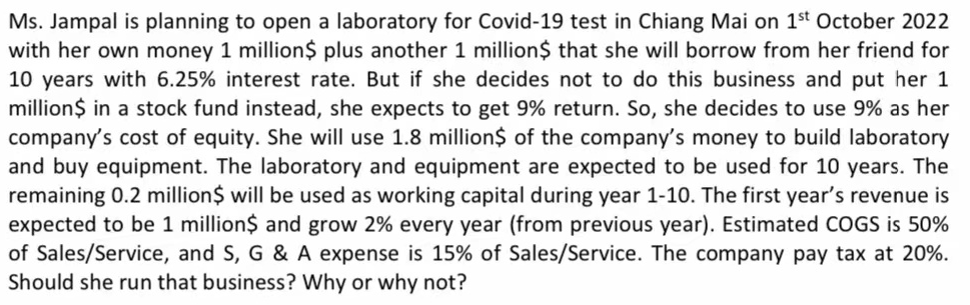

Ms. Jampal is planning to open a laboratory for Covid-19 test in Chiang Mai on 1st October 2022 with her own money 1 million $ plus another 1 million$ that she will borrow from her friend for 10 years with 6.25% interest rate. But if she decides not to do this business and put her 1 million$ in a stock fund instead, she expects to get 9% return. So, she decides to use 9% as her company's cost of equity. She will use 1.8 millions of the company's money to build laboratory and buy equipment. The laboratory and equipment are expected to be used for 10 years. The remaining 0.2 million $ will be used as working capital during year 1-10. The first year's revenue is expected to be 1 million $ and grow 2% every year (from previous year). Estimated COGS is 50% of Sales/Service, and S, G & A expense is 15% of Sales/Service. The company pay tax at 20%. Should she run that business? Why or why not?

Ms. Jampal is planning to open a laboratory for Covid-19 test in Chiang Mai on 1st October 2022 with her own money 1 million $ plus another 1 million$ that she will borrow from her friend for 10 years with 6.25% interest rate. But if she decides not to do this business and put her 1 million$ in a stock fund instead, she expects to get 9% return. So, she decides to use 9% as her company's cost of equity. She will use 1.8 millions of the company's money to build laboratory and buy equipment. The laboratory and equipment are expected to be used for 10 years. The remaining 0.2 million $ will be used as working capital during year 1-10. The first year's revenue is expected to be 1 million $ and grow 2% every year (from previous year). Estimated COGS is 50% of Sales/Service, and S, G & A expense is 15% of Sales/Service. The company pay tax at 20%. Should she run that business? Why or why not?

Chapter11: Property Dispositions

Section: Chapter Questions

Problem 52P

Related questions

Question

Transcribed Image Text:Ms. Jampal is planning to open a laboratory for Covid-19 test in Chiang Mai on 1st October 2022

with her own money 1 million $ plus another 1 million $ that she will borrow from her friend for

10 years with 6.25% interest rate. But if she decides not to do this business and put her 1

million$ in a stock fund instead, she expects to get 9% return. So, she decides to use 9% as her

company's cost of equity. She will use 1.8 million$ of the company's money to build laboratory

and buy equipment. The laboratory and equipment are expected to be used for 10 years. The

remaining 0.2 million $ will be used as working capital during year 1-10. The first year's revenue is

expected to be 1 million $ and grow 2% every year (from previous year). Estimated COGS is 50%

of Sales/Service, and S, G & A expense is 15% of Sales/Service. The company pay tax at 20%.

Should she run that business? Why or why not?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning