ne above 7. What is the adjusted cash in bank balance on December 31? 8. The net adjustment to cash as of December 31, 2010 would be a credit of: ion wite examination the C lige Cemp any presented to vOu Hbe fell nno

ne above 7. What is the adjusted cash in bank balance on December 31? 8. The net adjustment to cash as of December 31, 2010 would be a credit of: ion wite examination the C lige Cemp any presented to vOu Hbe fell nno

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 5PA

Related questions

Question

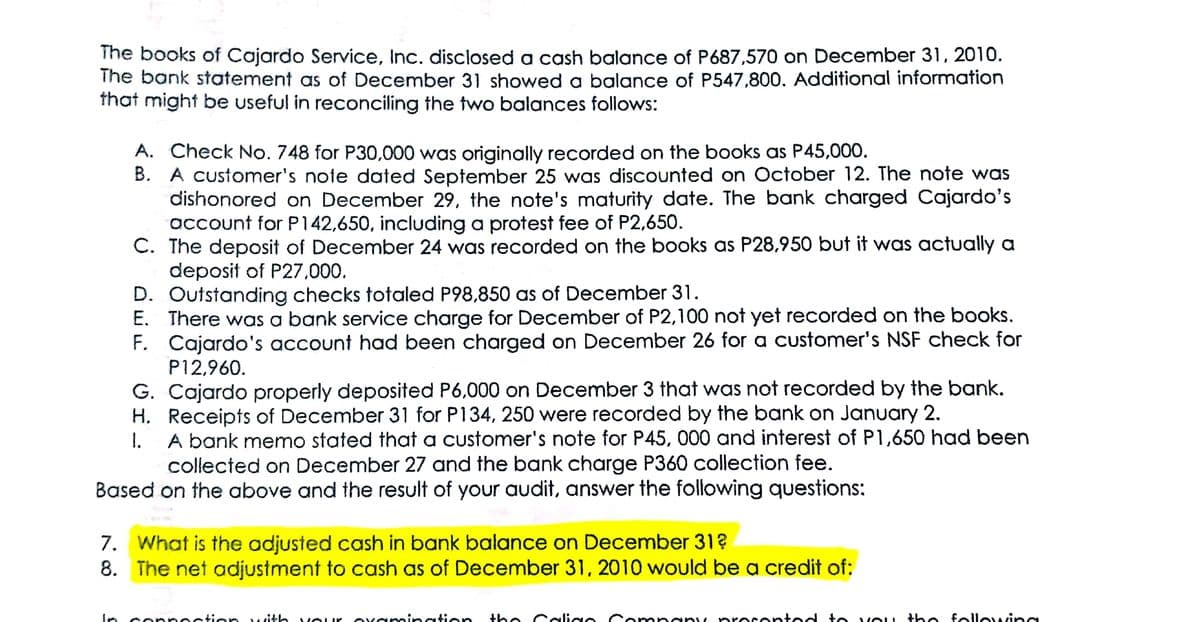

Transcribed Image Text:The books of Cajardo Service, Inc. disclosed a cash balance of P687,570 on December 31, 2010.

The bank statement as of December 31 showed a balance of P547,800. Additional information

that might be useful in reconciling the two balances follows:

A. Check No. 748 for P30,000 was originally recorded on the books as P45,000.

B. A customer's note dated September 25 was disCounted on October 12. The note was

dishonored on December 29, the note's maturity date. The bank charged Cajardo's

account for P142,650, including a protest fee of P2,650.

C. The deposit of December 24 was recorded on the books as P28,950 but it was actually a

deposit of P27,000.

D. Outstanding checks totaled P98,850 as of December 31.

E. There was a bank service charge for December of P2,100 not yet recorded on the books.

F. Cajardo's account had been charged on December 26 for a customer's NSF check for

P12,960.

G. Cajardo properly deposited P6,000 on December 3 that was not recorded by the bank.

H. Receipts of December 31 for P134, 250 were recorded by the bank on January 2.

1.

A bank memo stated that a customer's note for P45, 000 and interest of P1,650 had been

collected on December 27 and the bank charge P360 collection fee.

Based on the above and the result of your audit, answer the following questions:

7. What is the adjusted cash in bank balance on December 31 ?

8. The net adjustment to cash as of December 31, 2010 would be a credit of:

In

on with

VOur oramingtion

the Calige C ompany precenteo to vo u the following

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning