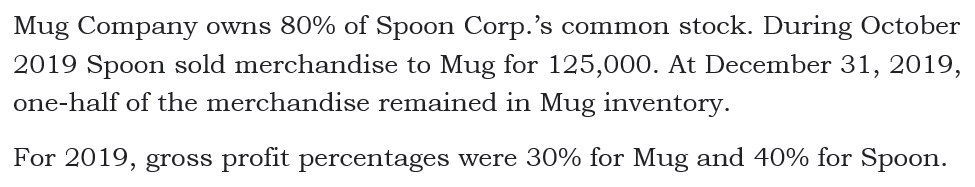

Mug Company owns 80% of Spoon Corp.'s common stock. During October 2019 Spoon sold merchandise to Mug for 125,000. At December 31, 2019, one-half of the merchandise remained in Mug inventory. For 2019, gross profit percentages were 30% for Mug and 40% for Spoon.

Q: 38. PP Corp owns 80% of SS Inc.'s common stock. During 2019, PP sold SS P250,000 of inventory on the…

A: As per the norms of the Bartleby, in case of multiple independent questions been asked, the expert…

Q: ABC owns 80% interest of DEF Company and at December 31, 2021, ABC's investment in DEF under the…

A: The calculation of non controlling interest in net income of DEF is shown hereunder : ABC acquired…

Q: In January 2019, Janeway AG doubled the amount of its outstanding shares by selling an additional…

A:

Q: Chapman Company obtains 100 percent of Abernethy Company’s stock on January 1, 2020. As of that…

A: Consolidated Statement- Consolidated Statement refers to the financial plan under which final…

Q: Chapman Company obtains 100 percent of Abernethy Company’s stock on January 1, 2020. As of that…

A: The question is based on the concept of Financial Accounting.

Q: ts payable $ 50,500 Accounts receiva

A: These are the accounting transactions that are having a monetary impact on the financial statement…

Q: On June 30, 2020, Wisconsin, Inc., issued $315,450 in debt and 18,100 new shares of its $10 par…

A: A set of consolidated financial statements comprises of reports that illustrate a parent company's…

Q: On September 5, 2021, Howard Corporation signed a purchase commitment to purchase inventory for…

A: Journal entry is a primary entry that records the financial transactions initially.

Q: On June 30, 2020, Wisconsin, Inc., issued $92,400 in debt and 23,400 new shares of its $10 par value…

A: Purchase Cost=Debt issued+Stock issued at fair value Book value of acquisition=Common stock+Retained…

Q: Acker Inc. bought 40% of Howell Co. on January 1, 2020 for $576,000. The equity method of accounting…

A: Unrealized profit, December 31, 2020 = [($20,000 / $75,000) x $15,000] x 40% = $1,600

Q: Dysabel Corp. owns 80% of Marina, Inc.'s common stock. During 2020, Dysabel sold Marina P337,500 of…

A: Following is the answer to the given question

Q: Nicolo manufacturing produced 10,000 Kitchen clocks in 2021 for P50 each and sold them to San Mig…

A: Consolidation In the consolidation parent company acquired the subsidiary company above the 50%…

Q: On June 30, 2020, Wisconsin, Inc., issued $147,900 in debt and 20,400 new shares of its $10 par…

A: Net Income of Wisconsin Less:- Commission Paid for Professional Services Net Income…

Q: Harrison Co. purchases 5,000 of the 50,000 outstanding ordinary shares of Taylor, Inc for £500,000…

A: Formula: Investment balance at year end = Beginning investment balance + net income - Dividends paid

Q: Alex, Inc., buys 30 percent of Steinbart Company on January 1, 2020, for $762,000. The equity method…

A: Introduction: Money earned from stock dividends is referred to as equity income. A dividend is…

Q: Chapman Company obtains 100 percent of Abernethy Company’s stock on January 1, 2020. As of that…

A: Calculation of Goodwill:

Q: On October 6, 2018, the Elgin Corporation signed a purchase commitment to purchase inventory for…

A:

Q: What are the consolidated balances for the following accounts?

A: The consolidated balances for the following accounts: a. Net income: 265000 - 30800 = $234200 b.…

Q: P Inc. owns a 60% interest in S Corp. During 2020 S sold inventory costing $160,000 to P for…

A:

Q: On June 30, 2020, Wisconsin, Inc., issued $279,150 in debt and 19,200 new shares of its $10 par…

A:

Q: On June 30, 2020, Wisconsin, Inc., issued $147,900 in debt and 20,400 new shares of its $10 par…

A:

Q: On December 31, 2016, Beckford Company issues 150,000 stock-appreciation rights to its officers…

A: a. Year Fair value Cumulative compensation (No. of SAR x Fair value) Percentage accrued…

Q: In January 2021, Tawatinaw Group paid $650,000 for 60,000 shares of Neerlandia Inc. giving Tawatinaw…

A: given In January 2021, Tawatinaw Group paid $650,000 for 60,000 shares of Neerlandia Inc., giving…

Q: Acker Inc. bought 40% of Howell Co. on January 1, 2020 for $576,000. The equity method of accounting…

A: Equity Method:-It is a method of accounting, the investor company shows the revenue earned from…

Q: Dysabel Corp. owns 80% of Marina, Inc.'s common stock. During 2020, Dysabel sold Marina P337,500 of…

A: While preparing the consolidated income statement, the effects of the intercompany transaction are…

Q: P Corporation owns 80 percent of S Inc.’s common stock. During 2020, P sold Inventory to S for…

A: Consolidated financial statements can be defined as the financial statements where the balance…

Q: Chapman Company obtains 100 percent of Abernethy Company’s stock on January 1, 2020. As of that…

A: Hi student Since there are multiple subparts, we will answer only first three subparts.

Q: Virginia Corp. owned all of the voting common stock of Stateside Co. Both companies use the…

A: A journal entry is made to record the financial transaction in the books of accounts.

Q: During 2021 Carla Vista Company purchased 10700 shares of Kingbird Inc. for $37 per share. During…

A: Purchased 10700 shares @$37 per share Sold 2850 shares @$42 per share Market price at 31 December…

Q: Tiberend, Inc., sold $150,000 in inventory to Schilling Company during 2017 for $225,000. Schilling…

A: Gross Profit Gross profit is refer as the profit of the company which are calculated by deducting…

Q: Parkette, Inc., acquired a 60 percent interest in Skybox Company several years ago. During 2020,…

A: Unrealized Profit Upto 31/12/2020 Profit from Intra Activity = (110,000 -90,200) = 19,800 Closing…

Q: Josie Inc was a C Corporation from January1, 2016 through Deceber 31, 2019 . At December 31,2019…

A: The amount on the revenue that is earned by an individual or any person paid to government is called…

Q: ayable $ 56,700 Accounts receivable $ 43,800 Additional paid-in capital 50,000…

A: Journal entry A journal entry is a record of the business transactions within the accounting books…

Q: Camille, Inc., sold $147,000 in inventory to Eckerle Company during 2020 for $245,000. Eckerle…

A: intra-entity gross profit is also known as unrealized gross profit. It is based on gross profit rate…

Q: Camille, Inc., sold $130,000 in inventory to Eckerle Company during 2020 for $250,000. Eckerle…

A: The equity method is used to record the profit earned through its investment in another business.…

Q: a. Compute the amount of net income or net loss that Lilly should report for 2021, taking into…

A: Investment may be defined as the allocation of amount into such avenues, financial instruments or…

Q: Scarlet Company owns 80% of Tamara Corp.'s common stock. During October 2019 Tamara sold merchandise…

A: Unrealized profit is a kind of potential profit that existed in the books, generated from an…

Q: Chapman Company obtains 100 percent of Abernethy Company’s stock on January 1, 2020. As of that…

A: Eliminating Entries: While consolidating income statements and balance sheet, come entries are…

Q: Razor Afternoon Co. owns 80% interest in Slice Morning Co. During 2019, Razor sold inventories…

A: Elimination entries refer to those journal entries that are made to simplify the consolidated…

Q: Alex, Inc., buys 40 percent of Steinbart Company on January 1, 2017, for $530,000. The equity method…

A: (1) Compute the annual amortization expense: Particulars Amount The acquisition price of shares…

Q: On October 1, 2021, Tyeso Company entered in a noncancellable purchase commitment to purchase…

A: a. P375,000 b. P7,275,000 c. P150,000 (gain) Explanation: See computations below:

Q: Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2020. As of that…

A:

Q: Padlock Corp. owns 90 percent of Safeco, Inc. During the year, Padlock sold 3,000 locking mechanisms…

A: Determine the amount of intra-entity profit that remains in S company inventory at year-end.

Q: Claire Corporation owns 80% of Jerald, Inc. ordinary stock. During 2020, Claire sold Jerald for…

A: Claire Corporation owns 80% of Jerald, Inc. The intra-company sales would be eliminated from the sum…

Q: L Company owns 30% of S Company’s common stock which gives it the ability to apply significant…

A: Since the intra sales include transfer of goods costing $120,000 to parent corporation for $200,000…

Q: On January 1, 2018, Spark Corp. acquired a 40% interest in Cranston Inc. for $250,000. On that date,…

A: Journal is the book of original entry in which all of the financial transactions of the business are…

Q: Detner International purchases 80% of the outstanding stock of Hardy Company for $1,600,000 on…

A: Determination of value analysis…

Q: Huge owns 25% of Small and at January 1, 2020 has a balance in its Investment in Small of $400,000.…

A: Huge owns 25% of Small and has a significant influence. The significant influence means power to…

Q: Rommel, Inc. acquired a 60% interest in Mikee Company several years ago. During 2020, Mikee sold…

A: Answer - Calculation of consolidated cost of sales - Particulars Amount Cost of sales of…

Q: On October 6, 2021, the Elgin Corporation signed a purchase commitment to purchase inventory for…

A:

The amount of unrealized intercompany profit in ending inventory at December 31, 2019 that should be eliminated in consolidation is:

Step by step

Solved in 2 steps

- Heller Company began operations in 2019 and used the LIFO method to compute its 300,000 cost of goods sold for that year. At the beginning of 2020, Heller changed to the FIFO method. Heller determined that its cost of goods sold under FIFO would have been 250,000 in 2019. For 2020, Hellers cost of goods sold under FIFO was 360,000, while it would have been 410,000 under LIFO. Heller is subject to a 21% income tax rate. Compute the cumulative effect of the retrospective adjustment on prior years income (net of taxes) that Heller would report on its retained earnings statement for 2020.Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1, 000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50, 000 to retire bonds with a face value (and book value) of 50, 000. e. On July 2, 2019, Farrell purchased equipment for 63, 000 cash. f. On December 31, 2019, land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows. (Appendix 21.1) Spreadsheet and Statement Refer to the information for Farrell Corporation in P21-13. Required: 1. Using the direct method for operating cash flows, prepare a spreadsheet to support a 2019 statement of cash flows. (Hint: Combine the income statement and December 31, 2019, balance sheet items for the adjusted trial balance. Use a retained earnings balance of 291,000 in this adjusted trial balance.) 2. Prepare the statement of cash flows. (A separate schedule reconciling net income to cash provided by operating activities is not necessary.)Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and 2018, and the statement of income and retained earnings for the year ended December 31, 2019: Additional information: a. On January 2, 2019, Farrell sold equipment costing 45,000, with a book value of 24,000, for 19,000 cash. b. On April 2, 2019, Farrell issued 1,000 shares of common stock for 23,000 cash. c. On May 14, 2019, Farrell sold all of its treasury stock for 25,000 cash. d. On June 1, 2019, Farrell paid 50,000 to retire bonds with a face value (and book value) of 50,000. e. On July 2, 2019, Farrell purchased equipment for 63,000 cash. f. On December 31, 2019. land with a fair market value of 150,000 was purchased through the issuance of a long-term note in the amount of 150,000. The note bears interest at the rate of 15% and is due on December 31, 2021. g. Deferred taxes payable represent temporary differences relating to the use of accelerated depreciation methods for income tax reporting and the straight-line method for financial statement reporting. Required: 1. Prepare a spreadsheet to support a statement of cash flows for Farrell for the year ended December 31, 2019, based on the preceding information. 2. Prepare the statement of cash flows.

- Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________Shaquille Corporation began the current year with inventory of 50,000. During the year, its purchases totaled 110,000. Shaquille paid freight charges of 8,500 for those purchases. At the end of the year, Shaquille had inventory of 47,800. Prepare a schedule to determine Shaquille's cost of goods sold for the current year.Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.

- Dani Corporation signed a binding commitment on December 2 to purchase inventory for 300,000 cash on January 2. By December 31, the market price (replacement cost) of the inventory had declined to 280,000. Prepare Danis journal entries at year-end and at the date of purchase.Camille, Inc., sold $147,000 in inventory to Eckerle Company during 2020 for $245,000. Eckerle resold $109,000 of this merchandise in 2020 with the remainder to be disposed of during 2021. Assuming that Camille owns 34 percent of Eckerle and applies the equity method, what journal entry is recorded at the end of 2020 to defer the intra-entity gross profit?Goddy Company owns 80% of the common stock of Morris, Inc. In the current year, Goddy reports sales of $10,000,000 and cost of goods sold of $7,500,000. For the same period, Morris has sales of $200,000 and cost of goods sold of $160,000. During the year, Goddy sold merchandise to Morris for $60,000 at a price based on the normal markup. At the end of the year, Morris still possesses 30 percent of this inventory. Compute consolidated cost of goods so ld. Select one: a. $7,604,500. b. $7,500,000. c. $7,660,000. d. $7,615,000. e. $7,600,000.

- Camille, Inc., sold $130,000 in inventory to Eckerle Company during 2020 for $250,000. Eckerle resold $89,000 of this merchandise in 2020 with the remainder to be disposed of during 2021. Assuming that Camille owns 20 percent of Eckerle and applies the equity method, what journal entry is recorded at the end of 2020 to defer the intra-entity gross profit? (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.)Parkette, Inc., acquired a 60 percent interest in Skybox Company several years ago. During 2020, Skybox sold inventory costing $90,200 to Parkette for $110,000. A total of 12 percent of this inventory was not sold to outsiders until 2021. During 2021, Skybox sold inventory costing $294,800 to Parkette for $335,000. A total of 29 percent of this inventory was not sold to outsiders until 2022. In 2021, Parkette reported cost of goods sold of $527,500 while Skybox reported $422,500. What is the consolidated cost of goods sold in 2021? Multiple Choice a $605,718. b $959,282. c $635,400. d $624,282.On January 1, 2020, Merlo Company acquired 80% of the stocks of Fritzie Company for P2,000,000. On this date, Fritzie Company had P1,000,000 of Capital Stock and P800,000 of Retained Earnings. On this date, the carrying values of the identifiable assets and liabilities of Fritzie Company are equal to their fair values.During the year, Merlo Company ships merchandise to Fritzie Company merchandise amounting to P800,000, which includes 25% gross profit rate. At the end of the year, records show the following: Merlo Company Fritzie CompanyInventories, Jan 1. P350,000 P120,000Inventories, Dec. 31 400,000 200,000Sales 5,500,000 2,500,000Cost of Sales 3,200,000 1,600,000Operating expenses 650,000 300,000Dividends paid 500,000 350,000The ending…