Nakeeta company owned 50,000 ordinary shares which were purchased for P120 per share. During the year, the investee distributed 50,000 stock rights to the investor. The investor was entitled to buy one new share for P90 cash and two of these rights. Each share had a market value of P130, and each righ had a market value of P20 on the date of issue. What amount should be debited to the investmen account upon exercise of the share rights if the rights were not accounted for separately? O 2,250,000 O 3,250,000 O 3,050,000 5,500,000

Nakeeta company owned 50,000 ordinary shares which were purchased for P120 per share. During the year, the investee distributed 50,000 stock rights to the investor. The investor was entitled to buy one new share for P90 cash and two of these rights. Each share had a market value of P130, and each righ had a market value of P20 on the date of issue. What amount should be debited to the investmen account upon exercise of the share rights if the rights were not accounted for separately? O 2,250,000 O 3,250,000 O 3,050,000 5,500,000

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter13: Corporations: Earning & Profits And Distributions

Section: Chapter Questions

Problem 31P

Related questions

Question

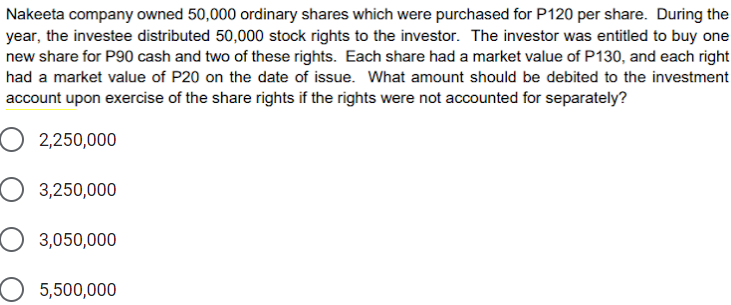

Transcribed Image Text:Nakeeta company owned 50,000 ordinary shares which were purchased for P120 per share. During the

year, the investee distributed 50,000 stock rights to the investor. The investor was entitled to buy one

new share for P90 cash and two of these rights. Each share had a market value of P130, and each right

had a market value of P20 on the date of issue. What amount should be debited to the investment

account upon exercise of the share rights if the rights were not accounted for separately?

2,250,000

3,250,000

3,050,000

5,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College