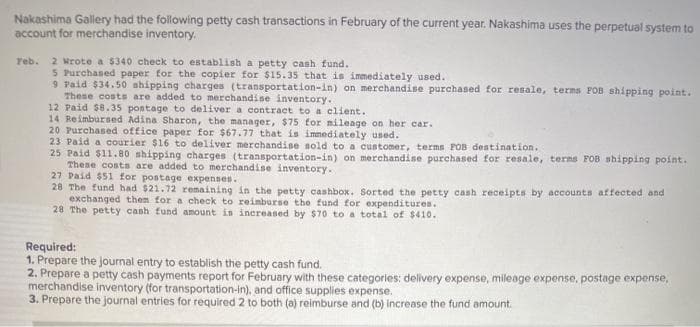

Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to account for merchandise inventory. reb. 2 Wrote a $340 check to establish a petty cash fund. 5 Purchased paper for the copier for $15.35 that is immediately used. 9 Paid $34.50 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These costs are added to merchandise inventory. 12 Paid $8.35 pontage to deliver a contract to a client. 14 Reimbursed Adina Sharon, the manager, $75 for mileage on her car. 20 Purchased office paper for $67.77 that is immediately used. 23 Paid a courier $16 to deliver merchandise sold to a customer, terms POB destination. 25 Paid $11.80 shipping charges (transportation-in) on merchandise purchased for resale, terns FOB shipping point. These costs are added to merchandise inventory. 27 Daid $51 for postage expenses. 28 The fund had $21.72 remaining in the petty cashbox. Sorted the petty cash receipts by accounts affected and exchanged them for a check to reimburse the fund for expenditures. 28 The petty cash fund amount in inereased by $70 to a total of $410. Required: 1. Prepare the journal entry to establish the petty cash fund. 2. Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense, merchandise inventory (for transportation-in), and office supplies expense. 3. Prepare the journal entries for required 2 to both (a) reimburse and (b) increase the fund amount.

Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to account for merchandise inventory. reb. 2 Wrote a $340 check to establish a petty cash fund. 5 Purchased paper for the copier for $15.35 that is immediately used. 9 Paid $34.50 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point. These costs are added to merchandise inventory. 12 Paid $8.35 pontage to deliver a contract to a client. 14 Reimbursed Adina Sharon, the manager, $75 for mileage on her car. 20 Purchased office paper for $67.77 that is immediately used. 23 Paid a courier $16 to deliver merchandise sold to a customer, terms POB destination. 25 Paid $11.80 shipping charges (transportation-in) on merchandise purchased for resale, terns FOB shipping point. These costs are added to merchandise inventory. 27 Daid $51 for postage expenses. 28 The fund had $21.72 remaining in the petty cashbox. Sorted the petty cash receipts by accounts affected and exchanged them for a check to reimburse the fund for expenditures. 28 The petty cash fund amount in inereased by $70 to a total of $410. Required: 1. Prepare the journal entry to establish the petty cash fund. 2. Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense, merchandise inventory (for transportation-in), and office supplies expense. 3. Prepare the journal entries for required 2 to both (a) reimburse and (b) increase the fund amount.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter5: Cash Control Systems

Section: Chapter Questions

Problem 4AP

Related questions

Question

100%

Transcribed Image Text:Nakashima Gallery had the following petty cash transactions in February of the current year. Nakashima uses the perpetual system to

account for merchandise inventory.

2 Mrote a 5340 check to establish a petty cash fund.

5 Purchased paper for the copier for $15.35 that is immediately used.

9 Paid $34.50 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point.

These costs are added to merchandise inventory.

12 Paid $8.35 postage to deliver a contract to a client.

14 Reimbursed Adina Sharon, the manager, $75 tor mileage on her car.

20 Purchased office paper for $67.77 that is immediately used.

23 Paid a courier $16 to deliver merchandise sold to a customer, terms POB destination.

25 Paid $11.80 shipping charges (transportation-in) on merchandise purchased for resale, terms FOB shipping point.

These costs are added to merchandise inventory.

27 Paid $51 for postage expenses.

28 The fund had $21.72 remaining in the petty cashbox. Sorted the petty cash receipts by accounts affected and

exchanged them for a check to reimburse the fund for expenditures.

28 The petty cash fund amount in inereased by $70 to a total of $410.

Teb.

Required:

1. Prepare the journal entry to establish the petty cash fund.

2. Prepare a petty cash payments report for February with these categories: delivery expense, mileage expense, postage expense,

merchandise inventory (for transportation-in), and office supplies expense.

3. Prepare the journal entries for required 2 to both (a) reimburse and (b) increase the fund amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning