Question 2 The balances in the accounts of Forrest Ltd at 30 June 2021 and 30 June 20 2021 ($) 2022 ($)

Question 2 The balances in the accounts of Forrest Ltd at 30 June 2021 and 30 June 20 2021 ($) 2022 ($)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 21E: (Appendix 21.1) Visual Inspection The following changes in account balances were taken from Walson...

Related questions

Question

Transcribed Image Text:Question 2

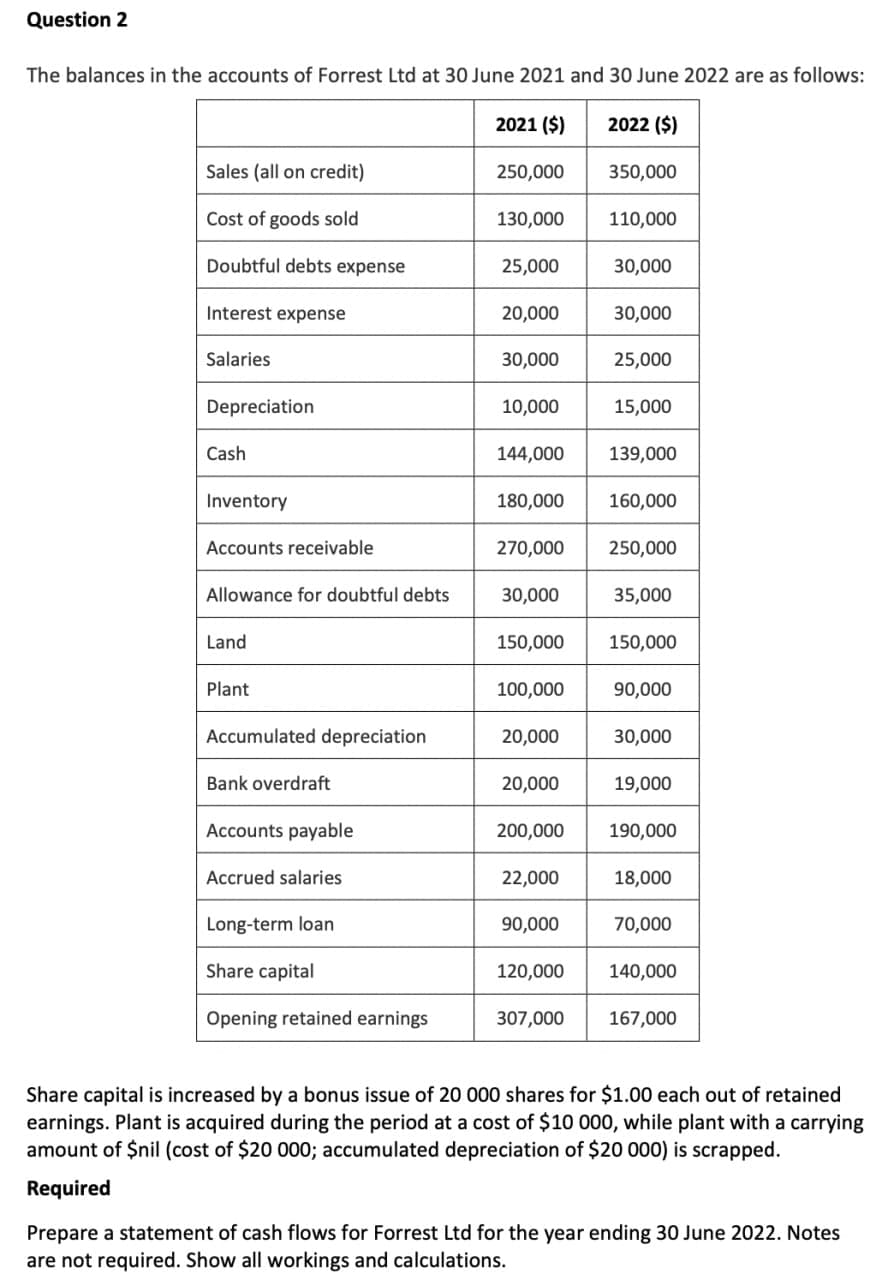

The balances in the accounts of Forrest Ltd at 30 June 2021 and 30 June 2022 are as follows:

2021 ($)

2022 ($)

Sales (all on credit)

250,000

350,000

Cost of goods sold

130,000

110,000

Doubtful debts expense

25,000

30,000

Interest expense

20,000

30,000

Salaries

30,000

25,000

Depreciation

10,000

15,000

Cash

144,000

139,000

Inventory

180,000

160,000

Accounts receivable

270,000

250,000

Allowance for doubtful debts

30,000

35,000

Land

150,000

150,000

Plant

100,000

90,000

Accumulated depreciation

20,000

30,000

Bank overdraft

20,000

19,000

Accounts payable

200,000

190,000

Accrued salaries

22,000

18,000

Long-term loan

90,000

70,000

Share capital

120,000

140,000

Opening retained earnings

307,000

167,000

Share capital is increased by a bonus issue of 20 000 shares for $1.00 each out of retained

earnings. Plant is acquired during the period at a cost of $10 000, while plant with a carrying

amount of $nil (cost of $20 000; accumulated depreciation of $20 000) is scrapped.

Required

Prepare a statement of cash flows for Forrest Ltd for the year ending 30 June 2022. Notes

are not required. Show all workings and calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning