Internal Growth Rate (IGR) Net Income ($) Total dividend paid ($) Retention ratio (%) Total assets (use beginning-of-period asset balance) IGR (%)

Internal Growth Rate (IGR) Net Income ($) Total dividend paid ($) Retention ratio (%) Total assets (use beginning-of-period asset balance) IGR (%)

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 13E: Reporting land acquisition for cash and mortgage note on statement of cash flows On the basis of the...

Related questions

Question

with explanation please on how you did it, including cell numbers

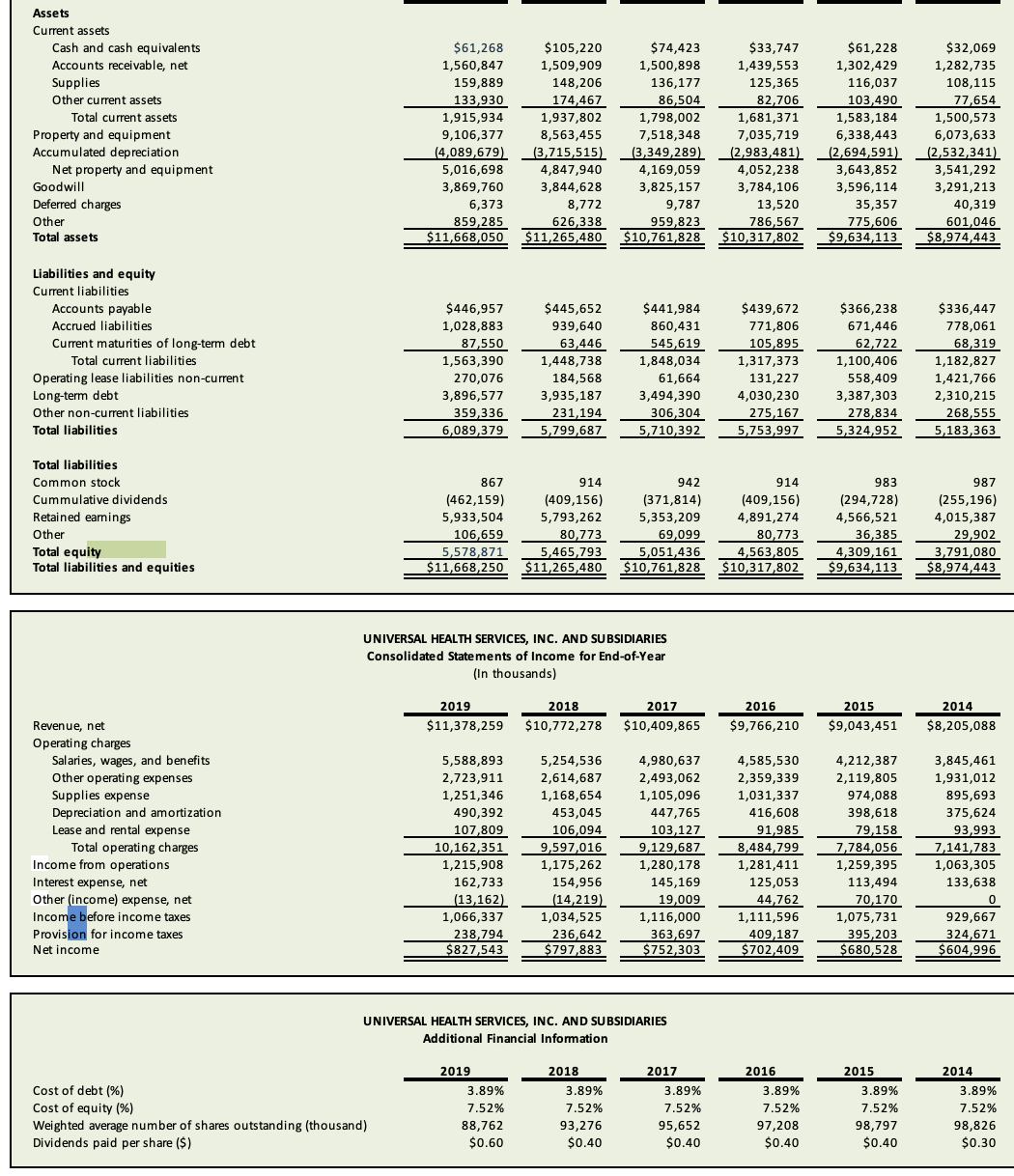

Transcribed Image Text:Assets

Current assets

Cash and cash equivalents

Accounts receivable, net

Supplies

Other current assets

Total current assets

Property and equipment

Accumulated depreciation

Net property and equipment

Goodwill

Deferred charges

Other

Total assets

Liabilities and equity

Current liabilities

Accounts payable

Accrued liabilities

Current maturities of long-term debt

Total current liabilities

Operating lease liabilities non-current

Long-term debt

Other non-current liabilities

Total liabilities

Total liabilities

Common stock

Cummulative dividends

Retained earnings

Other

Total equity

Total liabilities and equities

Revenue, net

Operating charges

Salaries, wages, and benefits

Other operating expenses

Supplies expense

Depreciation and amortization

Lease and rental expense

Total operating charges

Income from operations

Interest expense, net

Other (income) expense, net

Income before income taxes

Provision for income taxes

Net income

$61,268

1,560,847

Cost of debt (%)

Cost of equity (%)

Weighted average number of shares outstanding (thousand)

Dividends paid per share ($)

$105,220

1,509,909

159,889

148,206

133,930

174,467

1,915,934

1,937,802

1,798,002

9,106,377

8,563,455

7,518,348

(4,089,679) (3,715,515) (3,349,289)

5,016,698

3,869,760

4,847,940

3,844,628

4,169,059

3,825,157

6,373

859,285

8,772

626,338

9,787

959,823

$11,668,050 $11,265,480 $10,761,828

$446,957

1,028,883

87,550

1,563,390

270,076

3,896,577

359,336

6,089,379

867

(462,159)

5,933,504

UNIVERSAL HEALTH SERVICES, INC. AND SUBSIDIARIES

Consolidated Statements of Income for End-of-Year

(In thousands)

2019

2018

$11,378,259 $10,772,278

5,588,893

2,723,911

1,251,346

490,392

107,809

10,162,351

1,215,908

162,733

(13,162)

1,066,337

238,794

$827,543

$445,652

939,640

63,446

1,448,738

184,568

3,935,187

231,194

5,799,687

914

942

914

(409,156)

(371,814)

(409,156)

5,793,262

5,353,209

4,891,274

106,659

80,773

69,099

80,773

5,465,793

5,051,436

4,563,805

5,578,871

$11,668,250 $11,265,480 $10,761,828 $10,317,802

3.89%

7.52%

88,762

5,254,536

2,614,687

1,168,654

$0.60

453,045

106,094

9,597,016

1,175,262

154,956

(14,219)

1,034,525

236,642

$797,883

$74,423

1,500,898

136,177

86,504

UNIVERSAL HEALTH SERVICES, INC. AND SUBSIDIARIES

Additional Financial Information

3.89%

$441,984

860,431

545,619

1,848,034

61,664

3,494,390

306,304

5,710,392

7.52%

93,276

$0.40

4,980,637

2,493,062

1,105,096

447,765

103,127

9,129,687

1,280,178

145,169

19,009

1,116,000

363,697

$752,303

2017

2016

$10,409,865 $9,766,210

3.89%

$33,747

1,439,553

125,365

82,706

7.52%

$61,228

1,302,429

116,037

103,490

1,583,184

6,338,443

(2,983,481) (2,694,591)

4,052,238

3,643,852

3,784,106

3,596,114

95,652

1,681,371

7,035,719

$0.40

13,520

35,357

775,606

786,567

$10,317,802 $9,634,113

$439,672

771,806

105,895

1,317,373

131,227

4,030,230

275,167

5,753,997

4,585,530

2,359,339

1,031,337

416,608

91,985

8,484,799

1,281,411

125,053

44,762

1,111,596

409,187

$702,409

3.89%

LLLLLL

7.52%

97,208

$366,238

671,446

62,722

$0.40

1,100,406

558,409

3,387,303

278,834

5,324,952

983

(294,728)

4,566,521

36,385

4,309,161

$9,634,113

4,212,387

2,119,805

974,088

398,618

79,158

7,784,056

1,259,395

113,494

70,170

1,075,731

395,203

$680,528

3.89%

2015

2014

$9,043,451 $8,205,088

7.52%

$32,069

1,282,735

108,115

77,654

98,797

1,500,573

6,073,633

(2,532,341)

3,541,292

3,291,213

$0.40

40,319

601,046

$8,974,443

$336,447

778,061

68,319

1,182,827

1,421,766

2,310,215

268,555

5,183,363

987

(255,196)

4,015,387

29,902

3,791,080

$8,974,443

3,845,461

1,931,012

895,693

375,624

93,993

7,141,783

1,063,305

133,638

0

929,667

324,671

$604,996

3.89%

7.52%

98,826

$0.30

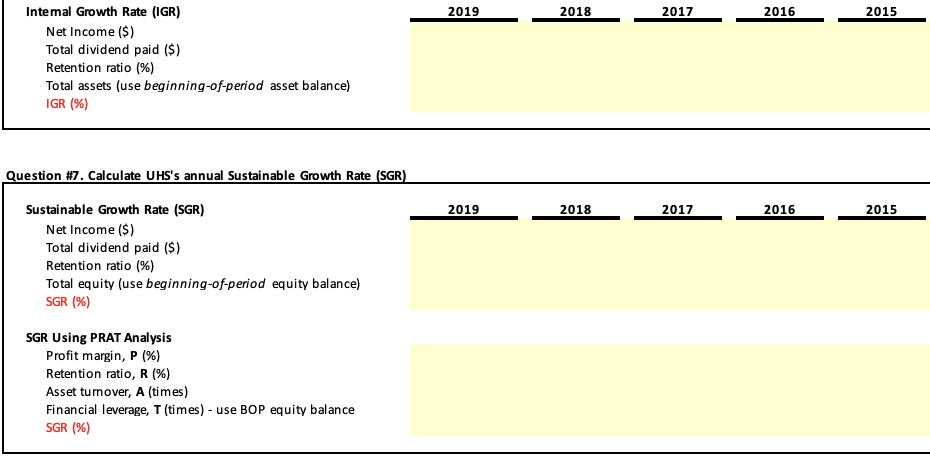

Transcribed Image Text:Intemal Growth Rate (IGR)

Net Income ($)

Total dividend paid ($)

Retention ratio (%)

Total assets (use beginning-of-period asset balance)

IGR (%)

Question #7. Calculate UHS's annual Sustainable Growth Rate (SGR)

Sustainable Growth Rate (SGR)

Net Income ($)

Total dividend paid ($)

Retention ratio (%)

Total equity (use beginning-of-period equity balance)

SGR (%)

SGR Using PRAT Analysis

Profit margin, P (%)

Retention ratio, R (%)

Asset turnover, A (times)

Financial leverage, T (times) - use BOP equity balance

SGR (%)

2019

2019

2018

2018

2017

2017

2016

2016

2015

2015

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub