n at the end of every month and make equal payments at the time of the interest payments into a sinking d until the loan is retired in 9 years. Interest on the loan is 14.8% compounded monthly and the interest on sinking fund is 17.4% compounded monthly. (Round all answers to the nearest dollar.) Determine the size of the periodic interest expense of the debt. Determine the size of the periodic payments into the sinking fund. What is the periodic cost of the debt? What is the book value of the debt after 5 years?

n at the end of every month and make equal payments at the time of the interest payments into a sinking d until the loan is retired in 9 years. Interest on the loan is 14.8% compounded monthly and the interest on sinking fund is 17.4% compounded monthly. (Round all answers to the nearest dollar.) Determine the size of the periodic interest expense of the debt. Determine the size of the periodic payments into the sinking fund. What is the periodic cost of the debt? What is the book value of the debt after 5 years?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter10: Property, Plant And Equipment: Acquisition And Subsequent Investments

Section: Chapter Questions

Problem 11RE

Related questions

Question

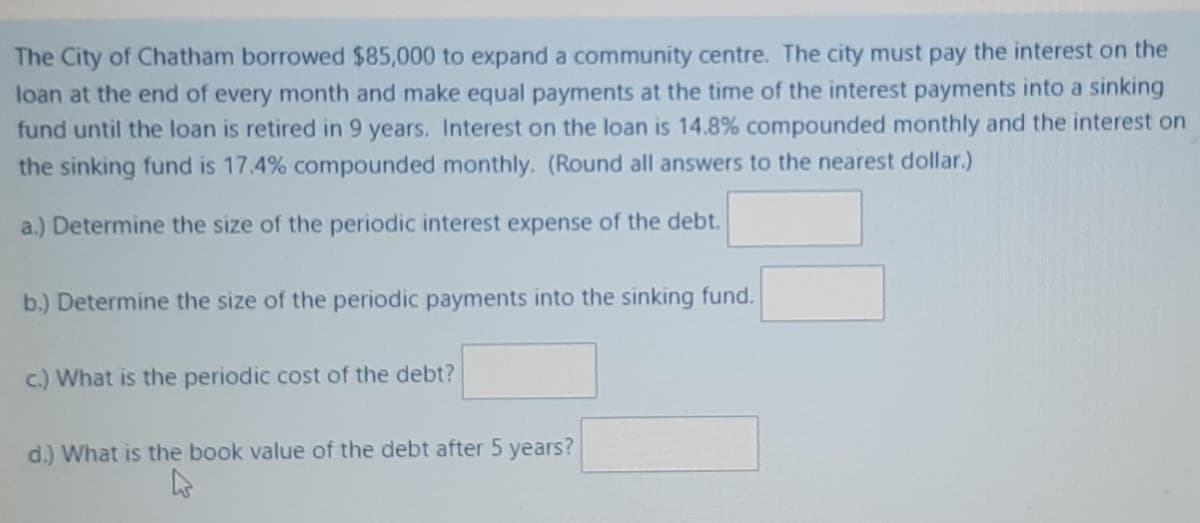

Transcribed Image Text:The City of Chatham borrowed $85,000 to expand a community centre. The city must pay the interest on the

loan at the end of every month and make equal payments at the time of the interest payments into a sinking

fund until the loan is retired in 9 years. Interest on the loan is 14.8% compounded monthly and the interest on

the sinking fund is 17.4% compounded monthly. (Round all answers to the nearest dollar.)

a.) Determine the size of the periodic interest expense of the debt.

b.) Determine the size of the periodic payments into the sinking fund.

c.) What is the periodic cost of the debt?

d.) What is the book value of the debt after 5 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College