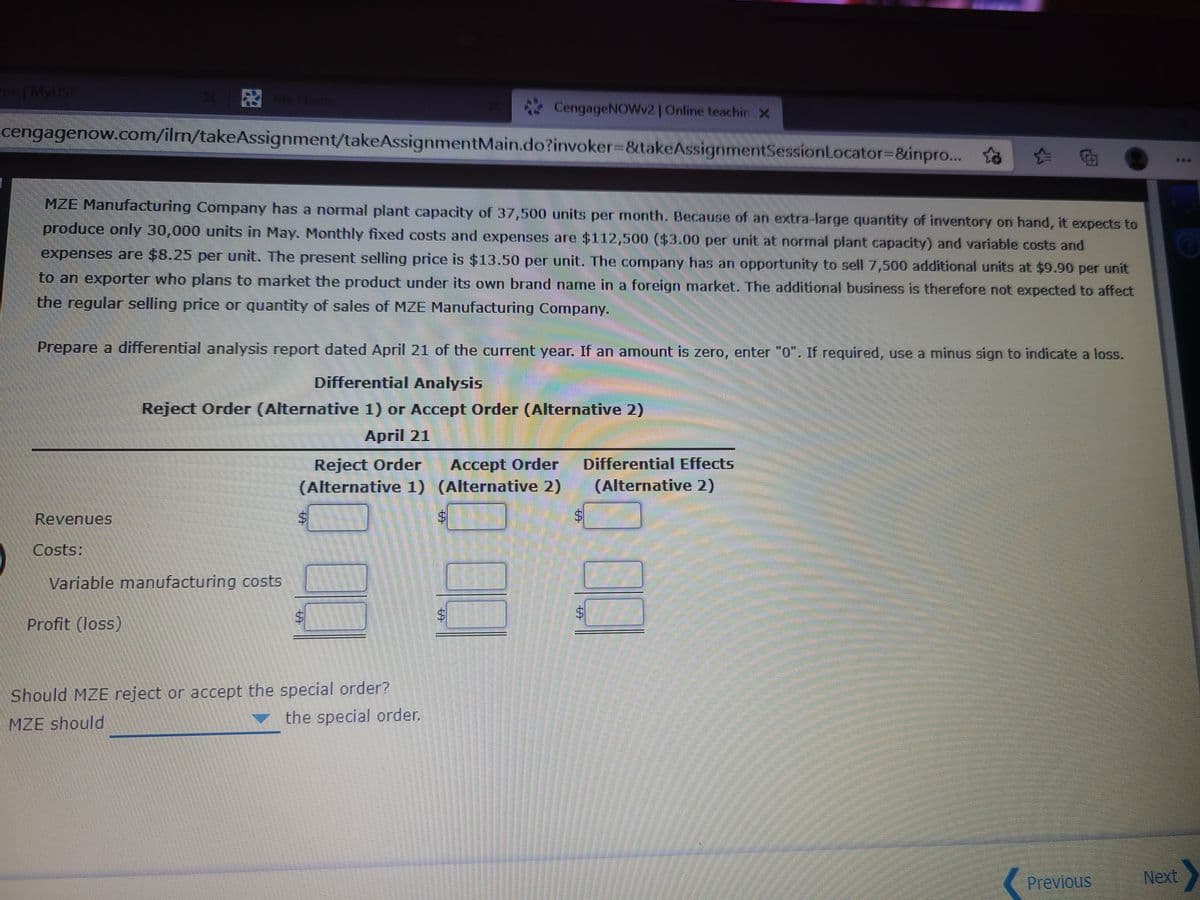

MZE Manufacturing Company has a normal plant capacity of 37,500 units per month. Because of an extra-large quantity of inventory on hand, it expects to produce only 30,000 units in May. Monthly fixed costs and expenses are $112,500 ($3.00 per unit at normal plant capacity) and variable costs and expenses are $8.25 per unit. The present selling price is $13.50 per unit. The company has an opportunity to sell 7,500 additional units at $9.90 per unit to an exporter who plans to market the product under its own brand name in a foreign market. The additional business is therefore not expected to affect the regular selling price or quantity of sales of MZE Manufacturing Company. Prepare a differential analysis report dated April 21 of the current year. If an amount is zero, enter "0". If required, use a minus sign to indicate a loss.

MZE Manufacturing Company has a normal plant capacity of 37,500 units per month. Because of an extra-large quantity of inventory on hand, it expects to produce only 30,000 units in May. Monthly fixed costs and expenses are $112,500 ($3.00 per unit at normal plant capacity) and variable costs and expenses are $8.25 per unit. The present selling price is $13.50 per unit. The company has an opportunity to sell 7,500 additional units at $9.90 per unit to an exporter who plans to market the product under its own brand name in a foreign market. The additional business is therefore not expected to affect the regular selling price or quantity of sales of MZE Manufacturing Company. Prepare a differential analysis report dated April 21 of the current year. If an amount is zero, enter "0". If required, use a minus sign to indicate a loss.

Chapter4: Preparing And Using Financial Statements

Section: Chapter Questions

Problem 2EP

Related questions

Question

Transcribed Image Text:My Home

CengageNOWv21Online teachir x

cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker3&takeAssignmentSessionLocator=&inpro.. to

MZE Manufacturing Company has a normal plant capacity of 37,500 units per month. Because of an extra-large quantity of inventory on hand, it expects to

produce only 30,000 units in May. Monthly fixed costs and expenses are $112,500 ($3.00 per unit at normal plant capacity) and variable costs and

expenses are $8.25 per unit. The present selling price is $13.50 per unit. The company has an opportunity to sell 7,500 additional units at $9.90 per unit

to an exporter who plans to market the product under its own brand name in a foreigrn market. The additional business is therefore not expected to affect

the regular selling price or quantity of sales of MZE Manufacturing Company.

Prepare a differential analysis report dated April 21 of the current year. If an amount is zero, enter "0". If required, use a minus sign to indicate a loss.

Differential Analysis

Reject Order (Alternative 1) or Accept Order (Alternative 2)

April 21

Differential Effects

(Alternative 2)

Reject Order

Accept Order

(Alternative 1) (Alternative 2)

Revenues

Costs:

Variable manufacturing costs

Profit (loss)

Should MZE reject or accept the special order?

the special order.

MZE should

Previous

Next

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning