Music Média Ltd. prepares statements quarterly. Part A: Required: 1. Based on 2019 results, Music's estimated tax liability for 2020 is $303,960. Music will accrue 1/18 of this amount at the end of each month (assume the installments are paid the next day) Prepare the entry on January 31, 2020, to accrue the tax liability and on February 1 to record the payment. View transaction list Journal entry worksheet ( 1

Music Média Ltd. prepares statements quarterly. Part A: Required: 1. Based on 2019 results, Music's estimated tax liability for 2020 is $303,960. Music will accrue 1/18 of this amount at the end of each month (assume the installments are paid the next day) Prepare the entry on January 31, 2020, to accrue the tax liability and on February 1 to record the payment. View transaction list Journal entry worksheet ( 1

Chapter6: Analysing And Journalizing Payroll

Section: Chapter Questions

Problem 10PA

Related questions

Question

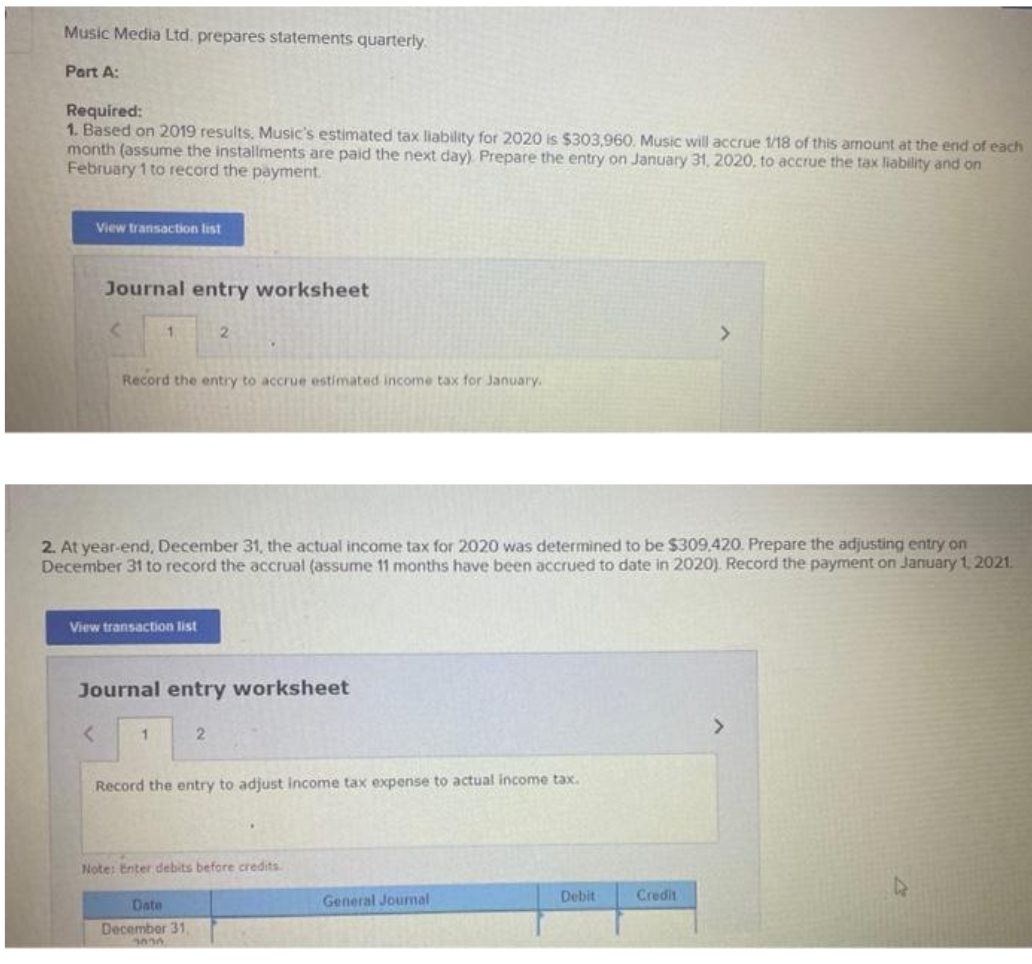

Transcribed Image Text:Music Media Ltd. prepares statements quarterly.

Port Ai

Required:

1. Based on 2019 results, Music's estimated tax liability for 2020 is $303,960. Music will accrue 1/18 of this amount at the end of each

month (assume the installments are paid the next day) Prepare the entry on January 31, 2020, to accrue the tax liability and on

February 1 to record the payment.

View transaction list

Journal entry worksheet

1

<

Record the entry to accrue estimated income tax for January.

2. At year-end, December 31, the actual income tax for 2020 was determined to be $309,420. Prepare the adjusting entry on

December 31 to record the accrual (assume 11 months have been accrued to date in 2020). Record the payment on January 1, 2021.

View transaction list

Journal entry worksheet

1

2

2

Record the entry to adjust income tax expense to actual income tax.

Date

December 31,

3036

Note: Enter debits before credits.

General Journal

Debit

Credit

>

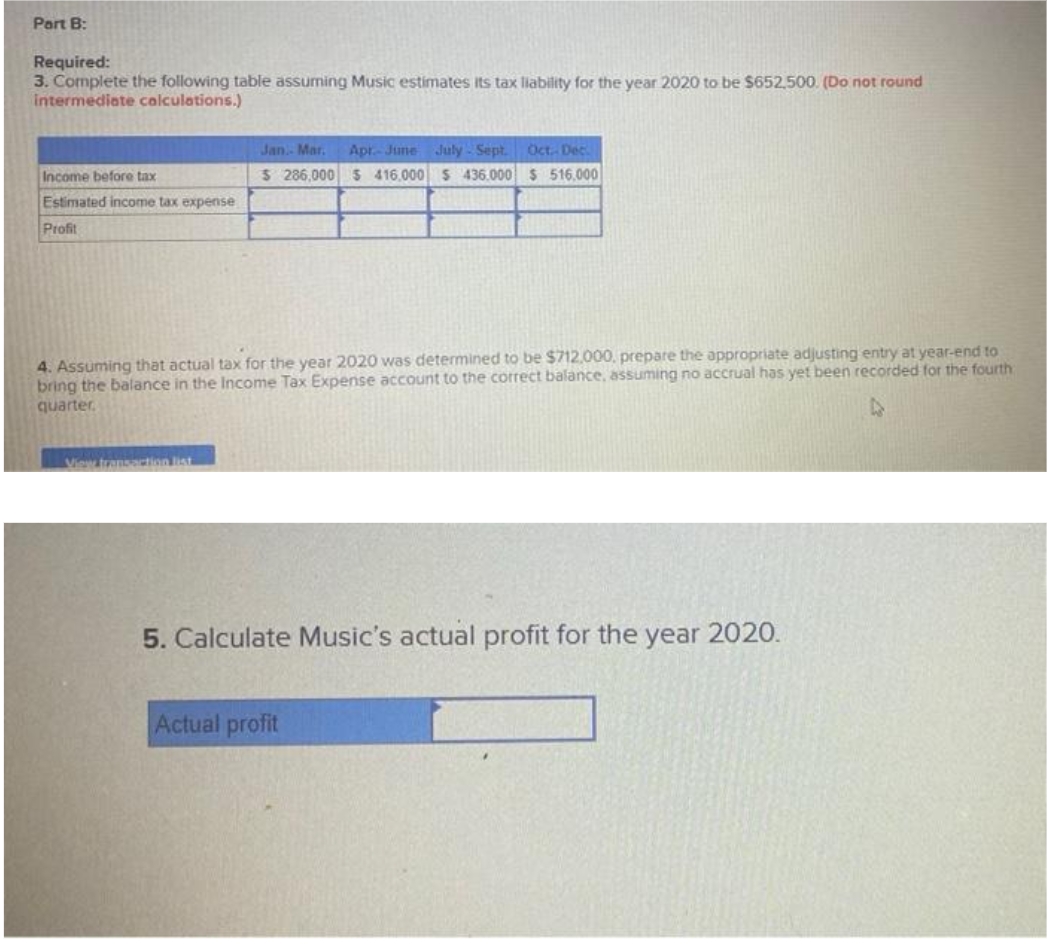

Transcribed Image Text:Part B:

Required:

3. Complete the following table assuming Music estimates its tax liability for the year 2020 to be $652,500. (Do not round

intermediate calculations.)

Income before tax

Estimated income tax expense

Profit

Jan.- Mar. Apr-June July-Sept. Oct-Dec.

$ 286,000 $ 416,000 $436.000 $ 516,000

4. Assuming that actual tax for the year 2020 was determined to be $712,000, prepare the appropriate adjusting entry at year-end to

bring the balance in the Income Tax Expense account to the correct balance, assuming no accrual has yet been recorded for the fourth

quarter.

D

View transaction list

5. Calculate Music's actual profit for the year 2020.

Actual profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT