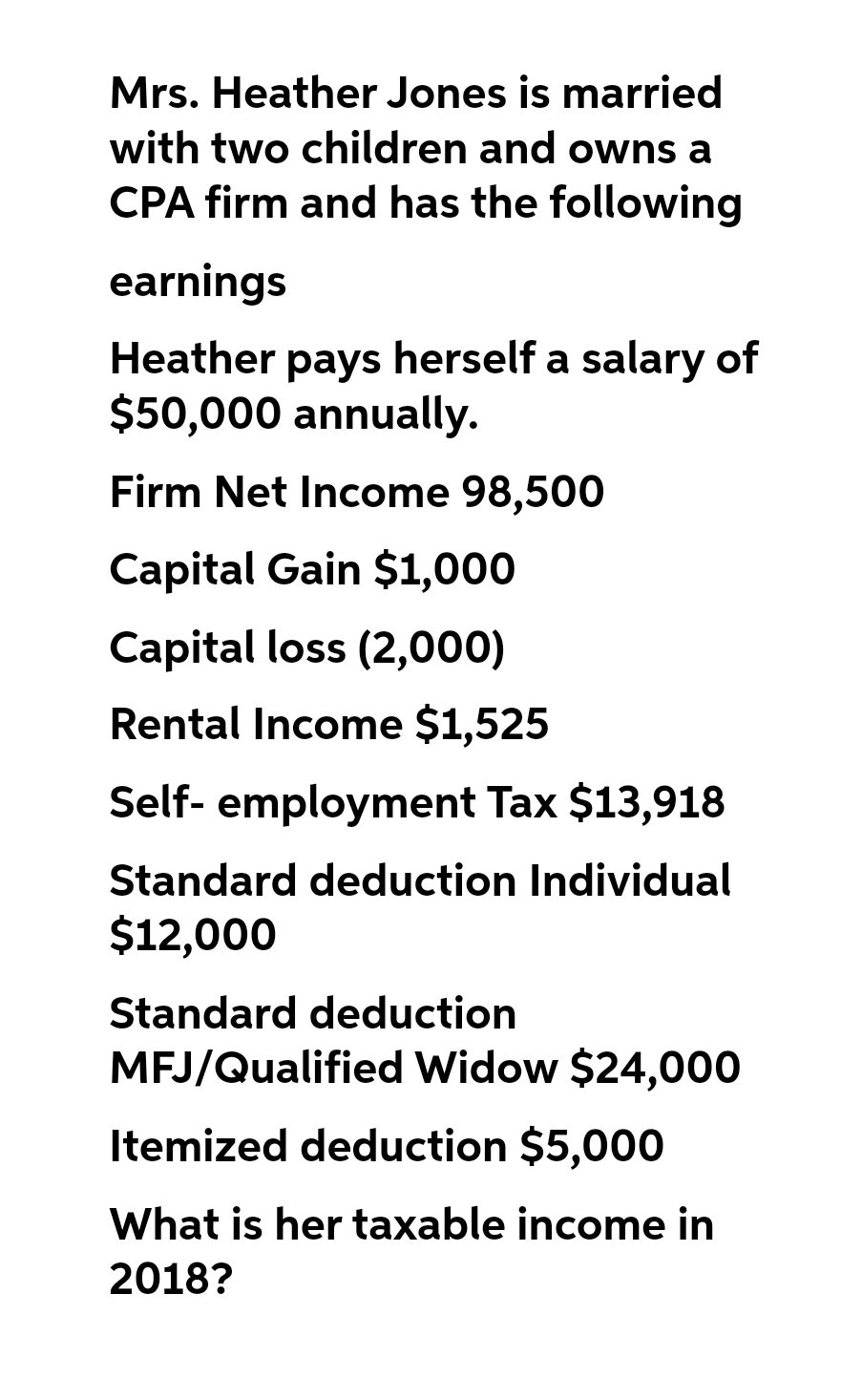

Mrs. Heather Jones is married with two children and owns a CPA firm and has the following earnings Heather pays herself a salary of $50,000 annually. Firm Net Income 98,500 Capital Gain $1,000 Capital loss (2,000) Rental Income $1,525 Self-employment Tax $13,918 Standard deduction Individual $12,000 Standard deduction MFJ/Qualified Widow $24,000 Itemized deduction $5,000 What is her taxable income in 2018?

Mrs. Heather Jones is married with two children and owns a CPA firm and has the following earnings Heather pays herself a salary of $50,000 annually. Firm Net Income 98,500 Capital Gain $1,000 Capital loss (2,000) Rental Income $1,525 Self-employment Tax $13,918 Standard deduction Individual $12,000 Standard deduction MFJ/Qualified Widow $24,000 Itemized deduction $5,000 What is her taxable income in 2018?

Chapter1: The Individual Income Tax Return

Section: Chapter Questions

Problem 4P: In 2019, Lou has a salary of $53,300 from her job. She also has interest income of $1,600 and...

Related questions

Question

3.

Transcribed Image Text:Mrs. Heather Jones is married

with two children and owns a

CPA firm and has the following

earnings

Heather pays herself a salary of

$50,000 annually.

Firm Net Income 98,500

Capital Gain $1,000

Capital loss (2,000)

Rental Income $1,525

Self-employment Tax $13,918

Standard deduction Individual

$12,000

Standard deduction

MFJ/Qualified Widow $24,000

Itemized deduction $5,000

What is her taxable income in

2018?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you