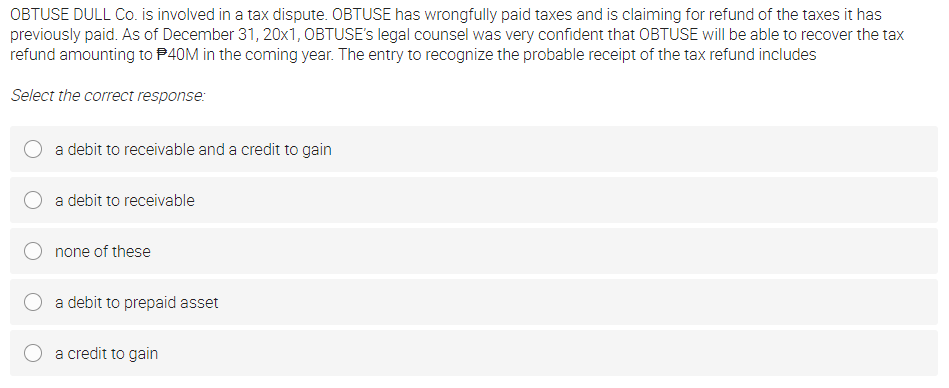

OBTUSE DULL Co. is involved in a tax dispute. OBTUSE has wrongfully paid taxes and is claiming for refund of the taxes it has previously paid. As of December 31, 20x1, OBTUSE's legal counsel was very confident that OBTUSE will be able to recover the tax refund amounting to P40M in the coming year. The entry to recognize the probable receipt of the tax refund includes Select the correct response: a debit to receivable and a credit to gain a debit to receivable none of these a debit to prepaid asset a credit to gain

OBTUSE DULL Co. is involved in a tax dispute. OBTUSE has wrongfully paid taxes and is claiming for refund of the taxes it has previously paid. As of December 31, 20x1, OBTUSE's legal counsel was very confident that OBTUSE will be able to recover the tax refund amounting to P40M in the coming year. The entry to recognize the probable receipt of the tax refund includes Select the correct response: a debit to receivable and a credit to gain a debit to receivable none of these a debit to prepaid asset a credit to gain

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter4: Gross Income

Section: Chapter Questions

Problem 5CE

Related questions

Question

100%

Transcribed Image Text:OBTUSE DULL Co. is involved in a tax dispute. OBTUSE has wrongfully paid taxes and is claiming for refund of the taxes it has

previously paid. As of December 31, 20x1, OBTUSE's legal counsel was very confident that OBTUSE will be able to recover the tax

refund amounting to P40M in the coming year. The entry to recognize the probable receipt of the tax refund includes

Select the correct response:

a debit to receivable and a credit to gain

a debit to receivable

none of these

a debit to prepaid asset

a credit to gain

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT