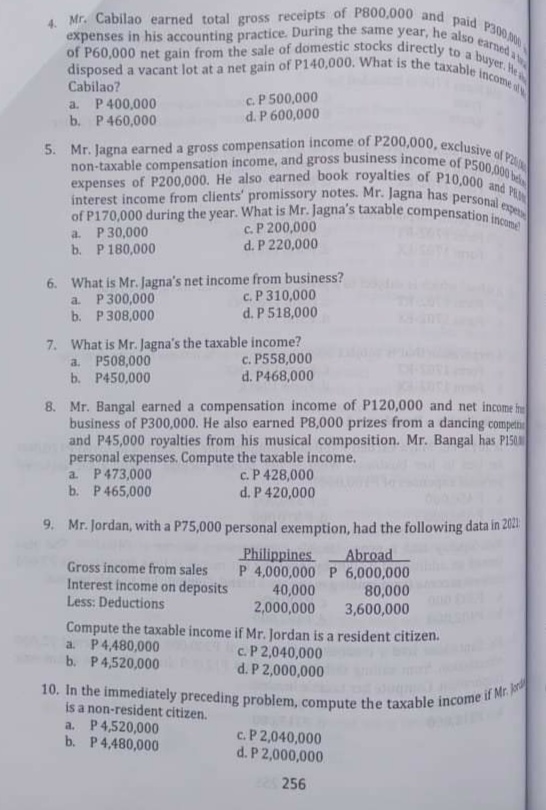

4 Mr. Cabilao earned total gross receipts of P800,000 and paid P300 disposed a vacant lot at a net gain of P140,000. What is the taxable income l earned buyer. He expenses in his accounting practice. During the same year, he al of P60,000 net gain from the sale of domestic stocks directly t Cabilao? a. P400,000 b. P 460,000 c.P 500,000 d. P 600,000

4 Mr. Cabilao earned total gross receipts of P800,000 and paid P300 disposed a vacant lot at a net gain of P140,000. What is the taxable income l earned buyer. He expenses in his accounting practice. During the same year, he al of P60,000 net gain from the sale of domestic stocks directly t Cabilao? a. P400,000 b. P 460,000 c.P 500,000 d. P 600,000

Chapter11: Investor Losses

Section: Chapter Questions

Problem 46P

Related questions

Question

Please show the solution.

Transcribed Image Text:10. In the immediately preceding problem, compute the taxable income if Mr. Jord

non-taxable compensation income, and gross business income of P500,000 bel

of P170,000 during the year. What is Mr. Jagna's taxable compensation income

interest income from clients' promissory notes. Mr. Jagna has personal expe

expenses of P200,000. He also earned book royalties of P10,000 and P

disposed a vacant lot at a net gain of P140,000. What is the taxable income ol

expenses in his accounting practice. During the same year, he also earned a

of P60,000 net gain from the sale of domestic stocks directly to a buyet. He

4. Mr. Cabilao earned total gross receipts of P800,000 and paid P300 00

5. Mr. Jagna earned a gross compensation income of P200,000, exclusive of Po

Cabilao?

a. P400,000

b. P460,000

c. P 500,000

d. P 600,000

a. P 30,000

b. P180,000

c. P 200,000

d. P 220,000

6. What is Mr. Jagna's net income from business?

a. P300,000

b. P308,000

c. P 310,000

d. P 518,000

7. What is Mr. Jagna's the taxable income?

a. P508,000

b. P450,000

c. P558,000

d. P468,000

8. Mr. Bangal earned a compensation income of P120,000 and net income f

business of P300,000. He also earned P8,000 prizes from a dancing compet

and P45,000 royalties from his musical composition. Mr. Bangal has PISO

personal expenses. Compute the taxable income.

a. P473,000

b. P465,000

c.P 428,000

d. P 420,000

9. Mr. Jordan, with a P75,000 personal exemption, had the following data in 2021

Philippines

P 4,000,000 P 6,000,000

40,000

2,000,000

Compute the taxable income if Mr. Jordan is a resident citizen.

Abroad

Gross income from sales

Interest income on deposits

Less: Deductions

80,000

3,600,000

a. P4,480,000

b. P4,520,000

c.P 2,040,000

d. P 2,000,000

is a non-resident citizen.

a. P4,520,000

b. P4,480,000

c.P 2,040,000

d. P 2,000,000

256

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT