nd loss shar

Q: Just like Accounts Receivable being recorded at gross with the Allowance for Doubtful Accounts in…

A: Solution Concept The books of accounts of partnership such as statement of financial position has…

Q: Posa Hotels, Inc., has a sixth night free policy. Every sixth night a guest stays at the hotel is…

A: A journal entry is getting used to file a commercial enterprise transaction in an organization's…

Q: 1. Based on the historical financial highlights extracted of statement of income and expenditure,…

A: Net asset value is calculated as the total assets less liabilities which represent the net asset…

Q: Select the correct statement regarding break-even point analysis. Multiple Choice O O The break-even…

A: The break-even point is that level of the unit where the company neither incurs any gain nor any…

Q: SHOW COMPUTATION AND SOLUTION An equipment cost P67,000 and has a life of 10 years and salvage…

A: Double Declining Depreciation Method In this method, depreciation is accelerated which counts as an…

Q: Task 1: Accounts receivable is the amount payable by the custome delivered and services provided.…

A: Bad Debts : Bad is the amount of accounts receivable which is certain that this shall not be…

Q: Jan 1 Bought new machineries worth P80.000 in account. Jan 3 Purchased P50,000 worth of computer…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: 1. Calculate the total direct materials variance and total direct labour variance, together with…

A:

Q: the absence of agreed profit distribution among partners, the most equitable way to distribute net…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: The FernRod Motorcycle Company invested $350,000 at 4.5% compounded monthly to be used for the…

A: Given information, Investment amount(P)=$350,000 Time(t)=5.5 years Compounded monthly (m)=12…

Q: Imagine you are an owner of a company. Listed below are your budgeted monthly unit sales sold at…

A: Sales budget shows expected level of sales revenue to be earned by the business. Cash collection…

Q: A company is considering an investment of €50.000 made at the beginning of the year for a period of…

A:

Q: Prepare Strange Things cash budget for the months of October, November, and December showing all…

A: Cash budget is one of the important budget that is being prepared in business and it shows expected…

Q: Short-term borrowing and investing transactions A local government operates on a calendar-year…

A: Borrowing by issue of notes will increase cash balance and increase liability

Q: Statement on Auditing Standards No. 99 (AU 316) includes which of these recommendations? Group of…

A: SAS no. 99 defines a procedure in which the auditor acquires data to find risks of significant…

Q: ABC Corporation reports on a calendar year. On August 15, 2020, it stopped business due to…

A: A tax year is an annual accounting period for paying taxes, keeping records and reporting income and…

Q: he college you are attending has a very busy canteen. Students are allowed to place and pay for…

A: Cash Management and Control: It is the system of managing the cash inflows and outflows. Cash…

Q: Carlo invested the following in the partnership being formed with Jamie: Cash of P60,000; . Land of…

A: A partnership's accounting is equal to that of a sole proprietor, with the difference that there are…

Q: Then, prepare the journal entry assuming the payment is made within 10 days (the discount period).

A: Formula: Net sales = Sales - discount where, Discount = Sales x discount rate

Q: ident citizen provid ar:

A: Income tax is the tax levied on the total income generated during the accounting period by the state…

Q: Required a) Explain, including calculations, how the issue of the bond would be accounted for by…

A: On 1st January 2021 Corgi Ltd. issued bonds of £5 million at par value, the bonds are redeemable on…

Q: 6. A machine costs $30 000 to purchase and $12 000 per year to operate. The machine has a 10-year…

A: Solution Equivalent annual worth method is used to determine the equivalent annual cost that is…

Q: required by law to provide the payer's name, address, & tax identification number on a separate…

A: Tax Return form are the formed which is been formed by the government to prepare the file the…

Q: Carlo and Jamie are partners who agreed that monthly salaries will be allowed to them as follows:…

A: Solution: As per question., Net Profit after tax: P580000 Annual salary of Carlo: Salary per month *…

Q: How much is the capital of A as of December 31 if net income for 2021 is ₱693,000?

A: The determination of Capital of A as of 31 December is shown hereunder. Net income for 2021 P…

Q: A firm has annual operating outlays of P1,800,000 and a cash conversion cycle of 60 days. If the…

A: Cash Conversion Cycle: The cash conversion cycle (CCC) is a statistic that represents the amount of…

Q: On May 1, 2022, Carlo and Jamie formed a partnership by contributing P500,000 each. In addition to…

A: The non cash assets invested by partners are recorded at fair market value.

Q: Nichols Enterprises has an investment in 31,500 bonds of Elliott Electronics that Nichols accounts…

A: Securities-available-for-sale represents the portion of investment made by the company with the…

Q: Exercise No. (7) prepare income sta Fixed Deposit Savings Deposit Current Account: Money at call and…

A: Balance Sheet- The balance sheet is a financial statement that shows an organization's assets,…

Q: Total production costs for Perth, Inc. are budgeted at £350,000 for 50,000 units of budgeted output…

A: solution concept when the mixed cost is given , it includes variable cost as well as fixed cost we…

Q: Carlo runs a butcher shop, Carlo Angus MNL, in Manila. Jamie, a close friend who lives in Makati,…

A: A partnership is a type of business that is run and controlled by two or more people who have agreed…

Q: Comparable balance sheets are presented below: Dec. 31, 2015 Dec. 31, 2014 Assets Cash 1.2 1.9…

A: As per the guidelines, only three sub-parts are allowed to be solved. Please resubmit the question…

Q: Which of the following is NOT true about the statement of financial position of a partnership? The…

A: Assets Contribution in the Partnership Firm: If a partner contribute assets rather than cash to the…

Q: Matthew's investment in her savings account matured to $5,892.79 at the end of 80 days. If the…

A: Simple interest is that form of interest under which interest is only charged on the principal…

Q: The Accounting Cycle of a Partnership and sole proprietorship are generally similar EXCEPT for: O…

A: Accounting cycle is the sequence which is used for maintaining the books the accounts.

Q: and E of c

A: Inventory management is the process of planning, monitoring, and controlling the movement of…

Q: On May 1, 2022, Carlo and Jamie formed a partnership by contributing P500,000 each. addition to…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: In a store that sells souvenirs, suppose an agent receives a $1 commission for each unit sold, and…

A: Agent is appointed by the principal in order to sell the goods. for selling the certain percentage…

Q: select all that applies) Group of answer choices a) will never make an investment with a risk-free…

A: risk loving person who are seeking to take additional risky order to earn higher returns as well as…

Q: , the Chairman of a small local company, recently bought a motor van for GH₵15,000 on 1st January,…

A: The answer has been mentioned below.

Q: Accounting Carlo invested the following in the partnership being formed with Jamie: • Cash of…

A: Partnership is one of the agreement or arrangement between two or more than two persons, in which…

Q: The following information relates to Donna Corporation for the last year. Donna uses direct labor…

A: Overhead means all type of indirect costs being incurred in business. These costs can not be…

Q: Posa Hotels, Inc., has a sixth night free policy. Every sixth night a guest stays at the hotel is…

A: Introduction: Revenue recognition conditions are the criteria under which a company can recognize a…

Q: Carlo and Jamie are partners who agreed that monthly salaries will be allowed to them as follows:…

A: A partnership is a kind of business structure in which two or more people agree to carry out…

Q: 12% Travel allowance- 2000 Insurance - 2500 Incentive- 75% target completion Pf 12%

A: The salary slip is given as,

Q: Problem 8. Persian Corporation is planning to introduce changes in its collection procedures. The…

A: 1. Option C . 900000 Explanation : Total Budgeted Sales is P32,400,000 Average Accounts Receivable…

Q: Mary owns 5, 000 shares of stocks from Inter-Pacific Company. The shares were purchased at ₱47.45…

A: solution concept On sales of stock when selling price is greater than purchase price there is profit…

Q: How recording assets, liabilities, provisions and foreign exchange transactions in the books of…

A: Accounting is the process of documenting the financial transactions of a business. Accounting is the…

Q: 20X3 20X2 20X1 $178,400 115,e00 $162,500 102,500 Sales $155,500 Cost of goods sold Operating…

A: Common Size Imcome Statement A common size an income statement whereby each line item is expressed…

Q: Required: Income statement for the year ended 31 December 2020

A: Income statement refers to a statement which shows the revenue and expense of the company of a…

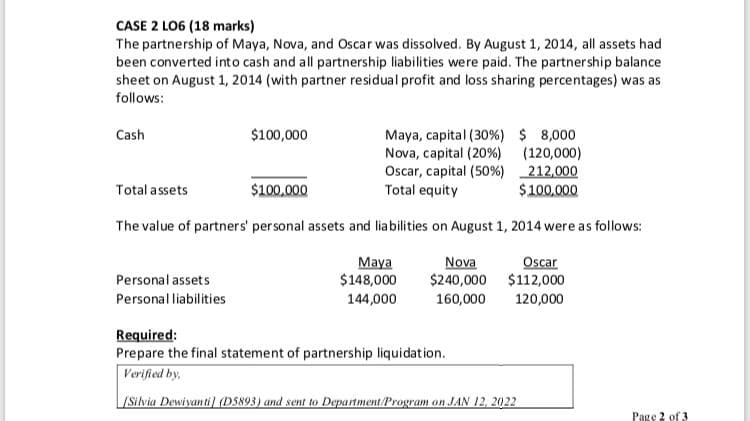

The

been converted into cash and all partnership liabilities were paid. The partnership balance

sheet on August 1, 2014 (with partner residual

follows:

Cash

$100,000

Maya, capital (30%) $ 8,000

Nova, capital (20%)

(120,000)

Oscar, capital (50%) 212,000

Total assets

$100,000

Total equity

$ 100,000

The value of partners' personal assets and liabilities on August 1, 2014 were as follows:

Maya

Nova

Oscar

Personal assets

$148,000 $240,000 $112,000

Personal liabilities

144,000

160,000

120,000

Required:

Prepare the final statement of partnership liquidation.

Step by step

Solved in 2 steps

- Chani contributes equipment to a partnership that she purchased 2 years ago for $10,000. The current book value is $7,500 and the market value is $9,000. At what value should the partnership record the equipment? A. $10,000 B. $9,000 C. $7,500 D. none of the aboveAA, BB and CC decided to liquidate the partnership on July 31, 2022. Their capital balances and profit ratio on this date follow: Capital Balances Profit Ratio AA P56,000 45% BB 72,000 25% CC 32,000 30% The net income from January 1to July 31, 2022 is P12,000. Also, on this date, cash and liabilities are P42,000 and P58,000 respectively. CC received P41,600 in full settlement of his interest in the firm. How much did AA receive?#410 On September 30, 2021, Lopez admits Mendez for an interest in his business. On this date, Lopez's capital account showed a balance of P158,400. The following were agreed upon before the formation of the partnership: Prepaid expenses of P17,500 and accrued expenses of P5,000 are to be recognized 5% of the outstanding accounts receivable of Lopez amounting to P100,000 is to be recognized as uncollectibles. Mendez is to be credited with a one-third interest in the partnership and is to investment cash for that interest. How much cash should be invested by Mendez?

- B1,B2,B3 are partners with average capital balances during 2021 of P945,000 P477 300 and P324,700, respectively. The partners received 10% interest on their average capital balances salaries of P244 650 to B1 and P165 250 to B3: any residual profit or loss is divided equally In 2021, the partnership had a net loss of P251,248 before the interest and salaries to partners What is the change in the capital balances of B1? Place a parenthesis if your answer is a decrease*E12-13B S. Heerey, E. Jenks, and N. Garland have capital balances of $60,000, $50,000, and $45,000, respectively. Their income ratios are 4 : 3 : 3. Garland withdraws from the partnership under each of the following independent conditions. 1. Heerey and Jenks agree to purchase Garland’s equity by paying $25,000 each from their personal assets. Each purchaser receives 50% of Garland’s equity. 2. Jenks agrees to purchase all of Garland’s equity by paying $33,000 cash from her personal assets. 3. Heerey agrees to purchase all of Garland’s equity by paying $38,000 cash from her personal assets. Instructions Journalize Garland’s withdrawal under each of the assumptions above.DD, EP. and FF decided to dissolve the partnership on July 31, 2021. Their capital balances and profit ratio on this date follow: DD, 33,600 (45%); EE, 43,200 (25%.); FF, 19,200 (30%), The net income from January 1 to luly 31, 2021 was P7,200. Also, on this date cash and liabilities were 25,200 and 34,800 respectively. FF received 24,960 In full settlement of his interest. 12. Which of the following statements is true? a. 115,200 was realized from sale of NCA b. DD recieved 42,240 in full settlement of his interest. c. 124,800 was the total distribution to outsiders and the partners. d. EE's share in the loss on realization was 3,000.

- A, B and C decided to dissolve their partnership on May 31, 2020. On this date their capital balances and profit sharing percent were as follows: A P150,000 40% B 180,000 30% C 60,000 30% The net income form January 1 to May 31, 2020 was P132,000. Also on May 31, 2020, the partnership cash and liabilities, respectively were P120,000 and P270,000. For A to receive P165,600 in full settlement of his interest in then partnership, how much must be realized from the sale of the partnership's non cash assets?#516 On December 31, 2020, ABC Partnership’s Statement of Financial Positions shows that A, B, and C have capital balances of P500,000, P300,000, and P200,000 with a profit and loss ratio of 1:3:6. On January 1, 2021, C retired from the partnership and received P350,000. At the time of C’s retirement, the assets of the partnership are undervalued and revaluation is necessary. What is the capital balance of B after the retirement of C? 375,000 537,500 525,000 562,500 What is the capital balance of A after the retirement of C? 537,500 525,000 562,500 375,0001. As of December 31, 2022, the books of AME Partnership showed capital balances of A, P40,000; M, P25,000; E P50,000. The partner’s profit and loss ratio was 3:2:1, respectively. The partners decided to liquidate and they sold all non-cash assets for P37,000. After settlement of all liabilities amounting to P12,000, they still have cash of P28,000 left for distribution. Assuming that any capital debit balance is uncollectible, the share of A in distribution of the P28,000 cash would be: A. P18,000 B. P0 C. P19,000 D. P17,800 2. Cloe, Doe and Lida are partners with capital balances on December 31, 2021 of P300,000, P300,000 and P200,000 respectively. Profits are shared equally. Lida wishes to withdraw and it is agreed that she is to take certain furniture and fixtures with second hand value of P50,000 which are carried on the books at P65,000. Brand new, the furniture and fixtures may cost, P80,000. How much is the value of the note that Lida will get from the…

- Judy, Jenelle, and Vanessa shared profit and losses based on 5:3:2. Vanessa was allowed to withdrew from the partnership on 31 December 2020 with P600,000 cash as full settlement. The condensed balance sheet of the partnership as of that date was as follows:AssetsDue from Vanessa P 250,000Goodwill 2,000,000Other Assets 4,750,000Total Assets P 7,000,000Liabilities and CapitalLiabilities P 2,000,000Due to Jenelle 750,000Judy, Capital 1,750,000 Jenelle, Capital 1,500,000Vanessa, Capital 1,000,000Total Liabilities and Capital P 7,000,000Using the partial adjustment of goodwill method, the new capital balances of the remaining partners after Vanessa’s withdrawal are:a. Judy, P1,842,750 and Jenelle, P1,556,250b. Judy, P1,375,000 and Jenelle, P1,275,000c. Judy, P2,000,000 and Jenelle, P1,650,000d. Judy, P1,750,000 and Jenelle, P1,500,0005. In January 1, 2009, partners AAA, BBB and CCC, who share profits and losses in the ratio of 5:3:2, respectively, decided to liquidate their partnership. On this date, the partnership’s condensed balance sheet was as follows: Cash P 50,000 Other assets 250,000 P 300,000 Liabilities P 60,000 AAA, capital 80,000 CCC, capital 90,000 BBB, capital 70,000 Total P 300,000 On June 15, 2009, the first cash sale of other assets with a carrying amount of P150,000 realized P120,000. Safe…On December 31, x2 the total partnership capital (assets less liabilities) for the Bird, Cage, and Dean partnership is P744,000.Selected information related to the preclosing capital balances is as follows: How much is the partnership net income during the year?a. P84,000b. P144,000c. P204,000d. P44,000