Muskoge Company uses a process-costing system. The company manufactures a product that is processed in two departments: Molding and Assembly. In the Molding Department, direct materials are added at the beginning of the process; in the Assembly Department, additional direct materials are added at the end of the process. In both departments, conversion costs are incurred uniformly throughout the process. As work is completed, it is transferred out. The following table summarizes the production activity and costs for February: Molding Assembly Beginning inventories: Physical units 10,000 8,000 Costs: Transferred in — $45,300 Direct materials $22,000 — Conversion costs $13,800 $16,900 Current production: Units started 25,000 ? Units transferred out 30,000 35,000 Costs: Transferred in — ? Direct materials $56,250 $40,250 Conversion costs $103,500 $143,000 Percentage of completion: Beginning inventory 40% 50% Ending inventory 80 50 Required:

Muskoge Company uses a process-costing system. The company manufactures a product that is processed in two departments: Molding and Assembly. In the Molding Department, direct materials are added at the beginning of the process; in the Assembly Department, additional direct materials are added at the end of the process. In both departments, conversion costs are incurred uniformly throughout the process. As work is completed, it is transferred out. The following table summarizes the production activity and costs for February: Molding Assembly Beginning inventories: Physical units 10,000 8,000 Costs: Transferred in — $45,300 Direct materials $22,000 — Conversion costs $13,800 $16,900 Current production: Units started 25,000 ? Units transferred out 30,000 35,000 Costs: Transferred in — ? Direct materials $56,250 $40,250 Conversion costs $103,500 $143,000 Percentage of completion: Beginning inventory 40% 50% Ending inventory 80 50 Required:

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter6: Process Costing

Section: Chapter Questions

Problem 17E: K-Briggs Company uses the FIFO method to account for the costs of production. For Crushing, the...

Related questions

Question

FIFO Method, Two-Department Analysis

Muskoge Company uses a process-costing system. The company manufactures a product that is processed in two departments: Molding and Assembly. In the Molding Department, direct materials are added at the beginning of the process; in the Assembly Department, additional direct materials are added at the end of the process. In both departments, conversion costs are incurred uniformly throughout the process. As work is completed, it is transferred out. The following table summarizes the production activity and costs for February:

| Molding | Assembly | |||

| Beginning inventories: | ||||

| Physical units | 10,000 | 8,000 | ||

| Costs: | ||||

| Transferred in | — | $45,300 | ||

| Direct materials | $22,000 | — | ||

| Conversion costs | $13,800 | $16,900 | ||

| Current production: | ||||

| Units started | 25,000 | ? | ||

| Units transferred out | 30,000 | 35,000 | ||

| Costs: | ||||

| Transferred in | — | ? | ||

| Direct materials | $56,250 | $40,250 | ||

| Conversion costs | $103,500 | $143,000 | ||

| Percentage of completion: | ||||

| Beginning inventory | 40% | 50% | ||

| Ending inventory | 80 | 50 |

Required:

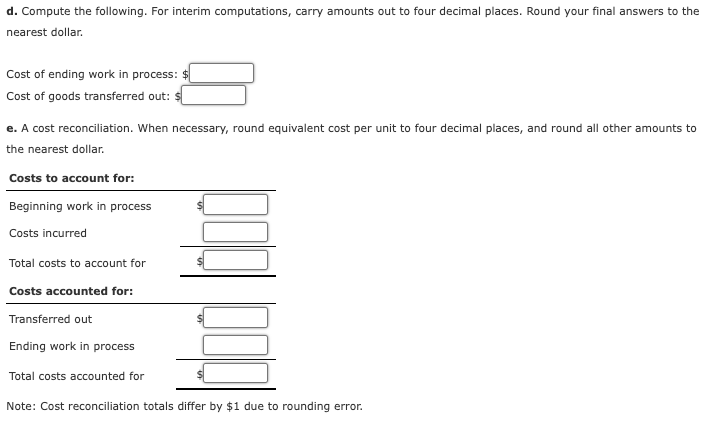

Transcribed Image Text:d. Compute the following. For interim computations, carry amounts out to four decimal places. Round your final answers to the

nearest dollar.

Cost of ending work in process: $

Cost of goods transferred out:

e. A cost reconciliation. When necessary, round equivalent cost per unit to four decimal places, and round all other amounts to

the nearest dollar.

Costs to account for:

Beginning work in process

Costs incurred

Total costs to account for

Costs accounted for:

Transferred out

Ending work in process

Total costs accounted for

Note: Cost reconciliation totals differ by $1 due to rounding error.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 8 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning