Review the contribution margin income statements for Cover-to-Cover Company and Biblio Files Company on their respective Income Statements. Complete the following table from the data provided on the income statements. Each company sold 80,800 units during the year. Cover-to-Cover Company Biblio Files Company Contribution margin ratio (percent) fill in the blank 88433c080069046_1% fill in the blank 88433c080069046_2% Unit contribution margin $fill in the blank 88433c080069046_3 $fill in the blank 88433c080069046_4 Break-even sales (units) fill in the blank 88433c080069046_5 fill in the blank 88433c080069046_6 Break-even sales (dollars) $fill in the blank 88433c080069046_7 $fill in the blank 88433c080069046_8 Question Content Area Income Statement - Cover-to-Cover Cover-to-Cover Company Contribution Margin Income Statement For the Year Ended December 31, 20Y8 Sales $404,000 Variable costs: Manufacturing expense $242,400 Selling expense 20,200 Administrative expense 60,600 (323,200) Contribution margin $80,800 Fixed costs: Manufacturing expense $5,000 Selling expense 4,000 Administrative expense 11,200 (20,200) Operating income $60,600 Income Statement - Biblio Files Biblio Files Company Contribution Margin Income Statement For the Year Ended December 31, 20Y8 Sales $404,000 Variable costs: Manufacturing expense $161,600 Selling expense 16,160 Administrative expense 64,640 (242,400) Contribution margin $161,600 Fixed costs: Manufacturing expense $83,000 Selling expense 8,000 Administrative expense 10,000 (101,000) Operating income $60,600

Cost-Volume-Profit Analysis

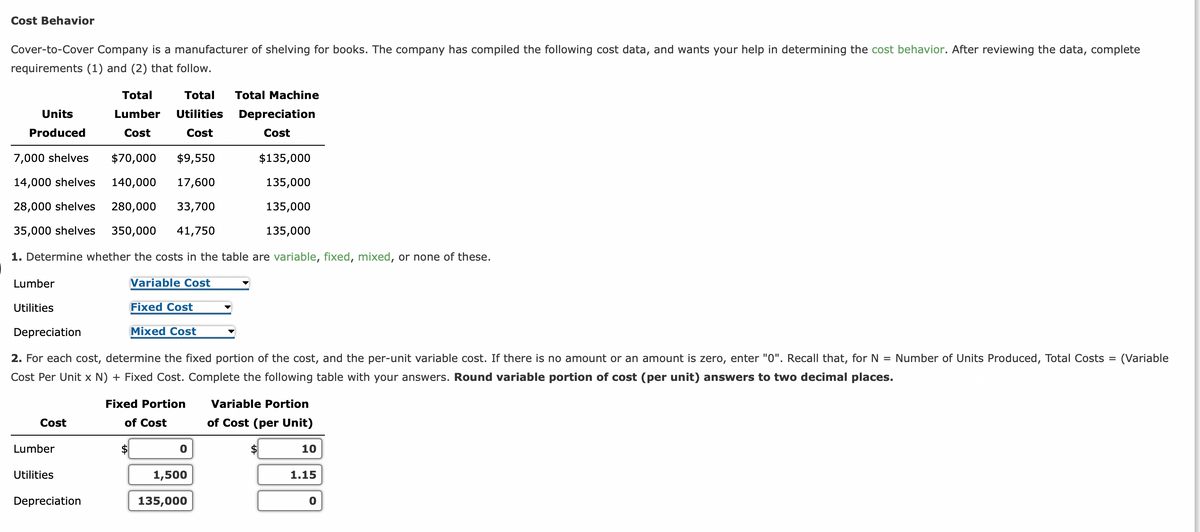

Cost Volume Profit (CVP) analysis is a cost accounting method that analyses the effect of fluctuating cost and volume on the operating profit. Also known as break-even analysis, CVP determines the break-even point for varying volumes of sales and cost structures. This information helps the managers make economic decisions on a short-term basis. CVP analysis is based on many assumptions. Sales price, variable costs, and fixed costs per unit are assumed to be constant. The analysis also assumes that all units produced are sold and costs get impacted due to changes in activities. All costs incurred by the company like administrative, manufacturing, and selling costs are identified as either fixed or variable.

Marginal Costing

Marginal cost is defined as the change in the total cost which takes place when one additional unit of a product is manufactured. The marginal cost is influenced only by the variations which generally occur in the variable costs because the fixed costs remain the same irrespective of the output produced. The concept of marginal cost is used for product pricing when the customers want the lowest possible price for a certain number of orders. There is no accounting entry for marginal cost and it is only used by the management for taking effective decisions.

Contribution Margin

Review the contribution margin income statements for Cover-to-Cover Company and Biblio Files Company on their respective Income Statements. Complete the following table from the data provided on the income statements. Each company sold 80,800 units during the year.

| Cover-to-Cover Company |

Biblio Files Company |

|

| Contribution margin ratio (percent) | fill in the blank 88433c080069046_1% | fill in the blank 88433c080069046_2% |

| Unit contribution margin | $fill in the blank 88433c080069046_3 | $fill in the blank 88433c080069046_4 |

| Break-even sales (units) | fill in the blank 88433c080069046_5 | fill in the blank 88433c080069046_6 |

| Break-even sales (dollars) | $fill in the blank 88433c080069046_7 | $fill in the blank 88433c080069046_8 |

Question Content Area

Income Statement - Cover-to-Cover

| Cover-to-Cover Company Contribution Margin Income Statement For the Year Ended December 31, 20Y8 |

||

| Sales | $404,000 | |

| Variable costs: | ||

| Manufacturing expense | $242,400 | |

| Selling expense | 20,200 | |

| Administrative expense | 60,600 | (323,200) |

| Contribution margin | $80,800 | |

| Fixed costs: | ||

| Manufacturing expense | $5,000 | |

| Selling expense | 4,000 | |

| Administrative expense | 11,200 | (20,200) |

| Operating income | $60,600 |

Income Statement - Biblio Files

| Biblio Files Company Contribution Margin Income Statement For the Year Ended December 31, 20Y8 |

||

| Sales | $404,000 | |

| Variable costs: | ||

| Manufacturing expense | $161,600 | |

| Selling expense | 16,160 | |

| Administrative expense | 64,640 | (242,400) |

| Contribution margin | $161,600 | |

| Fixed costs: | ||

| Manufacturing expense | $83,000 | |

| Selling expense | 8,000 | |

| Administrative expense | 10,000 | (101,000) |

| Operating income | $60,600 |

Sales Mix

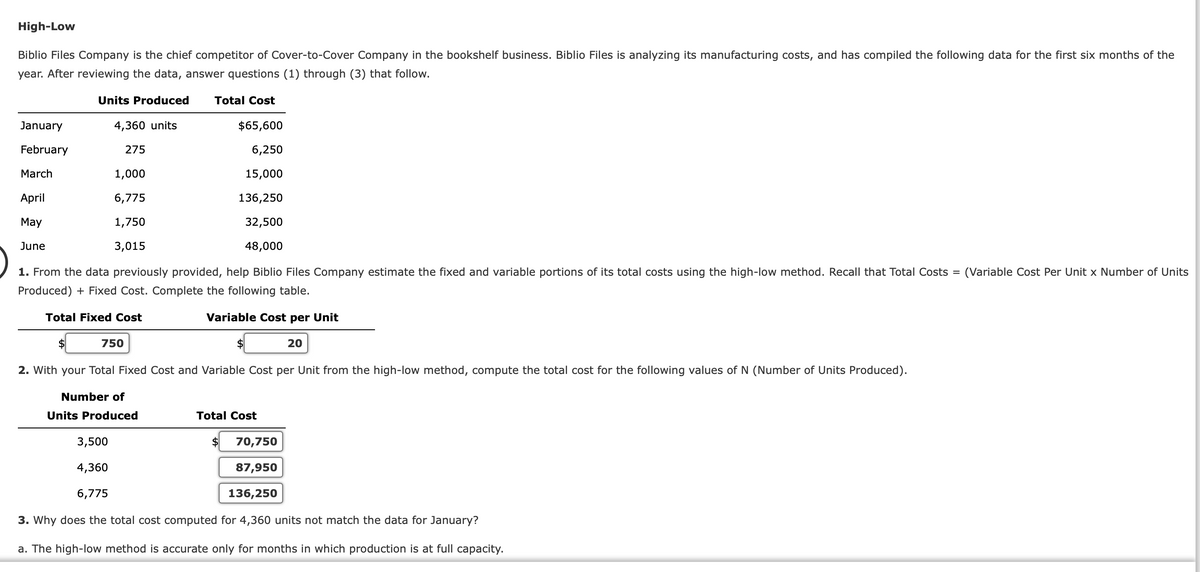

Biblio Files Company is making plans for its next fiscal year, and decides to sell two new types of bookshelves, Basic and Deluxe. The company has compiled the following estimates for the new product offerings.

| Type of Bookshelf |

Sales Price per Unit |

Variable Cost per Unit |

| Basic | $5.00 | $1.75 |

| Deluxe | 9.00 | 8.10 |

The company is interested in determining how many of each type of bookshelf would have to be sold in order to break even. If we think of the Basic and Deluxe products as components of one overall enterprise product called “Combined,” the unit contribution margin for the Combined product would be $2.31. Fixed costs for the upcoming year are estimated at $330,330. Recall that the totals of all the sales mix percents must be 100%. Determine the amounts to complete the following table.

| Type of Bookshelf | Percent of Sales Mix | Break-Even Sales in Units | Break-Even Sales in Dollars |

| Basic | fill in the blank 0f00c9f3c077024_1% | fill in the blank 0f00c9f3c077024_2 | $fill in the blank 0f00c9f3c077024_3 |

| Deluxe | fill in the blank 0f00c9f3c077024_4% | fill in the blank 0f00c9f3c077024_5 | $fill in the blank 0f00c9f3c077024_6 |

Question Content Area

Target Profit

Refer again to the income statements for Cover-to-Cover Company and Biblio Files Company on their respective Income Statement. Note that both companies have the same sales and net income. Answer questions (1) - (3) that follow, assuming that all data for the coming year is the same as the current year, except for the amount of sales.

1. If Cover-to-Cover Company wants to increase its profit by $20,000 in the coming year, what must their amount of sales be?

$fill in the blank 5b711b0cff88ffb_1

2. If Biblio Files Company wants to increase its profit by $20,000 in the coming year, what must their amount of sales be?

$fill in the blank 5b711b0cff88ffb_2

3. What would explain the difference between your answers for (1) and (2)?

a. Biblio Files Company has a higher contribution margin ratio, and so more of each sales dollar is available to cover fixed costs and provide operating income.

b. Cover-to-Cover Company’s contribution margin ratio is lower, meaning that it’s more efficient in its operations.

c. The companies have goals that are not in the relevant range.

d. The answers are not different; each company has the same required sales amount for the coming year to achieve the desired target profit.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images