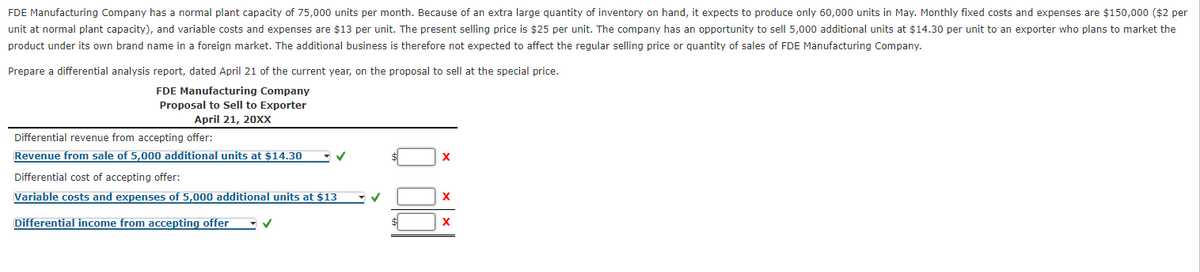

FDE Manufacturing Company has a normal plant capacity of 75,000 units per month. Because of an extra large quantity of inventory on hand, it expects to produce only 60,000 units in May. Monthly fixed costs and expenses are $150,000 ($2 per unit at normal plant capacity), and variable costs and expenses are $13 per unit. The present selling price is $25 per unit. The company has an opportunity to sell 5,000 additional units at $14.30 per unit to an exporter who plans t market the product under its own brand name in a foreign market. The additional business is therefore not expected to affect the regular selling price or quantity of sales of FDE Manufacturing Company. Prepare a differential analysis report, dated April 21 of the current year, on the proposal to sell at the special price. FDE Manufacturing Company Proposal to Sell to Exporter April 21, 20XX Differential revenue from accepting offer: Revenue from sale of 5,000 additional units at $14.30 - v X Differential cost of accepting offer: Variable costs and expenses of 5,000 additional units at $13 Differential income from accepting offer

FDE Manufacturing Company has a normal plant capacity of 75,000 units per month. Because of an extra large quantity of inventory on hand, it expects to produce only 60,000 units in May. Monthly fixed costs and expenses are $150,000 ($2 per unit at normal plant capacity), and variable costs and expenses are $13 per unit. The present selling price is $25 per unit. The company has an opportunity to sell 5,000 additional units at $14.30 per unit to an exporter who plans t market the product under its own brand name in a foreign market. The additional business is therefore not expected to affect the regular selling price or quantity of sales of FDE Manufacturing Company. Prepare a differential analysis report, dated April 21 of the current year, on the proposal to sell at the special price. FDE Manufacturing Company Proposal to Sell to Exporter April 21, 20XX Differential revenue from accepting offer: Revenue from sale of 5,000 additional units at $14.30 - v X Differential cost of accepting offer: Variable costs and expenses of 5,000 additional units at $13 Differential income from accepting offer

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 25E: Lowell Manufacturing Inc. has a normal selling price of 20 per unit and has been selling 125,000...

Related questions

Question

Transcribed Image Text:FDE Manufacturing Company has a normal plant capacity of 75,000 units per month. Because of an extra large quantity of inventory on hand, it expects to produce only 60,000 units in May. Monthly fixed costs and expenses are $150,000 ($2 per

unit at normal plant capacity), and variable costs and expenses are $13 per unit. The present selling price is $25 per unit. The company has an opportunity to sell 5,000 additional units at $14.30 per unit to an exporter who plans to market the

product under its own brand name in a foreign market. The additional business is therefore not expected to affect the regular selling price or quantity of sales of FDE Manufacturing Company.

Prepare a differential analysis report, dated April 21 of the current year, on the proposal to sell at the special price.

FDE Manufacturing Company

Proposal to Sell to Exporter

April 21, 20xx

Differential revenue from accepting offer:

Revenue from sale of 5,000 additional units at $14.30

Differential cost of accepting offer:

Variable costs and expenses of 5,000 additional units at $13

Differential income from accepting offer

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning