Natalia makes colorful beaded necklaces and sells them at a local farmer's market. Natalia currently sells her necklaces for $40 each. She spends approximately $18 on the materials (beads, wire, and clasp) and $2 on packaging for each necklace. She pays annual fixed costs of $4,180 ($3,500 for space at the farmer's market, $180 for licenses and permits, and $500 annual depreciation on tent, display cases, and signage). a) How many necklaces does Natalia need to sell in 2021 to break even? 209 necklaces b) How many necklaces does Natalia need to sell in 2021 to earn a profit of $25,000? 1,459 necklaces c) Natalia's best guess is that she will sell 1,500 necklaces in 2021. If she's correct, what is Natalia's expected 2021 profit? $25,820 d) Natalia estimates that if she reduces her selling price by 15% in 2021, she will sell 20% more necklaces. What is Natalia's expected profit if she reduces her selling price by 15%? Natalia estimates that if she instead increases her selling price by 15% in 2021, she will sell 10% fewer necklaces. What is Natalia's expected profit if she instead increases her selling price by 15%? These analyses suggest that a selling price of $ per necklace maximizes expected profit. e) Natalia learns that the fee to rent a space at the farmer's market will be $5,525 in 2022. Natalia wants to increase her selling price just enough to absorb this increased cost. If Natalia wants to earn the same profit in 2021 and 2022 and believes she will sell 1,350 units in both years, what does her per unit selling price need to be in 2022 to pass the increased space fee cost along to her customers? Assume that the necklaces' selling price was $46 in 2021 and that all costs other than the space rental fee are unchanged from 2021 to 2022.

Natalia makes colorful beaded necklaces and sells them at a local farmer's market. Natalia currently sells her necklaces for $40 each. She spends approximately $18 on the materials (beads, wire, and clasp) and $2 on packaging for each necklace. She pays annual fixed costs of $4,180 ($3,500 for space at the farmer's market, $180 for licenses and permits, and $500 annual depreciation on tent, display cases, and signage). a) How many necklaces does Natalia need to sell in 2021 to break even? 209 necklaces b) How many necklaces does Natalia need to sell in 2021 to earn a profit of $25,000? 1,459 necklaces c) Natalia's best guess is that she will sell 1,500 necklaces in 2021. If she's correct, what is Natalia's expected 2021 profit? $25,820 d) Natalia estimates that if she reduces her selling price by 15% in 2021, she will sell 20% more necklaces. What is Natalia's expected profit if she reduces her selling price by 15%? Natalia estimates that if she instead increases her selling price by 15% in 2021, she will sell 10% fewer necklaces. What is Natalia's expected profit if she instead increases her selling price by 15%? These analyses suggest that a selling price of $ per necklace maximizes expected profit. e) Natalia learns that the fee to rent a space at the farmer's market will be $5,525 in 2022. Natalia wants to increase her selling price just enough to absorb this increased cost. If Natalia wants to earn the same profit in 2021 and 2022 and believes she will sell 1,350 units in both years, what does her per unit selling price need to be in 2022 to pass the increased space fee cost along to her customers? Assume that the necklaces' selling price was $46 in 2021 and that all costs other than the space rental fee are unchanged from 2021 to 2022.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter6: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 1PA: Classify costs Seymour Clothing Co. manufactures a variety of clothing types for distribution to...

Related questions

Question

parts d, e

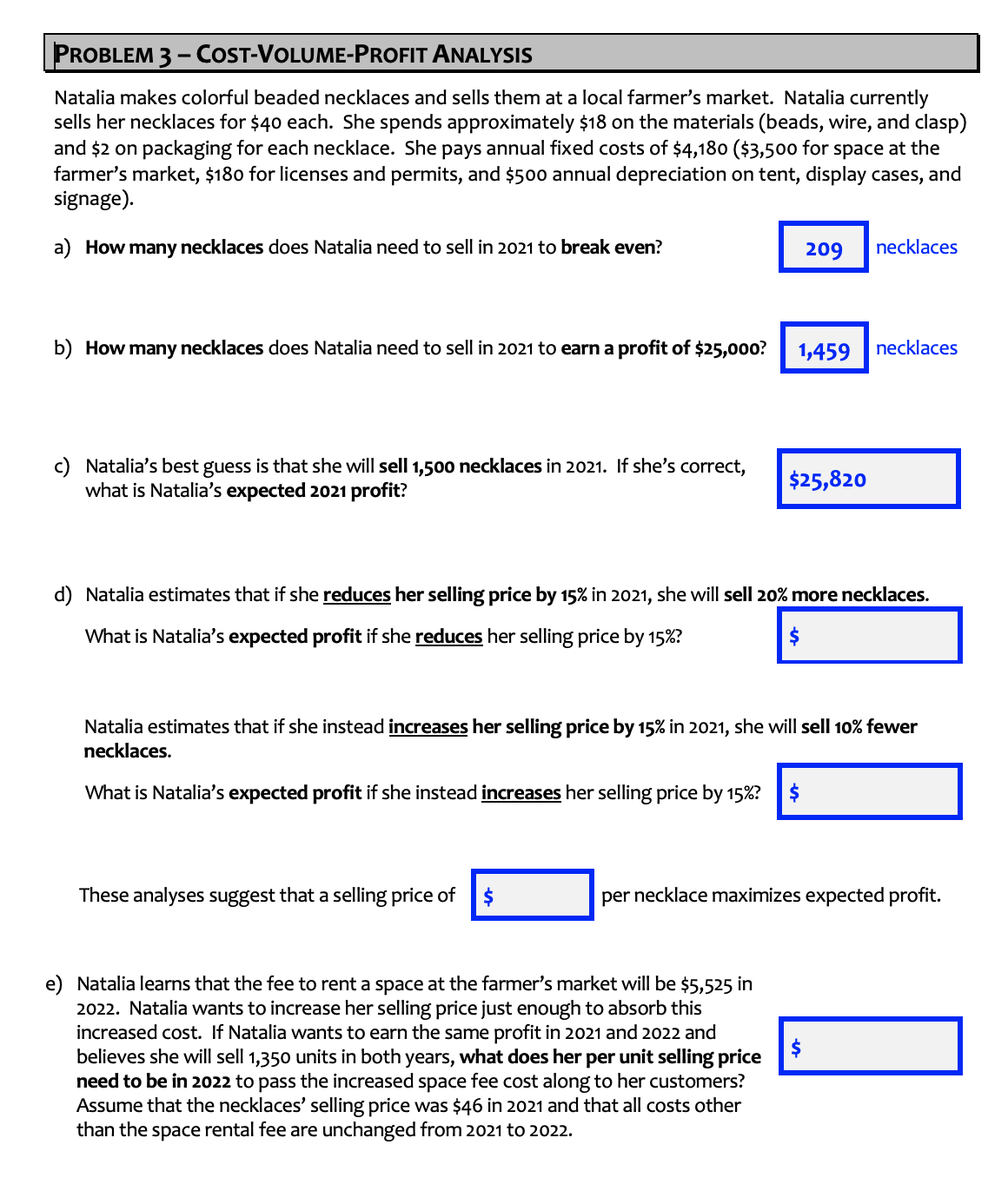

Transcribed Image Text:PROBLEM 3 - COST-VOLUME-PROFIT ANALYSIS

Natalia makes colorful beaded necklaces and sells them at a local farmer's market. Natalia currently

sells her necklaces for $40 each. She spends approximately $18 on the materials (beads, wire, and clasp)

and $2 on packaging for each necklace. She pays annual fixed costs of $4,180 ($3,500 for space at the

farmer's market, $180 for licenses and permits, and $500 annual depreciation on tent, display cases, and

signage).

a) How many necklaces does Natalia need to sell in 2021 to break even?

209

necklaces

b) How many necklaces does Natalia need to sell in 2021 to earn a profit of $25,0o0?

1,459

necklaces

c) Natalia's best guess is that she will sell 1,500 necklaces in 2021. If she's correct,

what is Natalia's expected 2021 profit?

$25,820

d) Natalia estimates that if she reduces her selling price by 15% in 2021, she will sell 20% more necklaces.

What is Natalia's expected profit if she reduces her selling price by 15%?

Natalia estimates that if she instead increases her selling price by 15% in 2021, she will sell 10% fewer

necklaces.

What is Natalia's expected profit if she instead increases her selling price by 15%?

These analyses suggest that a selling price of $

per necklace maximizes expected profit.

e) Natalia learns that the fee to rent a space at the farmer's market will be $5,525 in

2022. Natalia wants to increase her selling price just enough to absorb this

increased cost. If Natalia wants to earn the same profit in 2021 and 2022 and

believes she will sell 1,350 units in both years, what does her per unit selling price

need to be in 2022 to pass the increased space fee cost along to her customers?

Assume that the necklaces' selling price was $46 in 2021 and that all costs other

than the space rental fee are unchanged from 2021 to 2022.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning