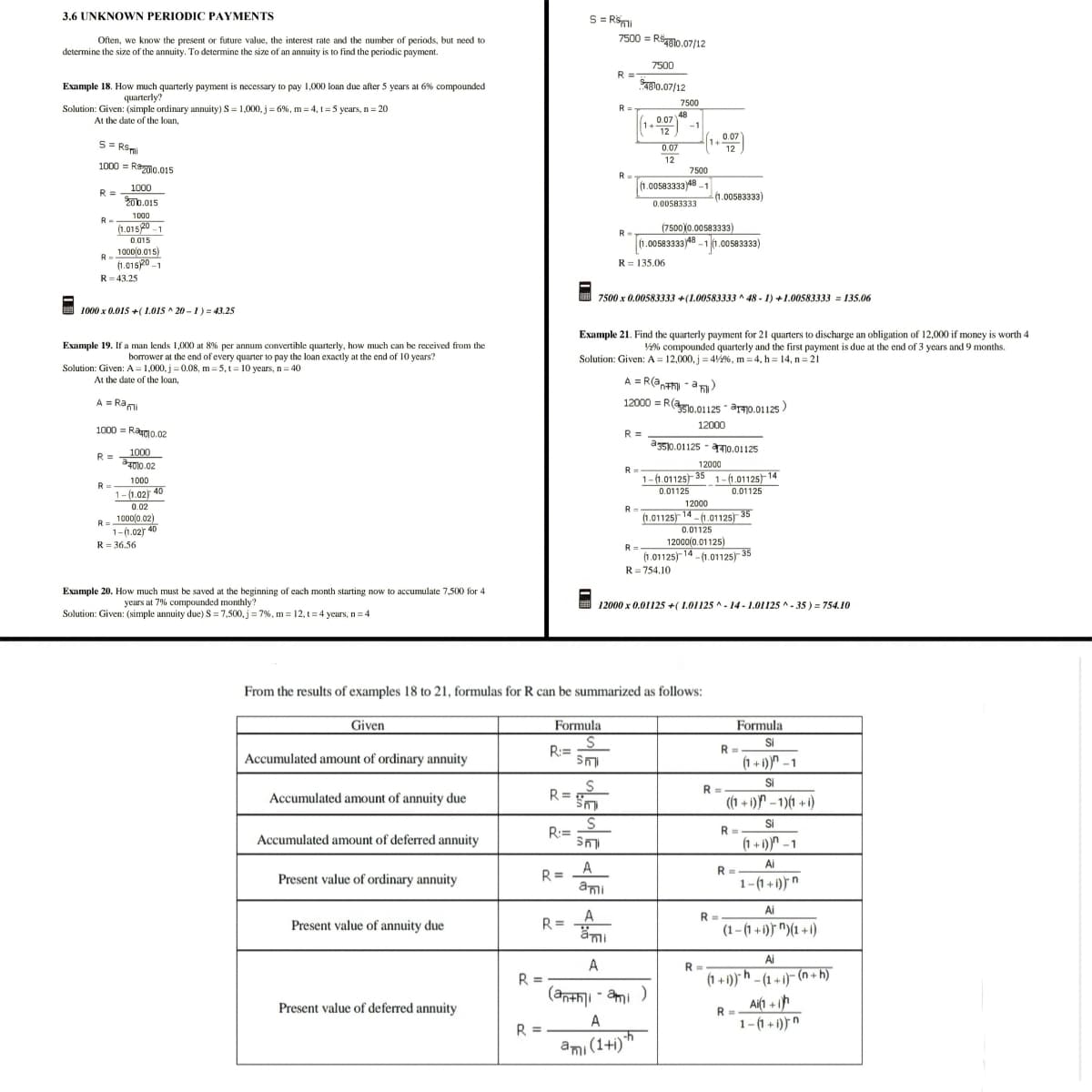

Transcribed Image Text:3.6 UNKNOWN PERIODIC PAYMENTS

S = RSmi

Often, we know the present or future value, the interest rate and the number of periods, but need to

7500 = RB10.07/12

determine the size of the annuity. To determine the size of an annuity is to find the periodic payment.

7500

R =

Example 18. How much quarterly payment is necessary to pay 1,000 loan due after 5 years at 6% compounded

80.07/12

quarterly?

7500

Solution: Given: (simple ordinary annuity) S = 1,000, j = 6%, m = 4, t=5 years, n = 20

R =

At the date of the loan,

48

0.07

1+12 -1

0.07

5= RSmi

12

0.07

12

1000 = Re00.015

7500

R =

1000

(1.00583333 48 1

R =

2ob.015

(1.00583333)

0.00583333

1000

(1.01520 -1

(7500)0.00583333)

R-

(1.00583333)48 -11.00.58 3333)

0.015

R.1000(0.015)

(1.01520 -1

R=43,25

R= 135.06

7500 x 0.00583333 +(1.00583333 ^ 48 - 1) +1.00583333 = 135.06

E 1000 x 0.015 +( 1.015 ^ 20 - 1) = 43.25

Example 21. Find the quarterly payment for 21 quarters to discharge an obligation of 12,000 if money is worth 4

V% compounded quarterly and the first payment is due at the end of 3 years and 9 months.

Example 19. If a man lends 1,000 at 8% per annum convertible quarterly, how much can be received from the

borrower at the end of every quarter to pay the loan exactly at the end of 10 years?

Solution: Given: A = 12,000, j = 4%, m = 4, h = 14, n= 21

Solution: Given: A = 1,000, j = 0.08, m = 5, t= 10 years, n= 40

At the date of the loan,

A = R(an -an)

A = Ra

12000 = R(ag0.01125 - arm0.01125)

12000

1000 = Rago.02

R =

ag50.01125 - a0.01125

1000

R =

4010.02

12000

R=

1-1.01125 35 1-1.01125 14

0.01125

4

1000

0.01125

1-(1.02) 40

0.02

12000

R =

(1.01125 14-(1.01125) 35

R= 1000(0.02)

1-1.02)

r40

0.01125

12000(0.01125)

(1.01125)14 -(1.01125)- 35

R = 36.56

R

R= 754,10

Example 20. How much must be saved at the beginning of cach month starting now to accumulate 7,500 for 4

yeurs at 7% compounded monthly?

Solution: Given: (simple annuity due)S= 7,500, j= 7%, m = 12, t= 4 yeurs, n = 4

E 12000 x 0.01125 +( 1.01125 - 14 - 1.01125 ^- 35 ) = 754.1O

From the results of examples 18 to 21, formulas for R can be summarized as follows:

Given

Formula

Formula

Si

R:=

Accumulated amount of ordinary annuity

(1 + 1)" - 1

Si

S

R =

R

Accumulated amount of annuity due

(1 + 1)" – 1)(1 + 1)

Si

R:=

Accumulated amount of deferred annuity

(1 + 1)" – 1

Ai

A

Present value of ordinary annuity

R =

1-(1+ 1) n

ami

Ai

Present value of annuity due

A

R =

mi

R =

(1- (1 + 1) ")(1 +1)

Ai

A

R-

R =

(1 + 1))" h – (1 + 1)– (n + h)

(anthi - ami )

Ai(1 + ih

Present value of deferred annuity

R=

A

1- (1 + 1) n

R =

ami (1+i)

Transcribed Image Text:09. Mrs. Aquino retires at the age of 63 and uses her life savings of 120,000 to purchase an annuity. The life

insurance company gives an interest rate of 6% and they estimate that her life expectancy is 15 years. How

much annuity due (that is how big an annual pension) will she receive?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Recommended textbooks for you

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,