nas Tollowi

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter10: Auditing Cash, Marketable Securities, And Complex Financial Instruments

Section: Chapter Questions

Problem 31CYBK

Related questions

Question

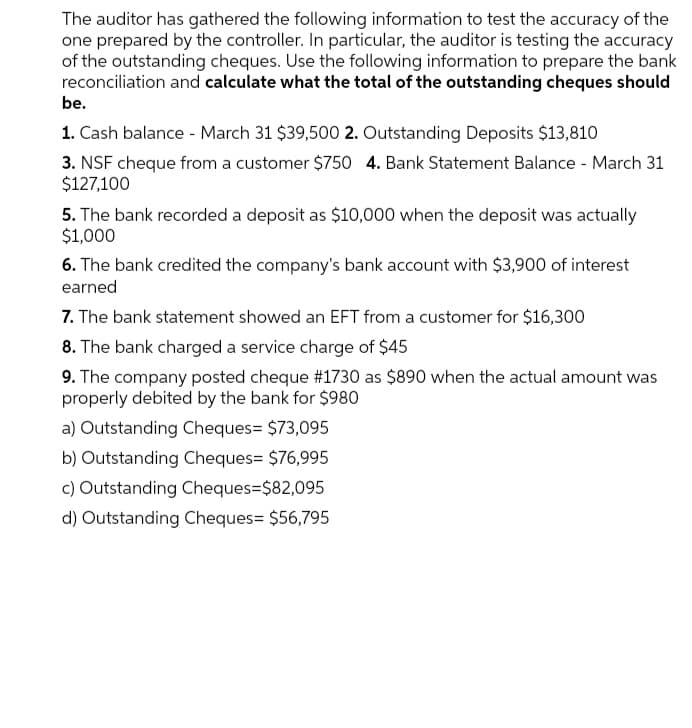

Transcribed Image Text:The auditor has gathered the following information to test the accuracy of the

one prepared by the controller. In particular, the auditor is testing the accuracy

of the outstanding cheques. Use the following information to prepare the bank

reconciliation and calculate what the total of the outstanding cheques should

be.

1. Cash balance - March 31 $39,500 2. Outstanding Deposits $13,810

3. NSF cheque from a customer $750 4. Bank Statement Balance - March 31

$127,100

5. The bank recorded a deposit as $10,000 when the deposit was actually

$1,000

6. The bank credited the company's bank account with $3,900 of interest

earned

7. The bank statement showed an EFT from a customer for $16,300

8. The bank charged a service charge of $45

9. The company posted cheque #1730 as $890 when the actual amount was

properly debited by the bank for $980

a) Outstanding Cheques= $73,095

b) Outstanding Cheques= $76,995

c) Outstanding Cheques=$82,095

d) Outstanding Cheques= $56,795

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,