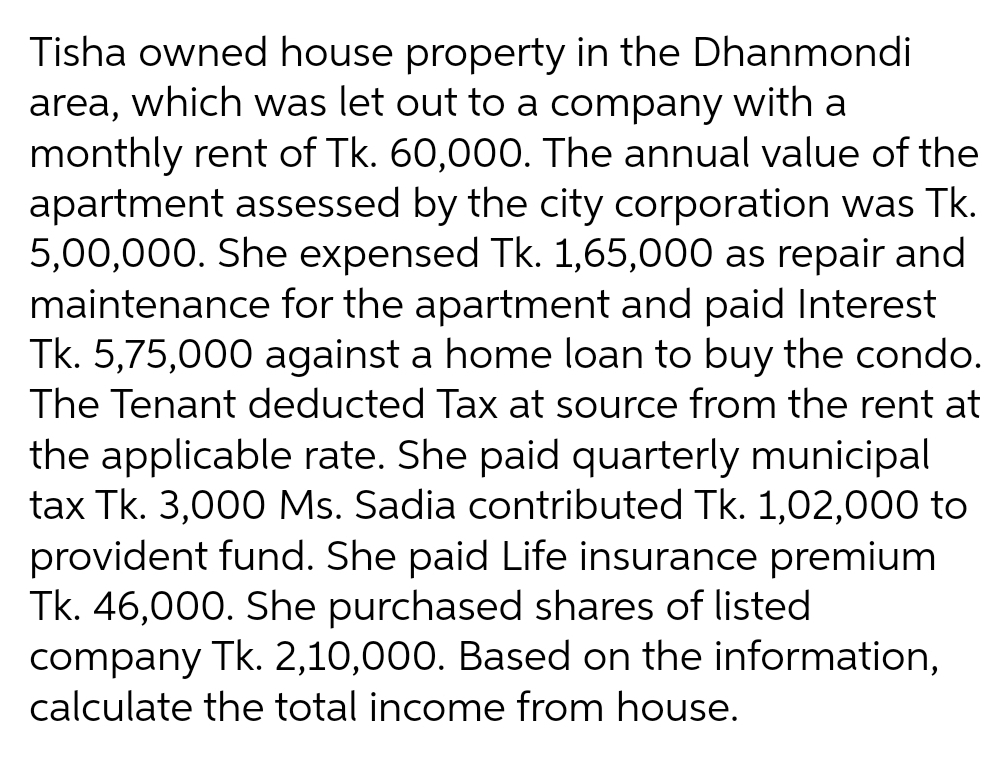

Tisha owned house property in the Dhanmondi area, which was let out to a company with a monthly rent of Tk. 60,000. The annual value of the apartment assessed by the city corporation was Tk. 5,00,000. She expensed Tk. 1,65,000 as repair and maintenance for the apartment and paid Interest Tk. 5,75,000 against a home loan to buy the condo. The Tenant deducted Tax at source from the rent at the applicable rate. She paid quarterly municipal tax Tk. 3,000 Ms. Sadia contributed Tk. 1,02,000 to provident fund. She paid Life insurance premium Tk. 46,000. She purchased shares of listed company Tk. 2,10,000. Based on the information, calculate the total income from house.

Tisha owned house property in the Dhanmondi area, which was let out to a company with a monthly rent of Tk. 60,000. The annual value of the apartment assessed by the city corporation was Tk. 5,00,000. She expensed Tk. 1,65,000 as repair and maintenance for the apartment and paid Interest Tk. 5,75,000 against a home loan to buy the condo. The Tenant deducted Tax at source from the rent at the applicable rate. She paid quarterly municipal tax Tk. 3,000 Ms. Sadia contributed Tk. 1,02,000 to provident fund. She paid Life insurance premium Tk. 46,000. She purchased shares of listed company Tk. 2,10,000. Based on the information, calculate the total income from house.

Chapter4: Additional Income And The Qualified Business Income Deduction

Section: Chapter Questions

Problem 16MCQ: John owns a second home in Palm Springs, CA. During the year, he rented the house for $5,000 for 56...

Related questions

Question

Transcribed Image Text:Tisha owned house property in the Dhanmondi

area, which was let out to a company with a

monthly rent of Tk. 60,000. The annual value of the

apartment assessed by the city corporation was Tk.

5,00,000. She expensed Tk. 1,65,000 as repair and

maintenance for the apartment and paid Interest

Tk. 5,75,000 against a home loan to buy the condo.

The Tenant deducted Tax at source from the rent at

the applicable rate. She paid quarterly municipal

tax Tk. 3,000 Ms. Sadia contributed Tk. 1,02,000 to

provident fund. She paid Life insurance premium

Tk. 46,000. She purchased shares of listed

company Tk. 2,10,000. Based on the information,

calculate the total income from house.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you