multiplier is 1.64. Using DuPont analysis, determine if the company's return on equity is above or below the industry average and what factor causes the difference?

multiplier is 1.64. Using DuPont analysis, determine if the company's return on equity is above or below the industry average and what factor causes the difference?

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 1P

Related questions

Question

100%

2

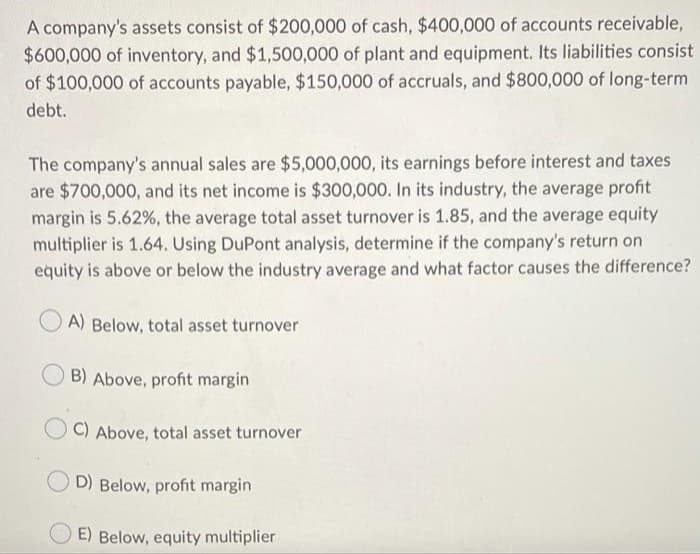

Transcribed Image Text:A company's assets consist of $200,000 of cash, $400,000 of accounts receivable,

$600,000 of inventory, and $1,500,000 of plant and equipment. Its liabilities consist

of $100,000 of accounts payable, $150,000 of accruals, and $800,000 of long-term

debt.

The company's annual sales are $5,000,000, its earnings before interest and taxes

are $700,000, and its net income is $300,000. In its industry, the average profit

margin is 5.62%, the average total asset turnover is 1.85, and the average equity

multiplier is 1.64. Using DuPont analysis, determine if the company's return on

equity is above or below the industry average and what factor causes the difference?

A) Below, total asset turnover

B) Above, profit margin

C) Above, total asset turnover

D) Below, profit margin

E) Below, equity multiplier

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning