Q: West Asset Management Inc. purchased a stock at $78.26 per share at the beginning of the year and he...

A: Investors invest in various securities to gain returns from the investment. This may be in the form ...

Q: Expected returns and standard deviations of three risky assets are as follows: Expected Return St...

A: Portfolio is the investment basket where several assets like bonds, securities and real assets like ...

Q: INSTRUCTIONS: PLEASE ATTACH A CASH FLOW DIAGRAM AND PROVIDE COMPLETE SOLUTION. Dan took a loan of P5...

A: We know, amount payable at the end = Amount of loan taken x (1+r) ^t where r= periodic interest rate...

Q: Which of the following statements about budgeting is incorrect? a. Budgets provide direction and coo...

A: a ) Budgets provide direction and coordination. This statement is correct because budgeting hel...

Q: Find the firm’s Cost of equity, given only the following information about the firm: the firm’s cost...

A: The cost which the firm has to bear for having equity funds in their capital structure is called cos...

Q: You are considering investing $2,000 into the stock market. In the first 3 years, you are expecting ...

A: Before investing in new assets or projects, profitability of the project is evaluated by using vario...

Q: loan is offered with monthly payments and a 10 percent APR. What’s the loan’s effective annual rate ...

A: Effective Annual Rate = [(1+ Annual Periodic rate /n)n] -1 Annual Periods = 12 months

Q: GMC is growing quickly. Dividends are expected to grow at a rate of 6 percent for the next three yea...

A: Dividend: The dividends are the returns provided to the shareholders by the company. The dividends a...

Q: 1. Over the past year, your friend Maura has been saving up for an epic road trip to travel across t...

A: Sound Financial Decisions are those decisions which are taken or which exhibits strength in the area...

Q: Give 5 functions of the Securities Commission under section 15 of the Securities Commission Act (SCA...

A: The SCA was created on 1st March 1993. This commission is a statutory body funding its operations by...

Q: Plz solve it within 30-40 mins I'll give you multiple upvote

A: Note : None of the answers are given correct , so we are solving the correct one for you as per the ...

Q: Aaron contributed $2100 to his RRSP at the end of every half-year. What was the value of his RRSP af...

A: The worth of a present commodity at a date in the future predicated on an estimated rate of growth i...

Q: What is portfolio Management? Describe the steps involved in portfolio management?

A: Portfolio means a bunch of different assets or investments. To reduce the risk, investors invest the...

Q: Portfolio Manager, what kind of investments are you going to offer to a client who is just a beginne...

A: The portfolio manager is job to design the portfolio for client according to the need and risk profi...

Q: Plz solve it within 30-40 mins I'll give you multiple upvote

A: Note : All the Options mentioned along with the question are incorrect,so we are solving the correct...

Q: ariance of Bobsled Inc. is 2.5 and the variance of Luge Inc. is 1.6, in a market with a variance of ...

A: Expected return and variance of portfolio can be calculated from the weighted return of each stock i...

Q: Find the EAR in each of the following cases (Use 365 days a year. Do t round Intermediat calculation...

A: Effective Annual Rate (EAR): It is the real interest rate taking into account the effects of compoun...

Q: From http://finance_yahoo.com/ the following current financial information for Apple Inc (AAPL), in...

A:

Q: a) Explain the term 'annuity'. b) What is meant by 'investment appraisal? c) Explain the term 'usefu...

A: As you have asked a question with multiple parts, we will solve the first 3 parts as per the policy ...

Q: Consider three stocks: Q, R and S Beta STD (annual) Forecast for Nov 2009 Dividend Stock Pr...

A:

Q: HOW DOES INTEREST RATE AFFECT THE FINANCIAL MARKET AND FINANCIAL INSTITUTIONS

A: Interest rate is the rate of interest which is charged on borrowings in the economy.

Q: Fashion Trends PH is seeking to borrow money to finance the development of its online retailing busi...

A: Present value of future value of money should be equal value of money today or more than that than o...

Q: Which of the following is true? Preferred dividends must paid first (assuming there is preferred sto...

A: The question is based on the understanding of payment to capital fund investors. The capital of a fi...

Q: Rank the following from highest present value to lowest present value. Assume they all have the same...

A: Lets assume that the rate of interest is 10% Lump sum - $1000 Time – 10 yrs r- 10% Present Value ...

Q: Ashely Corporation has 80 million outstanding equity shares and the following projected financial in...

A: We need to find the free cash flows in year 1 to 4 Cost of capital (c) = 13% Number of shares = 80 m...

Q: The cash-flow forecasta (in millions of dollara) for the project are as PS #1 Type B: You are a cons...

A:

Q: a. Use the Black-Scholes formula to find the value of the following call option. (Do not round inter...

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question s...

Q: 3 Outsourcing IT services has grown in popularity due to a variety of factors, according to you. Th...

A: Banking and financial sectors provide financial assistance to the companies or borrowers. It plays a...

Q: What is the January effect? Is this an anomaly or is there a rational explanation?

A: In the world of finance in general and investments in particular 'January effect' is a theoretical p...

Q: Which of the following is correct about the security market line (SML)? Investment projects that plo...

A: Security market line is the graphical representation of the values of stock against the risk relativ...

Q: customer? Compute your answer to the nearest penny.

A: Customer Lifetime Value (CLV): It represents the value contributed by the customer to the business ...

Q: Panyaroad Plc has just paid a dividend of USD 8 per share. The market value of share is USD 93. The ...

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question...

Q: 20 nsidering to invest in a vibratory finishing machine. The i s $3,000, and has a useful life of 8 ...

A:

Q: Upon further investigation, you have found that the amount of account payables for Companies A and X...

A: Ratio is a tool to measure the growth and performance of the company by establishing the relations b...

Q: Which of the following is a type of captive formed to write most types of liability insurance covera...

A: A captive insurance firm is a special arrangement for insurance, which is a subsidiary insurer to mi...

Q: An instructor plans to retire in exactly one year and want an account that will pay him P25,000 a y...

A: The instructor is planning to retire in one year and wants to get P25000 each year for 15 years. The...

Q: It is November 2019. The following variance -covariance matrix, for the market (S&P 500) and stocks ...

A: Alpha on a stock is the return over an above the minimum expected rate of return. A positive alpha m...

Q: Jo sportswear company needs someone to supply it with 4,000 tons of cotton cloth per year to support...

A: The lowest bid: The lowest bid price is the selling price that will earn the lowest required rate of...

Q: Rank the following from highest present value to lowest present value. A payment of $5000 to be rece...

A: Option 1. Payment of 5000 N = 5 Option 2. Payment of 5000 N = 2 Option 3. Payment of 2000 in 1 y...

Q: In 300 words describe what the one-year principle is?

A: Since you have posted a multiple question, we will be solving the first question as per our guidelin...

Q: Shahrul is considering an investment that will generate cash flows of RM800 in the first year, RM500...

A: Interest rate = 10% Year Cash flow 1 800 2 500 3 400 4 700

Q: 2013 2012 Revenues 3 751 331 021 3 430 700 496 Cost of Sales 3 067 218 589 2 799 747 640 Gross Profi...

A: a. Calculate the return on equity (ROE) in 2013 by dividing the net income by the average total equi...

Q: What are the upper and lower bounds for these projections?

A: Revenue: It is the amount received from the firm's normal operations. Revenue involves the sale of ...

Q: The Hartnett Corporation manufactures baseball bats with Pudge Rodriguez’s autograph stamped on them...

A: Selling price = $25 Variable cost = $14 Fixed cost = $25850

Q: arlo 1! you want to purchase a new vehicle and you have your heart set on a brand-new SUV. you take ...

A: Introduction : A credit score can be understood as the numerical expression that represents an indiv...

Q: I need help

A: Present Value(PV) refers to value of sum at current date which would be received or paid in future t...

Q: So: X LAssignments: 22S-F x 6 Question 6 - Exam 2 x b Login | bartleby Q FIN 3 A ezto.mheducation.co...

A: Expected Return is the amount of profit or gain that can be expected by the investor on the basis of...

Q: four employer has offered to contribute $50 a week to your retirement savings account. Assume you wo...

A: There is more compounding the more is effective rate and more is effective rate and less is the pres...

Q: The plan was to leave $8,000 on deposit in a savings account for 15 years at 7.5% interest compounde...

A: Deposit amount now (D) = $8000 Interest rate (r) = 7.5% Withdrawal after 5 years (W) = $2000 Period ...

Q: Is there a reason to pick one over the other? Which formula would apply to a certain company or scen...

A: The FCFF formulae: All the four formulae provided above are used to find the FCFF. However the infor...

Step by step

Solved in 4 steps

- Your client is shocked at how much risk Blandy stock has and would like to reduce the level of risk. You suggest that the client sell 25% of the Blandy stock and create a portfolio with 75% Blandy stock and 25% in the high-risk Gourmange stock. How do you suppose the client will react to replacing some of the Blandy stock with high-risk stock? Show the client what the proposed portfolio return would have been in each year of the sample. Then calculate the average return and standard deviation using the portfolios annual returns. How does the risk of this two-stock portfolio compare with the risk of the individual stocks if they were held in isolation?APT An analyst has modeled the stock of Crisp Trucking using a two-factor APT model. The risk-free rate is 6%, the expected return on the first factor (r1) is 12%, and the expected return on the second factor (r2) is 8%. If bi1 = 0.7 and bi2 = 0.9, what is Crisp’s required return?Expected return and standard of a risky portfolio are 11% and 21% respectively. Risk-free rate is 5%. Mr. Yen constructed a complete portfolio with these two assets, which maximises his utility. If the standard deviation of his complete portfolio is 15.75%, what is the value of Mr. Yen’s risk aversion coefficient? (You must show all necessary workings)

- Give typing answer with explanation and conclusion Assume that your client would prefer to invest her entire wealth into a portfolio with an annual risk premium of 6% and a standard deviation of 12%. You have constructed a risky portfolio with an expected return of 10% and a standard deviation of 15%. T-Bills are currently yielding 4%. What is the optimal allocation, y, to the risky portfolio given your client's risk preferences? What is the expected return and standard deviation on your client's optimal complete portfolio?Drew can design a risky portfolio based on two risky assets, Origami and Gamiori. Origami has an expected return of 13% and a standard deviation of 20%. Gamiori has an expected return of 6% and a standard deviation of 10%. The correlation coefficient between the returns of Origami and Gamiori is 0.30. The risk-free rate of return is 2%. What is the Sharpe ratio of the optimal risky portfolio? A. 60.26% B. 12.19% C. 9.34% D. 47.78%If your portfolio includes 35 percent of X, 40 percent of Y and 25 percent of Z, answer the following questions: (a) Calculate the portfolio expected return. (b) Calculate the variance and the standard deviation of the portfolio. (c) If the expected T-bill rate is 3.80 percent, calculate the expected risk premium on the portfolio. (d) If the market index fund has the same expected return as your portfolio, without considering any transaction cost, would you consider selling your portfolio and investing the market index fund instead? Explain your thoughts.

- You manage a risky portfolio with an expected rate of return of 19% and a standard deviation of 30%. The T-bill rate is 4%. Your client chooses to invest 75% of a portfolio in your fund and 25% in a T-bill money market fund. What is the reward-to-volatility (Sharpe) ratio (S) of your risky portfolio? Your client’s? (Do not round intermediate calculations. Round your answers to 4 decimal places.)You manage a risky portfolio with expected rate of return of 18% and standard deviation of 28%. The T-bill rate is 8%. a. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. What is the expected value and standard deviation of the rate of return on his portfolio? b. What is the reward-to-volatility ratio (S) of your risky portfolio? Your client’s? c. Draw the CAL of your portfolio on an expected return–standard deviation diagram. What is the slope of the CAL? Show the position of your client on your fund’s CAL. d. Suppose that your client decides to invest in your portfolio a proportion y of the total investment budget so that the overall portfolio will have an expected rate of return of 16%. What is the proportion y? What is the standard deviation of the rate of return on your client’s portfolio? e. Suppose that your client prefers to invest in your fund a proportion y that maximizes the expected return on the complete portfolio subject…Assume that you manage a risky portfolio with an expected rate of return of 15% and a standard deviation of 40%. The T-bill rate is 5% A client prefers to invest in your portfolio a proportion (y) that maximizes the expected return on the overall portfolio subject to the constraint that the overall portfolio's standard deviation will not exceed 30%. What is the investment proportion, y? What is the expected rate of return on the overall portfolio

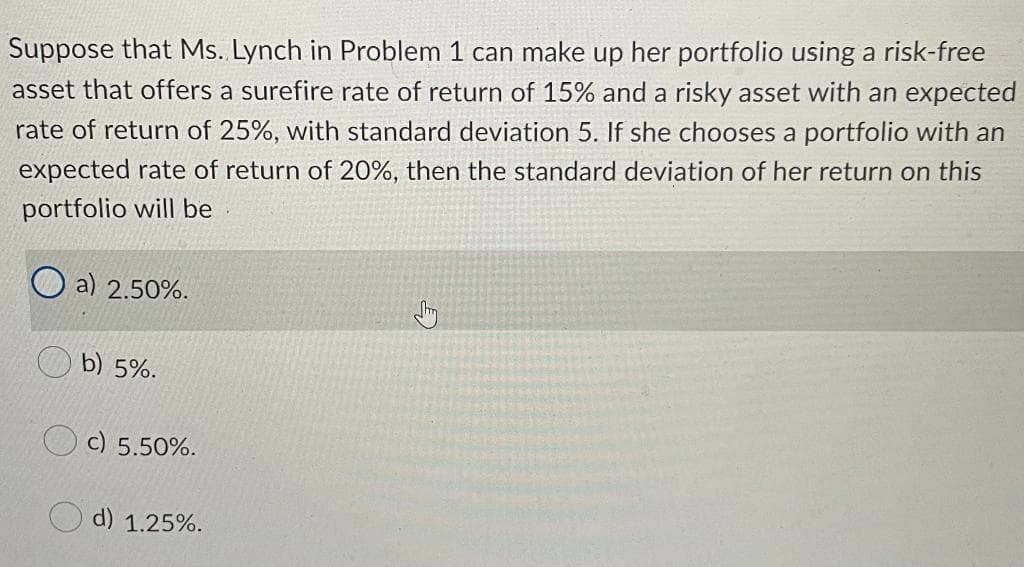

- Suppose that you have the following two opportunities from which to construct a complete portfolio: risk-free asset earning 2%, and a risky asset with expected return of 12% and standard deviation of 20%. If you construct a complete portfolio that has expected return of 5%, what is its standard deviation?You manage a risky portfolio with an expected return of 12% and a standard deviation of 24%. Assumethat you can invest and borrow at a risk-free rate of 3%, using T-bills. a) Draw the Capital Allocation Line (CAL) for this combination of risky portfolio and risk-free asset.What is the Sharpe ratio of the risky portfolio?b) Your client chooses to invest 50% of their funds into your risky portfolio and 50% risk-free. Whatis the expected return and standard deviation of the rate of return on their portfolio?An investor can design a complete portfolio based on a risky portfolio and a risk-free asset. The risky portfolio has an expected return of 10% and a standard deviation of 20%. Risk-free rate is 5%. If the investment weight on the risky portfolio is 70% and the weight on the risk-free asset is 30%, what is expected return and standard deviation of the complete portfolio?