39) Pall, Inc, owns 40% of the outstanding stocs received a $4,000 cash dividend from Sibil. WE financial statements?

Q: fety Razor Company has a large tax-loss carry-forward and does not expect to pay taxes for another 1...

A: The lease agreement gives the right to use the equipment for the economic life of the equipment by p...

Q: Comparative Statements of Retained Earnings for Renn-Dever Corporation were reported as follows for ...

A: Earning per share can be calculated by dividing net income by total outstanding shares.

Q: On January 1, 2021, Kat Company has decided to raise additional capital by issuing P5,000,000 face a...

A:

Q: Problem 1 Use the following data to answer the question below about actual food and beverage costs f...

A: While calculating cost of sales we should reduce ending inventory cost.

Q: Bach Instruments Inc. makes three musical instruments: flutes, clarinets, and oboes. The budgeted fa...

A: Single plantwide overhead rate = Budgeted factory overhead costs / Total Budgeted direct labor hours...

Q: Rantzow-Lear Company buys and sells debt securities expecting to earn profits on short-term differen...

A: Bonds: Bonds indicate fixed-income financial instruments issued by Corporates, any government, and M...

Q: Ahmed & Co. makes and sells two types of shoes, Plain and Fancy. Data concerning these products are ...

A: Contribution per unit = Selling price - Variable cost

Q: An item of p- O True O False

A: Real property means any item which may be factored into the property value.

Q: Exercise 19-19 (Algo) EPS; stock dividend; nonconvertible preferred stock; treasury shares; shares s...

A: The correct answer for the above mentioned question is given in the following steps for your referen...

Q: Delta Oil Company uses the successful-efforts method to accout for oil exploration cost. Delta start...

A: Income statement- An income statement assists the company's management and board of directors in ana...

Q: For each transaction, (1) analyze the transaction using the accounting equation, (2) record the tran...

A: Assets=Liabilities+Equity

Q: ainbow, Inc. began operations on January 1 of the current year with a $12,800 cash balance. Fifty pe...

A: Solution: Collection from sales for the month of February = Jan sales collection + Feb sales collect...

Q: Ivanhoe Leasing Company agrees to lease equipment to Shamrock Corporation on January 1, 2020. The fo...

A: Journal Entries- Journal entries refer to the authorized book of a business which is used to record ...

Q: Mr. Allen is a 65-year-old Jamaican tax resident. He is the director of a hotel, Allen’s Rest Well R...

A: Considering Jamaica tax rates citizens who are aged more than or equal to 65 years are given an exem...

Q: Grateful Enterprises had the following income before tax provision and effective annual tax rate for...

A: The tax rate for : Quarter 1 = 30% Quarter 2 = 30% Quarter 3 = 25% Cumulative Income ( Quarter ) = C...

Q: whether it is included in a post-closing trial balance

A: Trial Balance is a list of accounts having balances. Post ...

Q: Using a statement of Cash flow for the year ended 31st December 2019, write a report to the Managing...

A: Statement of cash flow is the part of financial statements which is used to show the movement of cas...

Q: Problem 7 On January 1, 2012 Outlandish Company entered into a franchise agreement with Jollibee Com...

A: A franchise is acknowledged as a form of business where a particular organization provides a license...

Q: Sellers Construction Company purchased a compressor for $104,300 cash. It had an estimated useful li...

A: Every transaction which is of financial nature affects two or more sides of an accounting equation. ...

Q: On November 10, 2020, Singh Electronics began to buy and resell scanners for $58 each. Singh uses th...

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three sub...

Q: Fixed Cost per Month Cost per Car Washed Cleaning supplies $ 0.80 Electricity $ 1,200 $ 0.15 Maint...

A: Solution: Lavage Rapide Revenue and spending Variances For the month ended August 31 Partic...

Q: On March 1, 2021, Special Company paid P500,000 for the calendar year'sproperty taxes. Advertising c...

A: Income statement is that financial statement which shows all incomes and all expenses of the busines...

Q:

A: The full costing method is also known as absorption costing under this method all the manufacturing ...

Q: On January 1, 2021, PAPASA BA AKO Company purchased 5-year bonds with face value of P8,000,000 and s...

A: Present Value of Bond = Present Value of Coupon Payments + Present Value of Redemption Value Present...

Q: If total liabilities decreased by $28,055 during a period of time and stockholders' equity increased...

A: The business transactions effects two or more accounts of the business. As per accounting equation, ...

Q: Flint Corp. reported the following items on its June 30, 2020 trial balance and on its comparative t...

A: Marketable Securities: Marketable securities are characterized as any unlimited monetary instrument ...

Q: Dried Fruit Corp. has had a valid S Corp election in effect at all times since its incorporation. Th...

A: Given Dried fruit Corp distributed $264,000 to Raisin. Thus share of income he received from distrib...

Q: XYZ Co has two divisions, X and Y. Division X makes a component for washing machines which it can on...

A: Transfer price refers is acknowledged as the price at which one division of an organization transfer...

Q: A law firm collected $1,800 in advance for work to be performed in three months. Which of the follow...

A: The question says , Amount collected of $ 1800 Service to be performed in 3 months. Cash has been c...

Q: CBA Corporation was incorporated on January 1, 2020. The following equity-related transactions occur...

A: Stockholders' Equity Statement For the Year Ended December 31, 2020 Common Stock P 1 par Pa...

Q: Citrus Corporation is a calendar year S corporation with the following current year information: Ope...

A: As per IRS The operating loss that Grapefruit can deduct currently = 60% purchase price of citrus c...

Q: Below is the exercice and solutions but I don't understand the solution, for example the cash collec...

A: Cash budget is prepared keeping in mind the flow of cash in the firm or out of the firm considering ...

Q: Closet Company had the following information for the month of December. All direct materials were on...

A: Calculation of Total equivalent units for conversion under the FIFO method :-

Q: Big Trucks INC. is a company that provides car rental services. The company's fleet is mostly made u...

A: Replacement cost is the cost that is incurred by the company by replacing the old asset with the new...

Q: If a company purchases equipment costing $4,500 on credit, the effect on the accounting equation wou...

A: The question is related to the purchase of equipment on credit. The Accounting Equation is Assets =...

Q: Skor Twix $ 4,000 30,000 40,000 (20,000) 24,000 (44,000) Dots 72,000 24,000 (4,000) 10,000 14,000 (8...

A: Cash Flow from Operating Activities - Cash flow from Operating Activities includes all the operating...

Q: Problem 1. Mr. Amer started his Car Repair Business in Muscat in June 2020. During the month of June...

A: The financial statements of the business including income statement and balance sheet are prepared f...

Q: Mr. Allen is a 65-year-old Jamaican tax resident. He is the director of a hotel, Allen’s Rest Well ...

A: Solution Tax Return is an official form that you fill in with details about your income so that the ...

Q: . Great Products, Inc. reported the following on the company’s income statement in two recent years:...

A: Time Interest Earned Ratio: When a company's current revenue exceeds its debt commitments, the time ...

Q: Penbirch Electronics manufactures most of the components that make up its products. A company has ap...

A: When business has two alternatives one is to manufacture the product inside and other is to purchase...

Q: Which of the following would not be reported as inventory? Land acquired for resale by a real estate...

A: The correct option in the given question is (D) Machinery acquired by a manufacturing company for us...

Q: For each separate case below, follow the three-step process for adjusting the Accumulated Depreciati...

A: Since these are three separate cases ( independent of each other ) , we are allowed to do one of the...

Q: Two types of machine tools are available for performing certain manufacturing firm. The estimated co...

A:

Q: Assume a manufacturing company,s estimated sales for january,febuar and march are 1,00,000 , 1,20,00...

A: Cost of goods sold = Sales x 40% Purchases = Cost of goods sold + Desired ending inventory - Beginni...

Q: Which scenario would be considered the most favorable by shareholders of a company? Select one: a. T...

A: The net earnings after all debt obligations, tax paid to government and dividend paid to preference ...

Q: What is leasing? Explain the process of leasing’s Underwriting process of Tenants.

A: Lease can be defined as a right to use equipment or capital goods on payment of periodical amount kn...

Q: Jacaranda Builders is undertaking an analysis of supplier costs in order to evaluate the relative co...

A: The method or technique of costing which is used in those manufacturing units which are continuously...

Q: n, Inc. uses the high-low method to analyze cost behavior. The company observed that at 17,000 machi...

A: Solution; Variable cost per unit will be computed in this case through high low method. Then Fixed c...

Q: What is a tax consequence for a noncorporate shareholder who receives a liquidating distribution fro...

A: Under Sec. 331, a liquidating distribution is considered to be full payment in exchange for the shar...

Q: Chandler Company purchased a factory machinery on May 1, 2030 for $133,500 with an estimated 5- year...

A: Depreciation will be charged for only 8 months of usage in the Year 2030

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

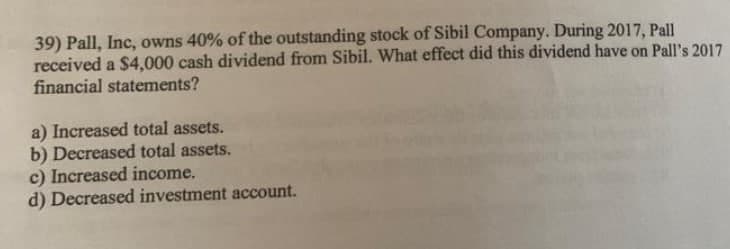

- On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic corporations in which the ownership percentage was 45 percent. Calculate the corporation's dividends received deduction for 2019. $_____________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $135,000. Calculate the corporation's dividends received deduction for 2019. $___________ Assume that instead of $210,000, Fisafolia Corporation has gross income from operations of $158,000. Calculate the corporation's dividends received deduction for 2019. $_____________Turner Company owns 40% of the outstanding stock of ICA Company. During the current year, ICA paid a $5 million cash dividend on its common shares. What effect did this dividend have on Turner’s 2016 financial statements? Explain the reasoning for this effect.

- Turner Company owns 40% of the outstanding stock of ICA Company. During the current year, ICA paid a $5million cash dividend on its common shares. What effect did this dividend have on Turner’s 2018 financial statements? Explain the reasoning for this effect.On December 31, 2016, Sannibel Company acquired a 20% interest in Edelweiss Company for $135,000. During 2017, Edelweiss had net income of $75,000 and paid a cash dividend of $30,000. If you applied the fair value method, what would be the debit balance in the Investment in Stock: Edelweiss Company account at the end of 2017?Superior Company owns 40% of the outstanding stock of Bernard Company. During 2016, Bernard paid a $100,000 cash dividend on its common shares. What effect did this dividend have on Superior’s 2016 financial statements?

- During the fourthquarter of 2018, Rainbarrel, Inc. generated excess cash, which the company invested in equitysecurities as follows:Nov 16 Purchased 1,200 common shares as an investment in equity securities,paying $6 per share. Rainbarrel owns less than 10% of the outstandingstock in the companies in which it invests.Dec 16 Received cash dividend of $0.35 per share on the equity securities.Dec 31 Adjusted the equity securities to fair value of $4 per share.2018Requirements1. Open T-accounts for Cash (including its beginning balance of $23,000), Investment inEquity Securities, Dividend Revenue, and Unrealized Gain (Loss) on Equity Securities.2. Journalize the foregoing transactions and post to the T-accounts.3. Show how to report the short-term investment on Rainbarrel’s balance sheet atDecember 31, 2018.4. Show how to report whatever should appear on Rainbarrel’s income statement for the yearended December 31, 2018.5. Rainbarrel sold the equity securities for $6,000 on January 14,…On July 1, 2015, Cleopatra Corporation acquired 25% of the shares of Marcus, Inc. for P1,000,000. At that date, the equity of Marcus was P4,000,000, with all the identifiable assets and liabilities being measured at amounts equal to fair value. The table below shows the profits and losses made by Marcus during 2015 to 2019: Year Profit (Loss) 2015 200,000 2016 2,000,000 2017 2,500,000 2018 160,000 2019 300,000 How much will the Investment in Associate account be debited/credited in 2018? Group of answer choices P1,060,000 Cr. P1,035,000 Cr. No entry P40,000 Dr.On July 1, 2015, Cleopatra Corporation acquired 25% of the shares of Marcus, Inc. for P1,000,000. At that date, the equity of Marcus was P4,000,000, with all the identifiable assets and liabilities being measured at amounts equal to fair value. The table below shows the profits and losses made by Marcus during 2015 to 2019: Year Profit (Loss) 2015 200,000 2016 2,000,000 2017 2,500,000 2018 160,000 2019 300,000 How much will the Investment in Associate account be debited/credited in 2018? Group of answer choices a. P40,000 Dr. b. No entry c. P1,035,000 Cr. d. P1,060,000 Cr.

- On July 1, 2015, Cleopatra Corporation acquired 25% of the shares of Marcus, Inc. for P1,000,000. At that date, the equity of Marcus was P4,000,000, with all the identifiable assets and liabilities being measured at amounts equal to fair value. The table below shows the profits and losses made by Marcus during 2015 to 2019: Year Profit (Loss) 2015 200,000 2016 2,000,000 2017 2,500,000 2018 160,000 2019 300,000 How much will the Investment in Associate account be debited/credited in 2018? a. P1,035,000 Cr. b. No entry c. P40,000 Dr. d. P1,060,000 Cr.On July 1, 2015, Cleopatra Corporation acquired 25% of the shares of Marcus, Inc. for P1,000,000. At that date, the equity of Marcus was P4,000,000, with all the identifiable assets and liabilities being measured at amounts equal to fair value. The table below shows the profits and losses made by Marcus during 2015 to 2019: Year Profit (Loss) 2015 200,000 2016 2,000,000 2017 2,500,000 2018 160,000 2019 300,000 How much will the Investment in Associate account be debited/credited in 2018? A. No entry B. 40,000 debit C. 1,035,000 credit D. 1,060,000 creditOn July 1, 2015, Cleopatra Corporation acquired 25% of the shares of Marcus, Inc. for P1,000,000. At the date, the equity of Marcus was P4,000,000. with all the identifiable assets and liabilities being measured at amounts equal to fair value. The table below shoes the profits and losses made by Marcus during 2015 to 2019: Year 2015 200,000 2016 2,000,000 2017 2,500,000 2018 160,000 2019 300,000 How much will the investment in associate account be debited/credited in 2018? A. 1,060,000 Cr B. No entry C. 40,000 Dr D. 1,035,000 Cr