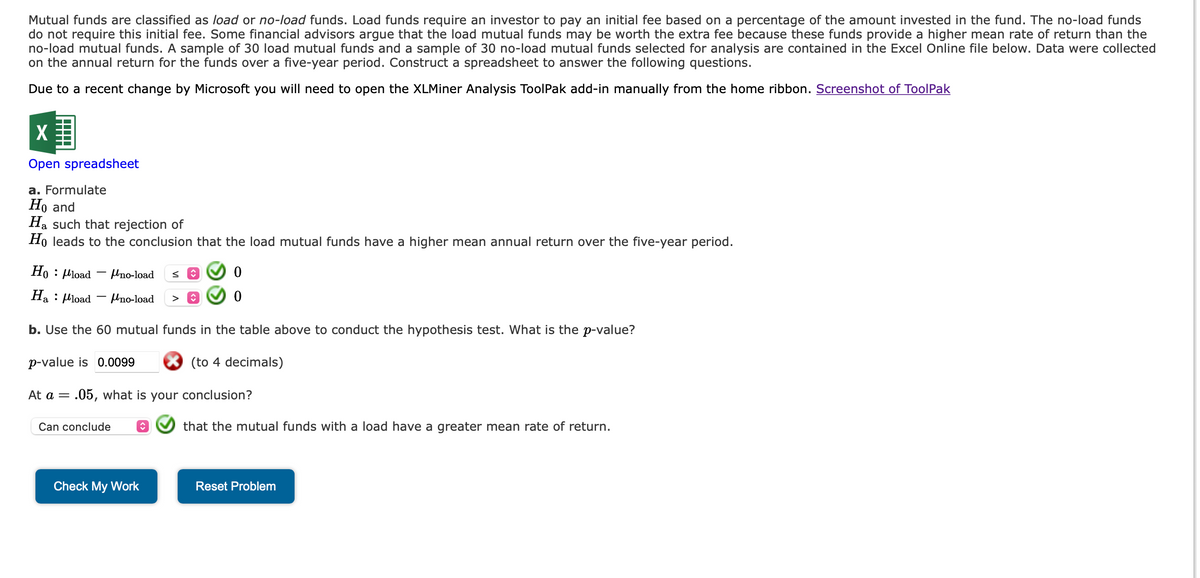

Mutual funds are classified as load or no-load funds. Load funds require an investor to pay an initial fee based on a percentage of the amount invested in the fund. The no-load funds do not require this initial fee. Some financial advisors argue that the load mutual funds may be worth the extra fee because these funds provide a higher mean rate of return than the no-load mutual funds. A sample of 30 load mutual funds and a sample of 30 no-load mutual funds selected for analysis are contained in the Excel Online file below. Data were collected on the annual return for the funds over a five-year period. Construct a spreadsheet to answer the following questions. Due to a recent change by Microsoft you will need to open the XLMiner Analysis ToolPak add-in manually from the home ribbon. Screenshot of ToolPak X Open spreadsheet a. Formulate Ho and Ha such that rejection of Ho leads to the conclusion that the load mutual funds have a higher mean annual return over the five-year period. Ho load no-load S Ha load no-load > b. Use the 60 mutual funds in the table above to conduct the hypothesis test. What is the p-value? p-value is 0.0099 (to 4 decimals) At a = .05, what is your conclusion? Can conclude Ⓒ Check My Work 0 O 0 that the mutual funds with a load have a greater mean rate of return. Reset Problem

Mutual funds are classified as load or no-load funds. Load funds require an investor to pay an initial fee based on a percentage of the amount invested in the fund. The no-load funds do not require this initial fee. Some financial advisors argue that the load mutual funds may be worth the extra fee because these funds provide a higher mean rate of return than the no-load mutual funds. A sample of 30 load mutual funds and a sample of 30 no-load mutual funds selected for analysis are contained in the Excel Online file below. Data were collected on the annual return for the funds over a five-year period. Construct a spreadsheet to answer the following questions. Due to a recent change by Microsoft you will need to open the XLMiner Analysis ToolPak add-in manually from the home ribbon. Screenshot of ToolPak X Open spreadsheet a. Formulate Ho and Ha such that rejection of Ho leads to the conclusion that the load mutual funds have a higher mean annual return over the five-year period. Ho load no-load S Ha load no-load > b. Use the 60 mutual funds in the table above to conduct the hypothesis test. What is the p-value? p-value is 0.0099 (to 4 decimals) At a = .05, what is your conclusion? Can conclude Ⓒ Check My Work 0 O 0 that the mutual funds with a load have a greater mean rate of return. Reset Problem

Holt Mcdougal Larson Pre-algebra: Student Edition 2012

1st Edition

ISBN:9780547587776

Author:HOLT MCDOUGAL

Publisher:HOLT MCDOUGAL

Chapter11: Data Analysis And Probability

Section11.4: Collecting Data

Problem 2E

Related questions

Question

data is given in the link below. please help asap i will upvote!!

https://drive.google.com/file/d/1hJOE15HlRoRXTBgl25qgdlj4Av8tc-BT/view?usp=sharing

Transcribed Image Text:Mutual funds are classified as load or no-load funds. Load funds require an investor to pay an initial fee based on a percentage of the amount invested in the fund. The no-load funds

do not require this initial fee. Some financial advisors argue that the load mutual funds may be worth the extra fee because these funds provide a higher mean rate of return than the

no-load mutual funds. A sample of 30 load mutual funds and a sample of 30 no-load mutual funds selected for analysis are contained in the Excel Online file below. Data were collected

on the annual return for the funds over a five-year period. Construct a spreadsheet to answer the following questions.

Due to a recent change by Microsoft you will need to open the XLMiner Analysis ToolPak add-in manually from the home ribbon. Screenshot of ToolPak

X

Open spreadsheet

a. Formulate

Ho and

Ha such that rejection of

Ho leads to the conclusion that the load mutual funds have a higher mean annual return over the five-year period.

Ho: Mload Uno-load s ↑

Ha: load

Uno-load >

b. Use the 60 mutual funds in the table above to conduct the hypothesis test. What is the p-value?

p-value is 0.0099

(to 4 decimals)

At a

=

.05, what is your conclusion?

Can conclude

♥

0

0

Check My Work

that the mutual funds with a load have a greater mean rate of return.

Reset Problem

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Recommended textbooks for you

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning