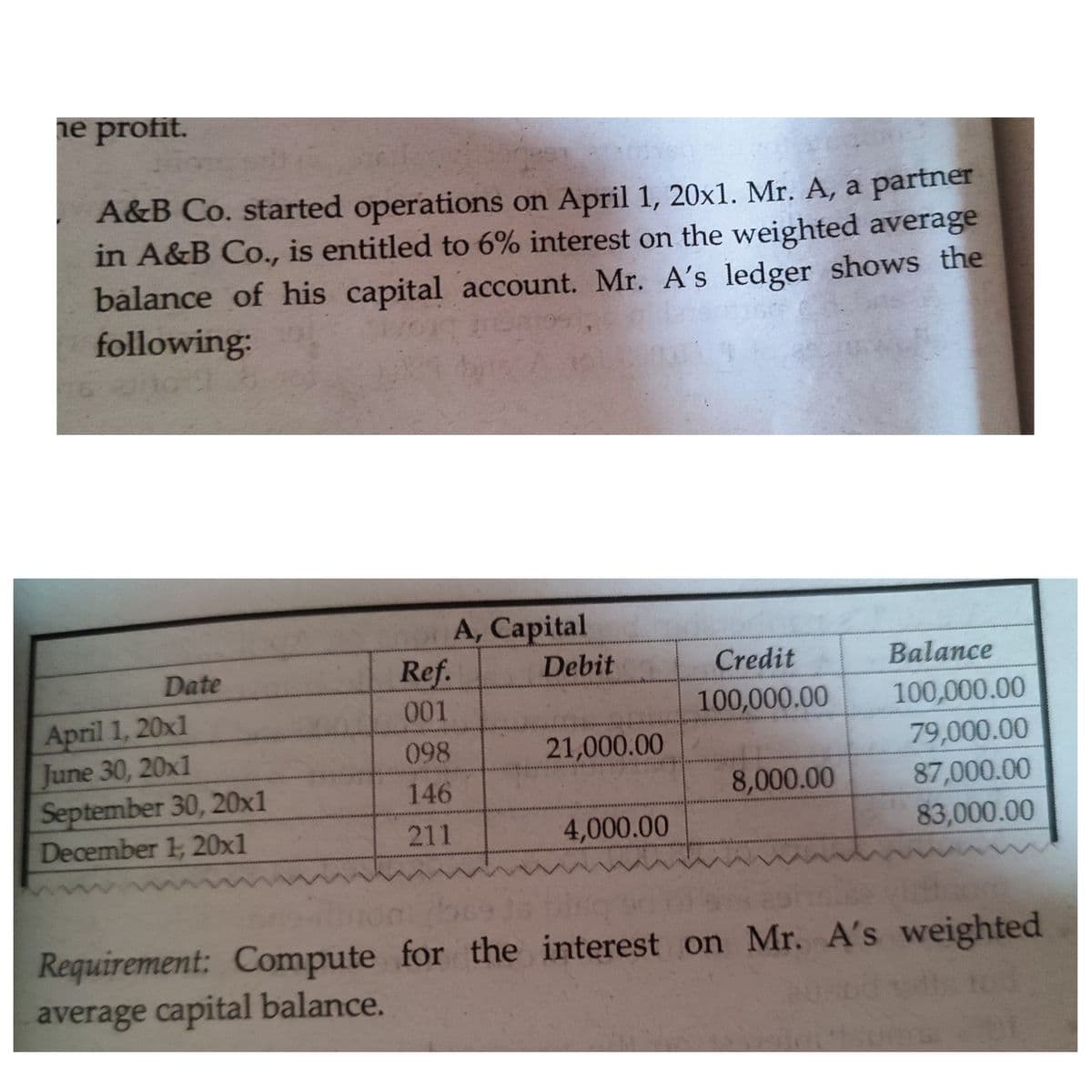

ne profit. A&B Co. started operations on April 1, 20x1. Mr. A, a partner in A&B Co., is entitled to 6% interest on the weighted average balance of his capital account. Mr. A's ledger shows the following: A, Capital Ref. Date Debit Credit Balance April 1, 20x1 June 30, 20x1 September 30, 20x1 December 1, 20x1 001 100,000.00 100,000.00 21,000.00 79,000.00 87,000.00 83,000.00 098 146 8,000.00 211 4,000.00 Requirement: Compute for the interest on Mr. A's weighted average capital balance.

ne profit. A&B Co. started operations on April 1, 20x1. Mr. A, a partner in A&B Co., is entitled to 6% interest on the weighted average balance of his capital account. Mr. A's ledger shows the following: A, Capital Ref. Date Debit Credit Balance April 1, 20x1 June 30, 20x1 September 30, 20x1 December 1, 20x1 001 100,000.00 100,000.00 21,000.00 79,000.00 87,000.00 83,000.00 098 146 8,000.00 211 4,000.00 Requirement: Compute for the interest on Mr. A's weighted average capital balance.

Chapter22: S Corporations

Section: Chapter Questions

Problem 23CE

Related questions

Question

question in the pic.

Transcribed Image Text:ne profit.

A&B Co. started operations on April 1, 20x1. Mr. A, a partner

in A&B Co., is entitled to 6% interest on the weighted average

balance of his capital account. Mr. A's ledger shows the

following:

A, Capital

Ref.

Date

Debit

Credit

Balance

100,000.00

79,000.00

87,000.00

001

100,000.00

April 1, 20x1

June 30, 20x1

September 30, 20x1

December 1, 20x1

(98

21,000.00

146

8,000.00

211

4,000.00

83,000.00

Requirement: Compute for the interest on Mr. A's weighted

average capital balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you