On May 1, a commercial baking company purchased a commercial oven on account. The oven costs $40,000, has a life of 5 years, and has no salvage value. The company ordinally uses straight-line depreciation. The company recorded the following transaction. Debit equipment maintenance expense $40,000; credit Accounts payable $40,000. The company paid for the oven in June. If the company does not correct this error before December 31, which impact will the error have on the balance sheet? • Property. plant, and equipment (PP&E) will be understated Operating expenses will be understated • Property. plant and equipment (PP&E) will be overstated o Accumulated depreciation will be overstated

On May 1, a commercial baking company purchased a commercial oven on account. The oven costs $40,000, has a life of 5 years, and has no salvage value. The company ordinally uses straight-line depreciation. The company recorded the following transaction. Debit equipment maintenance expense $40,000; credit Accounts payable $40,000. The company paid for the oven in June. If the company does not correct this error before December 31, which impact will the error have on the balance sheet? • Property. plant, and equipment (PP&E) will be understated Operating expenses will be understated • Property. plant and equipment (PP&E) will be overstated o Accumulated depreciation will be overstated

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 13PA: Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value...

Related questions

Question

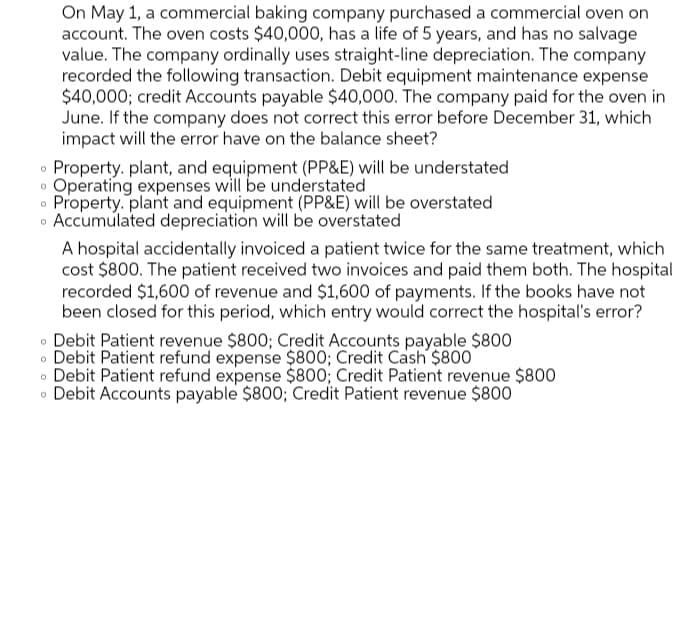

Transcribed Image Text:On May 1, a commercial baking company purchased a commercial oven on

account. The oven costs $40,000, has a life of 5 years, and has no salvage

value. The company ordinally uses straight-line depreciation. The company

recorded the following transaction. Debit equipment maintenance expense

$40,000; credit Accounts payable $40,000. The company paid for the oven in

June. If the company does not correct this error before December 31, which

impact will the error have on the balance sheet?

Property. plant, and equipment (PP&E) will be understated

Operating expenses will be understated

Property. plant and equipment (PP&E) will be overstated

Accumulated depreciation will be overstated

A hospital accidentally invoiced a patient twice for the same treatment, which

cost $800. The patient received two invoices and paid them both. The hospital

recorded $1,600 of revenue and $1,600 of payments. If the books have not

been closed for this period, which entry would correct the hospital's error?

• Debit Patient revenue $800; Credit Accounts payable $800

o Debit Patient refund expense $800; Credit Cash $800

• Debit Patient refund expense $800; Credit Patient revenue $800

o Debit Accounts payable $800; Credit Patient revenue $800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning