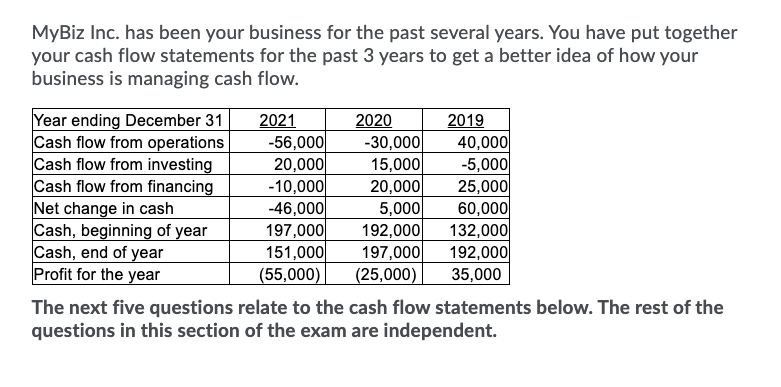

MyBiz Inc. has been your business for the past several years. You have put together your cash flow statements for the past 3 years to get a better idea of how your business is managing cash flow. Year ending December 31 Cash flow from operations Cash flow from investing Cash flow from financing Net change in cash Cash, beginning of year Cash, end of year Profit for the year 2021 -56,000| 20,000 -10,000 -46,000 197,000 151,000 (55,000) 2020 -30,000| 15,000 20,000 5,000| 192,000 197,000 (25,000) 2019 40,000 -5,000 25,000 60,000 132,000 192,000 35,000 The next five questions relate to the cash flow statements below. The rest of the questions in this section of the exam are independent.

MyBiz Inc. has been your business for the past several years. You have put together your cash flow statements for the past 3 years to get a better idea of how your business is managing cash flow. Year ending December 31 Cash flow from operations Cash flow from investing Cash flow from financing Net change in cash Cash, beginning of year Cash, end of year Profit for the year 2021 -56,000| 20,000 -10,000 -46,000 197,000 151,000 (55,000) 2020 -30,000| 15,000 20,000 5,000| 192,000 197,000 (25,000) 2019 40,000 -5,000 25,000 60,000 132,000 192,000 35,000 The next five questions relate to the cash flow statements below. The rest of the questions in this section of the exam are independent.

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 3DQ

Related questions

Question

Answer both subparts

59 and 60

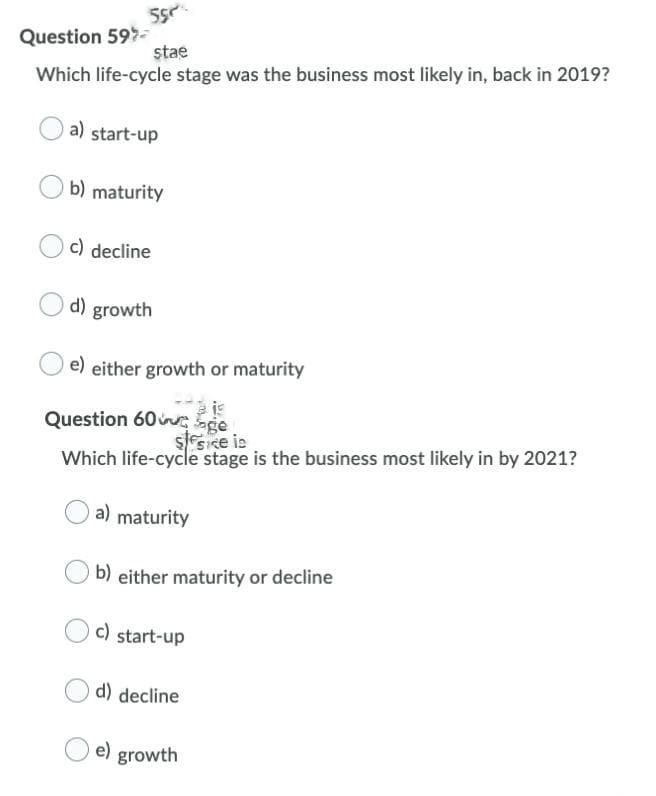

Transcribed Image Text:Question 59-

stae

Which life-cycle stage was the business most likely in, back in 2019?

a) start-up

b) maturity

c) decline

d) growth

e) either growth or maturity

Question 60 ge

ssice is

Which life-cycle stage is the business most likely in by 2021?

a) maturity

b) either maturity or decline

c) start-up

d) decline

e) growth

Transcribed Image Text:MyBiz Inc. has been your business for the past several years. You have put together

your cash flow statements for the past 3 years to get a better idea of how your

business is managing cash flow.

Year ending December 31

Cash flow from operations

Cash flow from investing

Cash flow from financing

Net change in cash

Cash, beginning of year

Cash, end of year

Profit for the year

2021

-56,000

20,000

-10,000

-46,000

197,000

151,000|

(55,000)

2020

-30,000

15,000

20,000

5,000

192,000

197,000

(25,000)

2019

40,000

-5,000

25,000

60,000

132,000

192,000

35,000

The next five questions relate to the cash flow statements below. The rest of the

questions in this section of the exam are independent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning